Revisiting Dynamatic Technologies

At an inflection point?

In the last post, we evaluated Dynamatic Technologies through the lens of 4-cylinder model (4 levers of profitability).

Over one year has passed. Was the reasoning correct or flawed? The stock with all the ups and downs is hovering at the same levels, but is the business still in the same place?

Disclosure: I am invested and added recently as well. Numbers and Narratives

Let me start by introducing a wonderful book by valuation guru Prof. Aswath Damodaran (well, who am I to introduce him!) - Numbers and Narratives

There are two camps - the number crunchers and the storytellers. However, the real magic happens when these two worlds are bridged - when the story and numbers align.

Coming to Dynamatic Technologies, it is an engineering company operating in Aerospace, Hydraulic, and Metallurgy segments.

We have covered it extensively in the previous post (Dec 2024), where we explored Dynamatic through the lens of the 4-Cylinder Model (4 levers of profitability)

The core thesis in December 2024 was

Growth in the Aerospace Segment & Hydraulics

Margin increase and operating leverage

The key question is - does this thesis still hold?Growth in Aerospace

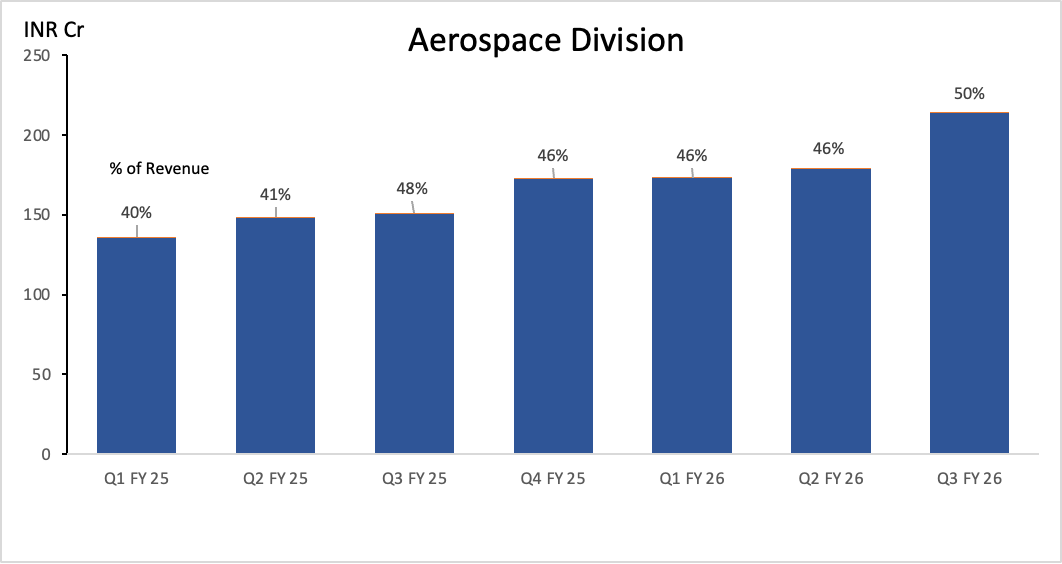

The Aerospace segment has grown consistently since Q1 FY 25. The share of Aerospace has increased from 40% to 50%.

So even though we have not witnessed hyper growth, directionally, Aerospace contribution is increasing meaningfully.

At an inflection point

Why do I believe that the company is at an inflection point?

Capabilities are a store of value. But value itself can become a value trap unless the value is unlocked. Value will be unlocked when the capability is translated into cash flows.

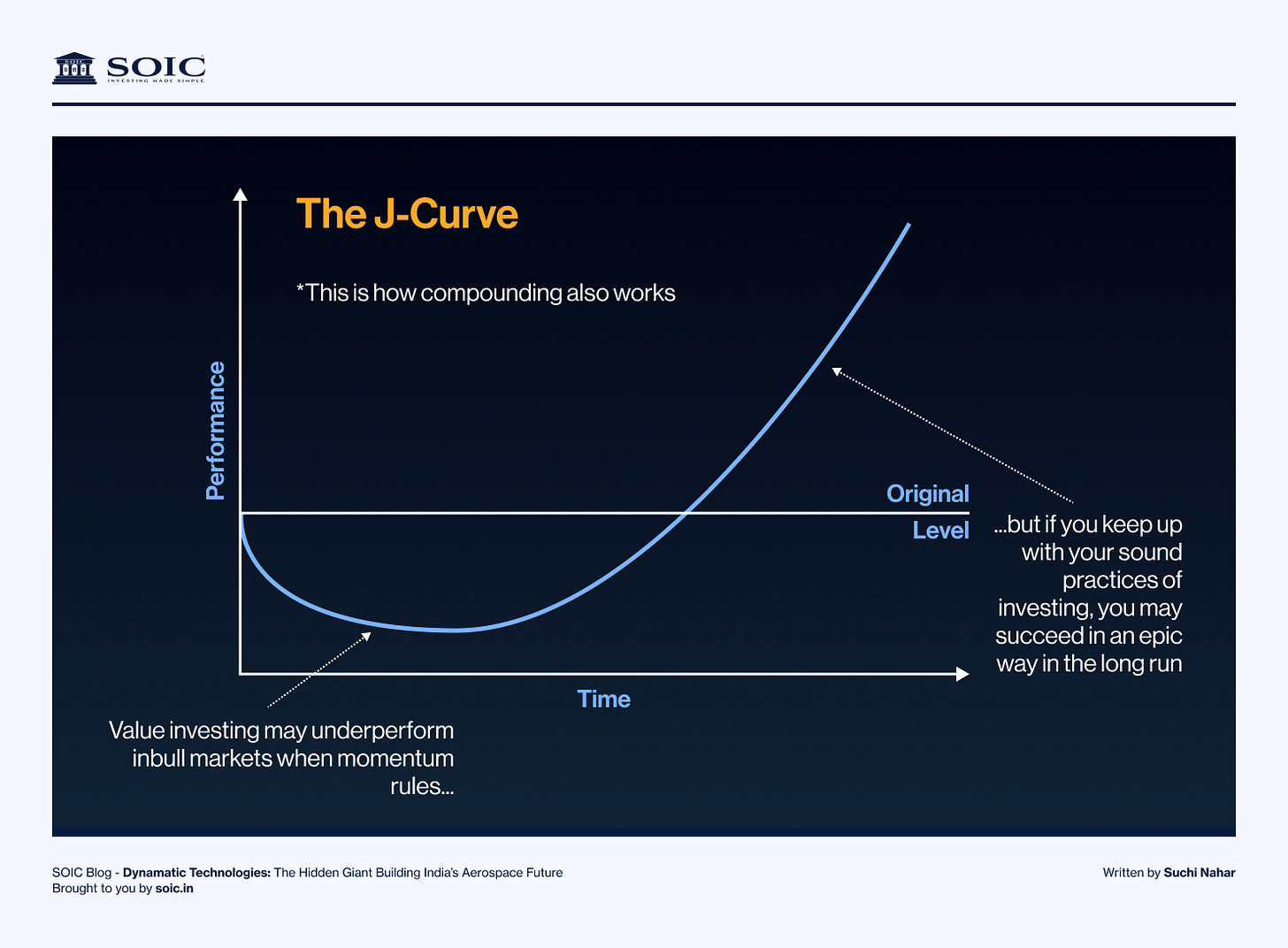

The J-Curve mental model is explained succinctly by SOIC, and it can very well be applied to Dynamatic Tech. In a nutshell, the model can be explained by the quote:

“There are decades where nothing happens; and there are weeks where decades happen.”

This is the nature of compounding. Coming back to the why, Dynamatic might be at an inflection point. Let’s dig into some of the opportunities:

(1) A220 doors

The company has supplied the first shipset ahead of time

Each shipset is USD 0.5 million (~4.5 cr), As per AGM, they target 2 shipsets per month, making it a 10 Million Dollar revenue per year i.e. 90 cr from this program. In 3 years it will go to 10 shipsets per month i.e. a 50 million dollar revenue stream ~450 cr revenue (FY 25 total revenue from Aerospace was 600 cr).

(2) Rear fuselage of Dassault Falcon 6X

Going up the value chain - from sections of fuselage to fuel tank to the complete rear fuselage.

Around 50 Falcon 6X are going to be produced annually. While the order value is not disclosed, Falcon 6X is a USD 50 million dollar product. Airframe, fuselage etc, generally accounts for 25-30% of the cost i.e. 12.5-15 million dollar and the rear fuselage could be anywhere between 1-2.5 million dollars/fuselage. Again, this is a 50 million dollar opportunity annually.

The above are the secured contracts. There are a few more optionalities that can play out:

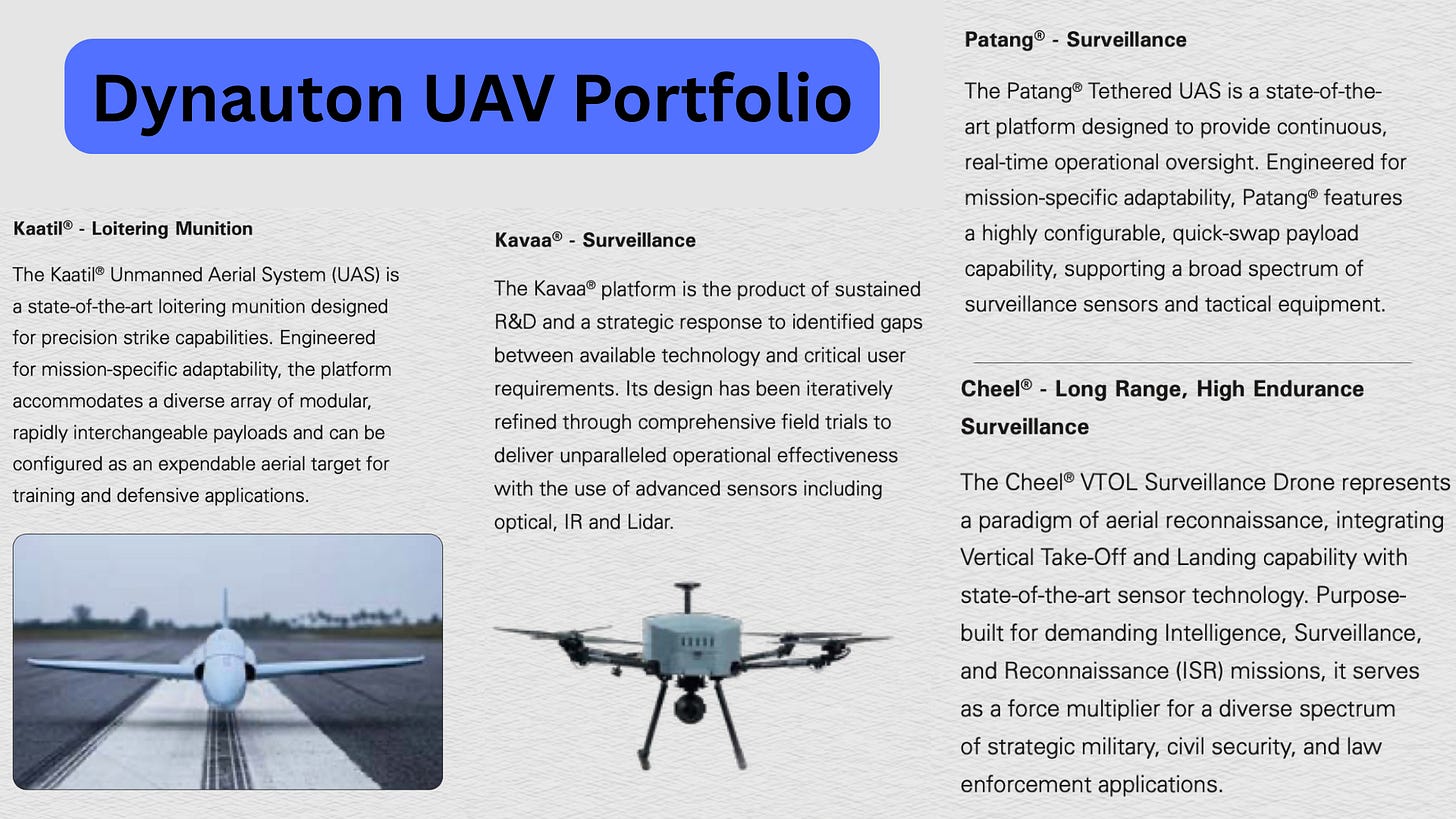

(1) Dynauton

Dynauton focuses on the design and manufacture of advanced Unmanned Aerial Systems and critical subsystems such as gimbals, autopilots, radars, propulsion units, avionics, and integrated software solutions.

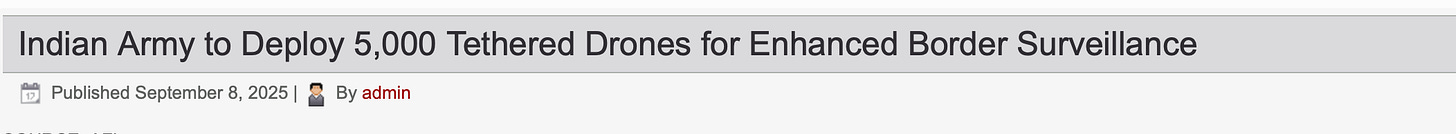

Focus on IP / tech stack. Patang is a tethered drone and a RFI has already been issued

(2) Advanced Medium Combat Aircraft (AMCA)

The Advanced Medium Combat Aircraft (AMCA) is India’s ambitious program to develop an indigenous fifth-generation stealth multirole fighter. ADA has planned to develop 5 prototypes of AMCA for flight testing at an estimated cost of Rs 15,000 crore

The private sector is at the forefront of this project. Dynamatic is part of the L&T + BEL + Dynamatic consortium. It is reportedly one of the front-runners for this project.

(3) Artillery Shells

The German foundry of DTL has the capability of producing extremely complicated castings in the most complex materials. The company intends to move its metallurgical business to Aerospace and Defence. They have a good potential for Artillary shells

(4) Growing Aerospace Manufacturing Ecosystem in India

There is renewed focus on this sector. India can capture some of the Assembly lines, e.g., the Embraer Assembly line (Adani Embraer MoU), SJ-100 production in India (HAL and Russia’s United Aircraft Corporation), or Rafale Assembly in India, etc.

Right to win

Not just a manufacturer but a design partner

Evolving from a traditional “build-to-print” manufacturer into a Tier-1 design and assembly partner. A prime example of their design capability is the A320 Flap Track Beam. DTL took a 40-year-old design and completely re-engineered it into a monolithic structure, reducing the total part count from 200 to just 20. This transformation is backed by its three dedicated R&D centers staffed by 90 scientists and 650 engineers.

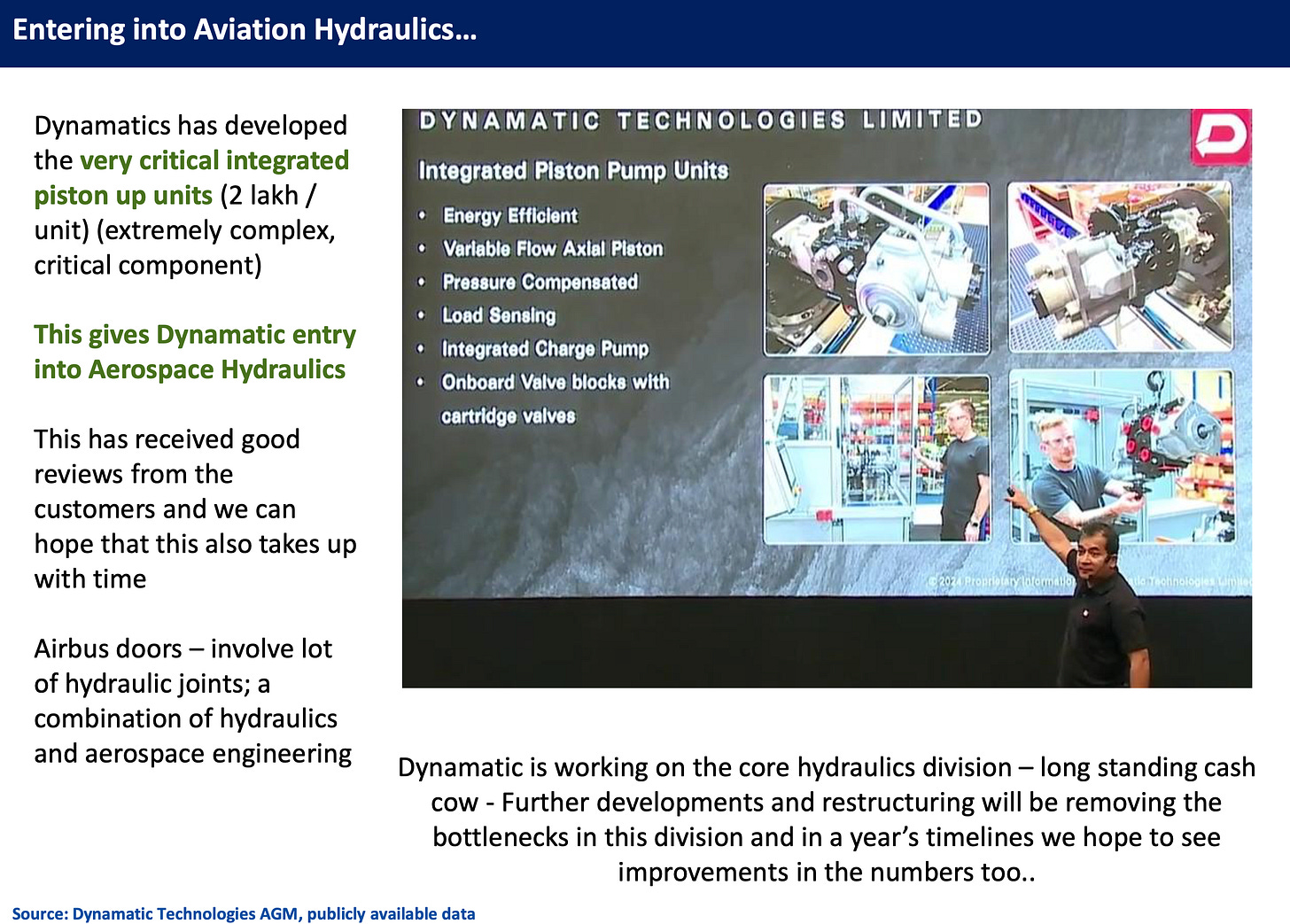

Applying hydraulics know-how to move up in Aerospace

The Airbus A220 door win is actually a testament to this.

Global Operations

Defence and Aerospace are strategic sectors. The company has deliberately kept global operations so as to leverage global presence for cheaper cost of capital and a way in global defence supply chain.

Risks

I’ve covered this here. In Aerospace, there are no small parts, a whole movie (flight) showcased how one screw can screw the aircraft. The industry itself is a duopoly. Its a tightly regulated industry.

***

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Make your stock scanning easy with ChartsMaze

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.