Dynamatic Technologies: Niche Aerospace player at an inflection point

Analyzing through the lens of 4-Cylinder Model

The Company operates in 3 businesses - Aerospace (poised for Strong Growth), Hydraulics (increased profitability going forward), and Metullargy (turnaround candidate). Looking at the business through the lens of 4 Cylinder Model (read on to know more about this framework) Dynamatic Technologies

Dynamatic Technologies manufactures highly engineered, mission-critical products for the Hydraulic, Aerospace, and Metallurgy industries.

Hydraulics: Market Leader - almost 80% market share in the Indian OEM tractor market and ~38% in the global tractor market (organized)

Aerospace: Tier-one manufacturer for Bell Helicopter, Airbus, and Boeing etc. and in Domestic Defence Aerospace (indigenizing various assemblies).

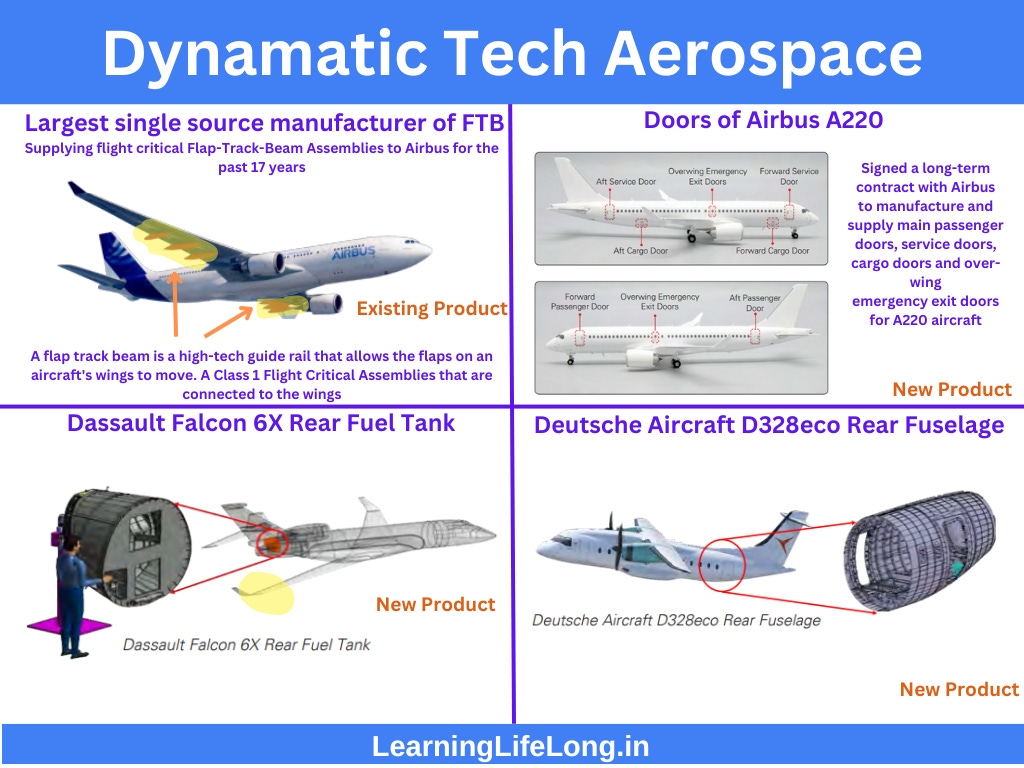

Flap Track Beams to Airbus

Indigenized major helicopter cabin assemblies in collaboration with Bell Helicopter.

Was the only vendor (among private players) to be collocated in HAL’s Nashik plant during the manufacturing of Su30MK-I. Was also involved in developing front fuselage jigs for LCA aircraft and rear fuselage of Su-30MK-I.

International presence in Defence

Checkout the previous article for the Industry value chain - Tier 1 manufacturer means that they are very competent in manufacturing

Understanding Aircraft Manufacturing Ecosystem

·Aerospace Industry: Critical to India’s strategic and economic interests

Framework: 4 Cylinder Model

An important learning from Raamdeo Agrawal Ji was to evaluate ideas through the lens of different frameworks.

One such framework I apply in understanding a company is the 4-cylinder model (Credits: Vivek Mashrani of Technofunda Investing from whom I learned this framework).

In a nutshell, it is a way to probe the income statement and see how different activities of the company affect its profitability. When you have multiple factors working together you may get the Lollaplaza effect!! (Poor Charlie’s Almanack)

Applying this framework to Dynamatic Technologies…

(1) Sales Growth

Aerospace

Has secured contracts that should double the size of its aerospace business in the next 2.5 Years. This is mainly on account of new products:

Agreement with Airbus to manufacture escape hatch doors for Airbus's A220 aircraft, production of which will begin at the end of 2026.

Rear fuel tanks for Dassault Aviation's Falcon 6X business jet. The first delivery of these tanks is scheduled for December 2025, with full-scale production beginning in early 2026.

Potential to win additional contracts both by expanding its work with existing customers and by securing contracts with new customers. The company points to its strong reputation as a "best supplier" in an industry that is looking to consolidate its supply chains

According to management, the Aerospace segment could experience "multifold" growth over the next five to eight years.Hydraulics

Is one of the largest manufacturers of hydraulic gear pumps globally, holding a leading position in the market - with approximately 80% of the Indian OEM tractor market and 38% of the global tractor market

Focusing on "wallet share," i.e. aiming to sell more products per customer.

Hydraulics business currently generates approximately 500 cr a year, can double in size over the next five years, and double again in the five years after that

(2) Margin Expansion

As the share of the Aerospace Business in the whole business mix increases, the margins will expand.

FY24 EBITDA margin profile was as follows:

Aerospace (25.7%) > Hydraulics (8.4%)> Metallurgy (5.2%)

(3) Operating Leverage

Aerospace

Already has the employees and facilities to support a doubling of its Aerospace business. Significant capital expenditure is not required.

Hydraulics

Strategy is to rationalize product lines between the Swindon and Bangalore facilities and grow its aftermarket share, improve operational efficiencies, and utilize value engineering to boost margins.

Metallurgy

Metallurgy segment has been under pressure due to industrial weakness, including the weak global economy, low domestic demand, and reduced competitiveness in the German industry.

This is a legacy business, whereby the management is trying to transition the Metallurgy subsidiary into the aerospace and defense business.

Not investing in Metallurgy business, to the contrary, shrinking it and focusing on securing higher-margin business and leveraging its latent capacity e.g. strategically positioned as a potential supplier of critical products to NATO through its German foundry.

Focus on higher-margin products and transition away from the automotive businessOverall, Dynamatic Technologies anticipates significant growth in its Aerospace and Hydraulics segments, driven by new contracts, strategic initiatives, and favorable market conditions. The company will leverage its existing capacity and workforce to support this expansion and aims to achieve growth with increased margins. The Metallurgy segment is currently undergoing a transformation to focus on higher-margin businesses, particularly in the aerospace and defense sectors, which is expected to improve its performance in the coming years.If they are able to capitalize on the opportunity, the return ratios will also improve as they output can double without significant investments.(4) Debt Reduction

Owing to lower interest repayments and peak capex behind us, the company can become net cash positive in FY 27.

Tailwinds / Enabling Factors

Dynamatic Aerotropolis, wholly-owned subsidiary - Strategically located facility near Bengaluru Airport.

Growth in the Aircraft Component Industry in India

Defence Aerospace tailwinds

Well placed to grab that opportunity in higher indigenization

and more involvement of local companies in Defence Manufacturing.

Have supplied the front fuselage for LCA, middle fuselage for F-15EX and rear

fuselage for Su-30MK-I.

Indigenized foldable strut mechanism for ALH Dhruv that facilitates opening and closing of helicopter door during rugged environmental conditions. (single source supplier to HAL for this product and has patent for the same)

Developed complex machined beams and frames for complex naval applications (replacing imports) for BEL.

Partnered with Israel Aerospace Industries (IAI) for manufacturing of UAVs in India and entered into a tripartite agreement with HAL, IAI, and Dynamatic for manufacturing, sales, and service of large UAVs in India to cater to the requirements of the Indian Defence and Central Armed Police Force (CAPF).

Hydraulics division to benefit from global OEMs shifting their manufacturing bases to India and modernization in agriculture which is likely to improve the demand for tractors and construction equipment.

Optionalities:

NAL RTA-90 program: Initiative by the National Aerospace Laboratories (NAL) in India to develop a 90-seater regional transport aircraft to cater to regional connectivity demands.

Other MNCs to set shop in India. Dynamatic can supply subsystems. It targets to balance the Aerospace segment 50:50 between Civilian/Commercial: Defence.

Gain from Germany revving up its defense spending, requiring artillery shells, which are currently under development at the Erla site (in Germany).

Valuations

On the face of it, the valuations look expensive. However, looking at it through the lens of the 4-cylinder model, significant growth is waiting to happen to go to the bottom line.

The main moat is that switching from one supplier to another will typically involve significant additional costs - a long vendor approval process (compliance matters a lot). Domain expertise is also a barrier for new entrants.

This is not a recommendation. (Not SEBI Registered)

Key Risks

Businesses operate in Probabilistic Space - thinking through what can go wrong.Based on my limited understanding. Not an exhaustive listGeopolitical Uncertainties

One of Dynamatic's key strategies is to have capital-intensive business (complex machinery) in the west, taking advantage of lower cost of capital, a mature ecosystem of raw material suppliers, and maintenance support locally while doing labour-intensive tasks like Assembly and Engineering in India. Invariably, the plants in different geographies function like different workstations of the same supply chain for different kinds of jobs, placed 7,000kms apart. There is to and fro movement of components wherein the machined components from west are airlifted to India for assembling and are then either despatched from India to the end-customer or transported back to the west for further machining in case required. Geopolitical uncertainties and Economic Downturns in the west can create supply chain issues within the Company itself.Customer and Product Concentration Risk - especially in the aerospace segment

Most OEMs maintain multiple suppliers for their products and do not prefer exclusive contracts to ensure redundancy in the supply chain. Since they are big players in FTB assembly and getting big in A220 doors, there will be a risk if Airbus develops one more vendor for this.

Plus there is concentration risk w.r.t. Airbus and given its a duopoly (Boeing/Airbus), so far Boeing is lagging but can get support from US Govt. to outdo Airbus.

End-End we can know only that much. The dynamics in the sector can change!! Technological changes

This is a tech-savvy space, New Competitors with more efficient technologies can disrupt.

So far Dynamatic themselves participated in the change e.g. using a monolithic structure reducing the number of components and changing the material from titanium to aluminum in FTB for A320s; re-modeled the entire fuselage for Bell Helicopter.

Next time someone else can also catch up on them or outdo them!Dependence on KMP

To Sum Up

Unique Company. It takes sheer passion, willpower and commitment to be able to manufacture the components that Dynamatic is manufacturing.

Strong growth, operating leverage, and opportunities are visible, but one has to take individual calls.

For me, I would not look at it as a trading opportunity but rather look for an investment opportunity.

Again, this is not a recommendation nor I am SEBI registered. Not associated with the Company. Have position in the family long-term portfolio.Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

Resources / Recommendations

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Learning Lifelong! Subscribe for free to receive new posts and support my work.