Revisiting: Zen Technologies

A relevant player in the new age warfare

Zen Technologies is providing combat training solutions and anti-drone solutions to defense and security forces, making it relevant in 1) Increased operational capabilities of the defence and security personnel, and 2) Solutions for new age warfare like Anti-Drone Solutions.

Check out the previous posts for more details about the Company:

Q1 FY 2025 Result Update

Q2 FY 2025 Result Update

(1) Strong continued performance

In the past 3 years, Zen has performed extremely well, ~14x topline in 3 years.

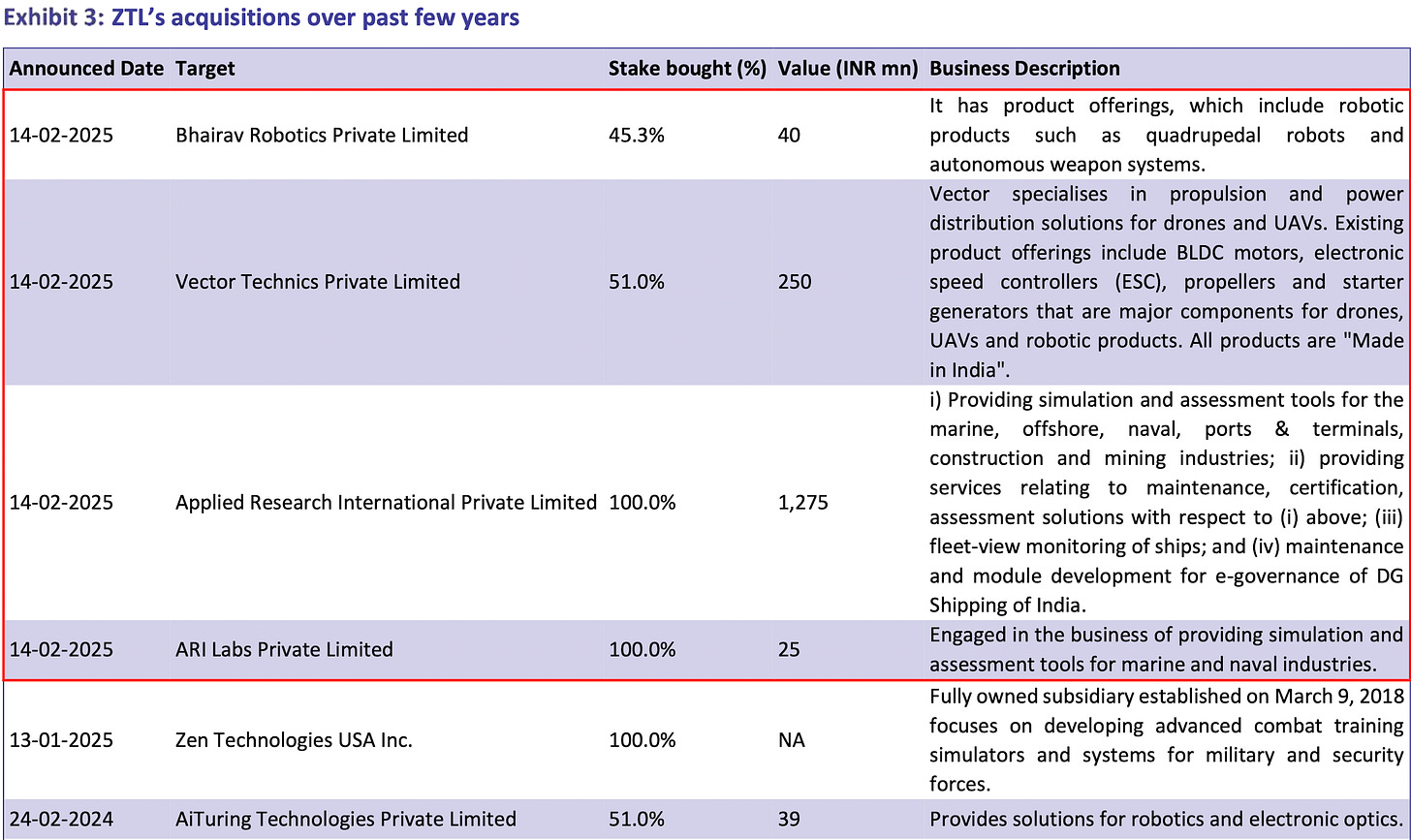

(2) Bolstering capabilities through acquisitions

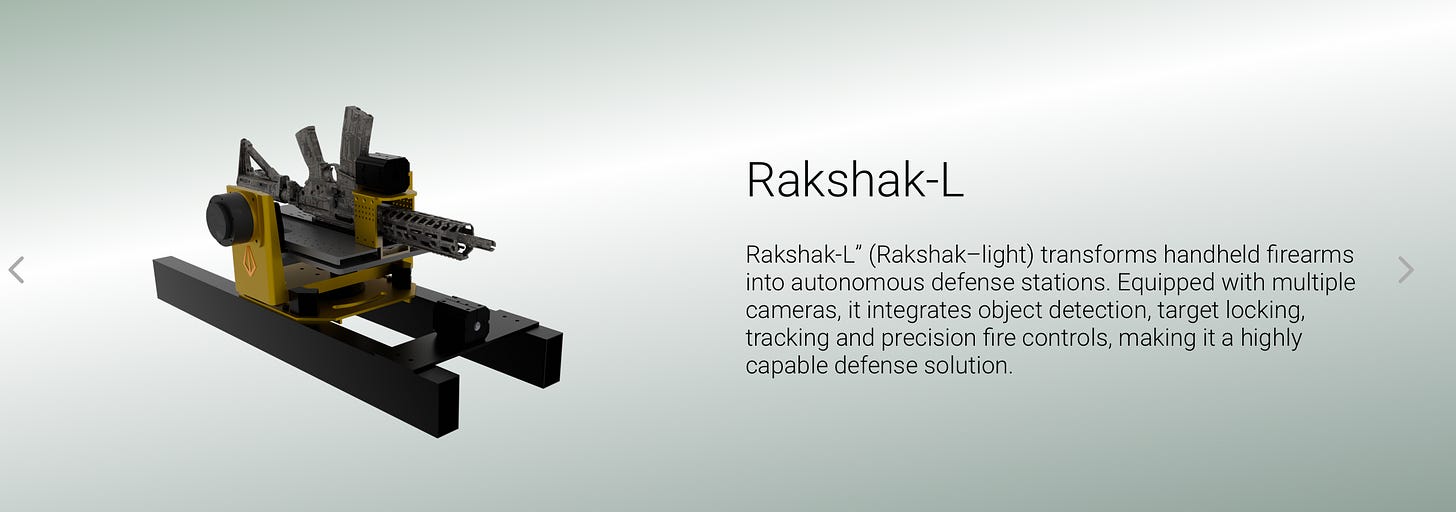

We have seen Bharat’s Air Defence in action during Operation Sindoor, which comprise not only of the S-400 or the Akash SAM but have integrated legacy weapons like the Shilka and L-70s, which have been modernized with sensors and tracking systems etc. and were proved very effective in the modern warfare where drone comes in swarms aiming for saturation of defences and attrition of arsenal.

Now imagine a similar modernization happening to the ground forces, including their artillery weapons, etc. This can be game-changing in the conflict.

Foray into Naval Simulators with the acquisition of Applied Research International.

As per concall, ARI has all the simulation products for the navy minus the weapon simulators (which Zen has)

Going deeper into the Drone ecosystem with the acquisition of Vector Technics.

The initial acquisition was UTS to foray into anti-drone systems, and this has become a new segment for the company.

The recent acquisitions seem to be complementary to the existing operations and bolster the capabilities.(3) Some excerpts from Concall

Designed, Developed, and Made in India Solutions. Own IP

Selected alone from the 2 companies in the RFP of 2023 for anti-drone companies. While a majority of anti-drone companies focus on 2 frequencies (commercial frequencies) but Zen’s solution is band-independent.

UTS collaborated with DRDO for the jammer and detector (or maybe some parts of them)

Chips are being procured from abroad (non-Chinese sources)

Don’t have a laser-based anti-drone kill system

Expecting cumulative turnover of 6000 cr in the next 3 years with 35% EBITDA and 25% PAT margin

FY2027 is the year we should get orders in the US

In the future, drones, anti-drones, and hard kill systems will be 70% of the business

R&D expenses: Looking at 70 cr for the R&D facility and 5 cr for machinery. Expect 50-60 cr on R&D consistently, but there may be a lump sum R&D requirement based on opportunities

(4) Order-book Bridge

So what's next?

This is a manufacturing company. One of the leading indicators for growth is the order book. At this stage, they have muted orders at hand, given the fact that they have delivered on their orderbook leading to this strong growth.

But, future growth needs orders. They have guided for 800 cr of orders by H1FY2026 in the simulators segment. The overall order pipeline is for ~4000 crore.

Further positive triggers

✅ Emergency procurement: Orders are expected to trickle from the 40,000 crore emergency procurement. There is a sense of urgency towards modern warfare.

✅ Exports: Africa, CIS, and the Middle East are Zen’s main markets.

✅ EU-India FTA - potential opportunities from the EU as they up their defence spend (a positive for the huge industry, not just Zen)

Technical

Defence is one of the leading sectors. It has shown urgency in its upmove post Operation Sindoor.

So technically, it is nearing a low-risk entry, which I would be keenly observing.To Sum Up

The sphere of operations Zen operates is poised for growth. They are going further in their simulation business by adding naval simulation capabilities and enhancing their capabilities in Drone and Anti-Drone Solutions. Plus, assisting forces with their capabilities in some unmanned robotics products.

There is a lot of uncertainty if we look at the current order book. Plus, the order receipts and execution are bound to be lumpy.

This year, as per management, is expected to be muted, and accordingly, a long-term investment opportunity may strike again at a favorable valuation; however, given that defence is leading the pack, it can give good risk-reward technically, and be a momentum trade. *****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.