Result Update: Zen Tech Q2 2025

Strong show but the litmus test is replenishment of Order-Book

Previous posts:

Q1 FY 2025Result Update

Key takeaways from Q2 / FY2025 results:

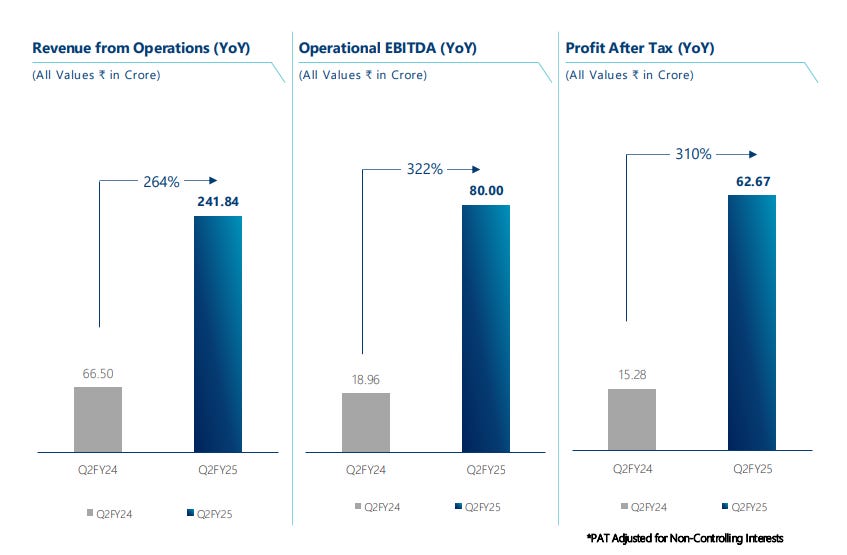

(1) Execution Continues

Q1 had witnessed 92% growth YoY. The current quarter Q2 saw 264% revenue growth.

i.e. a superb performance in the First Half of FY 2025

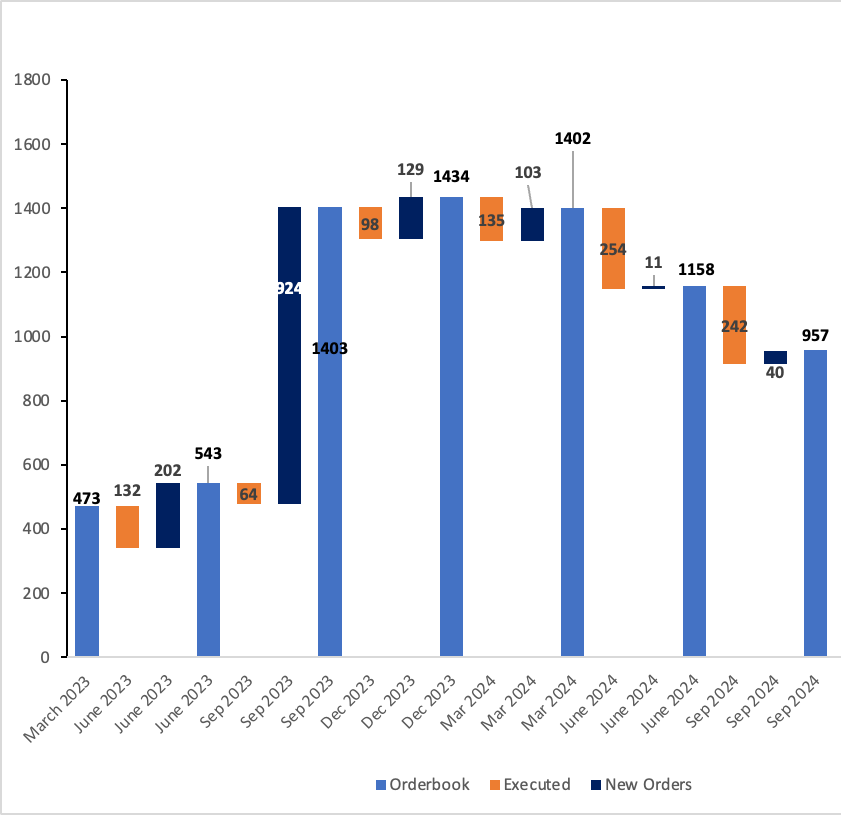

(2) No new orders

The management had articulated this well in advance (Q1 FY25 results concall).

Replenishing the orderbook will is number 1 monitorable for H2 FY 2025(3) What next??

The guidance given by the management is quite aggressive.

Guided for 900cr + revenue in FY 2025.

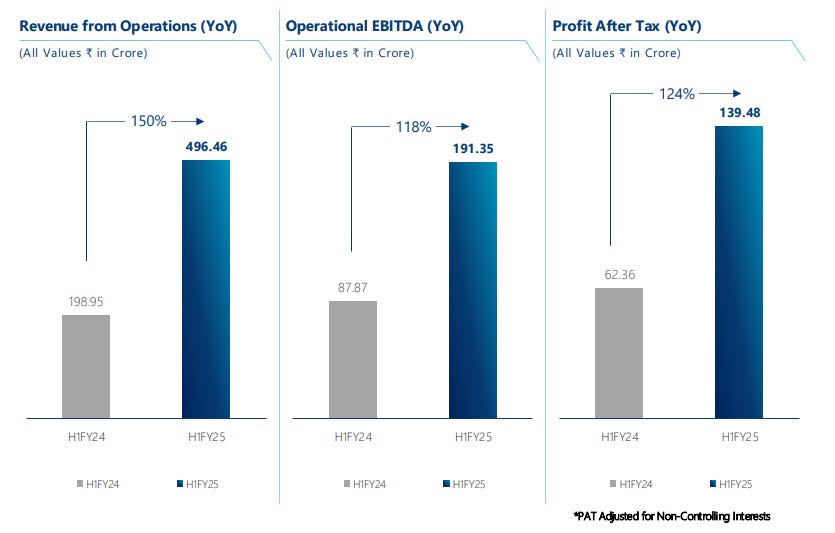

Are they on track to meet this guidance?

Well they have already clocked 496 cr revenue in H1 FY2025. To put in prespective, they have done more in 6 months than what they did in last FY. So I'm quite positive that they will be able to meet the guidance for FY25 Further, they have guided for 50% CAGR growth till FY 2027 which we can extrapolate as FY2026 rev of 1350 cr and FY2027 rev of 2000 cr.

The foundation of this growth will be built on new orders which I reiterate is the key driver. The new orders in Q3 and Q4 may lift the stock (4) Acquisition on the cards

They are Evaluating Inorganic Opportunities in Electronic Warfare or Aerospace Simulators. The potential size of the acquisition is 100-300 cr.

Their track record of acquisition is good. If the acquisition can bolster their position in the value chain, it would lead to long-term growth.

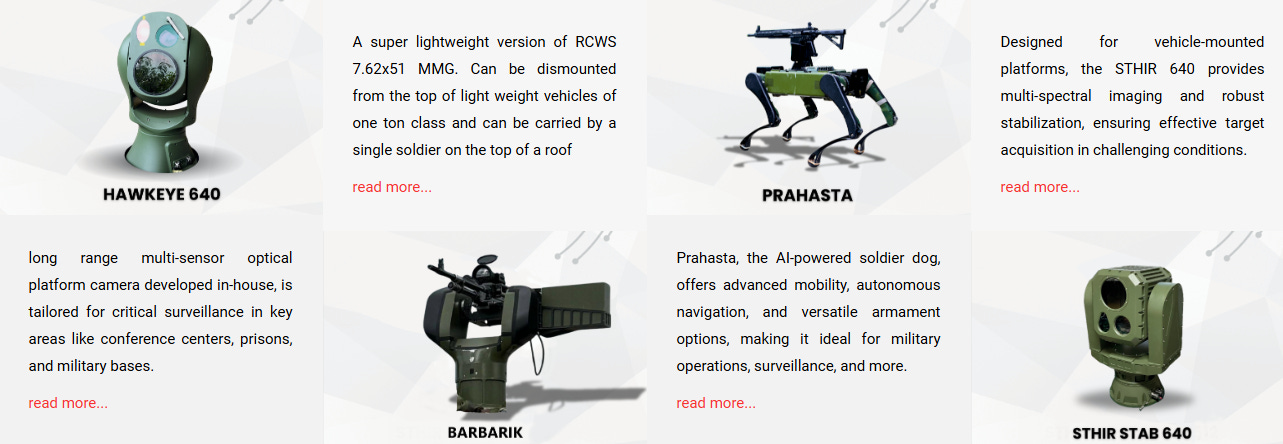

E.g. Zen’s acquisition of AI Turing. Through this acquisition, they can develop new products that fit well with simulators and Anti Drone Systems to transform the Company into Electronic Warfare Company.

AI Turing Products

Updated Order-book Bridge

Technicals

The chart is constructive given the broader market condition. A VCP pattern seems to be in the works.To sum up, this is not a time to be aggressive. Howver, any change in the market conditions or order intake as per guidance can renew interest for a good sized upmove.

Do you have this in the watchlist? *****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Learning Lifelong! Subscribe for free to receive new posts and support my work.