Revisiting: Apar Industries

In a nutshell, long-term triggers like the capex on transmission, shift to Solar and Wind, investments in railways, and premiumisation, etc., are still at play...but brace for uncertainty from developments in tariffs and how they navigate Chinese competition. APAR Industries is a global leader in conductors, cables, and specialty oils - a direct beneficiary of investments in the power sector, particularly with a thrust on renewables.

After a 6X profit growth in 4 years, APAR in FY2025 reported a rather subdued performance with significant margin pressure leading to no profit growth.

Shall we discard the company after 1 year of dismal results? There is a significant overhang due to US tariff uncertainty and competition from China in certain markets. However, from my scuttlebutt to whomsoever I have interacted with from the industry, I’ve always heard positive things about the company.

They have been quietly laying the foundation for a multi-year growth cycle — through investments in capacity, Premiumization and reducing cost through digital transformation (Industry 4.0 related enhancements in operations) and remain a key beneficiary of global trends like energy transition, grid modernization, renewable energy adoption, and telecom digitization.

The elephant in the room- US Tariffs

There is a lot of uncertainty about how the tariff situation will pan out. India is yet to sign an agreement with the US.

Well, there is no easy fix for the US to substitute its $20bn import of Cables and Conductors with domestic manufacturing in a short time frame. However, the tariffs can very well dent the margins in the geography.

In the near term, the customers might be looking at absorbing the tariffs as they intend to finish projects on time (cost of time overruns in a project > tariff differential) but on a long term basis they might demand to put warehouse capacity in the US whereby customer is not in the tariff picture (although the prices will reflect the permutation/ combination of tariff impact on different suppliers)

US Tariffs are the biggest source of uncertainty + push on conventional energy in US is creating headwindsChinese Competition

Basically, exports are facing headwindsLong Term Tailwinds

1) Investments in Transmission Infra

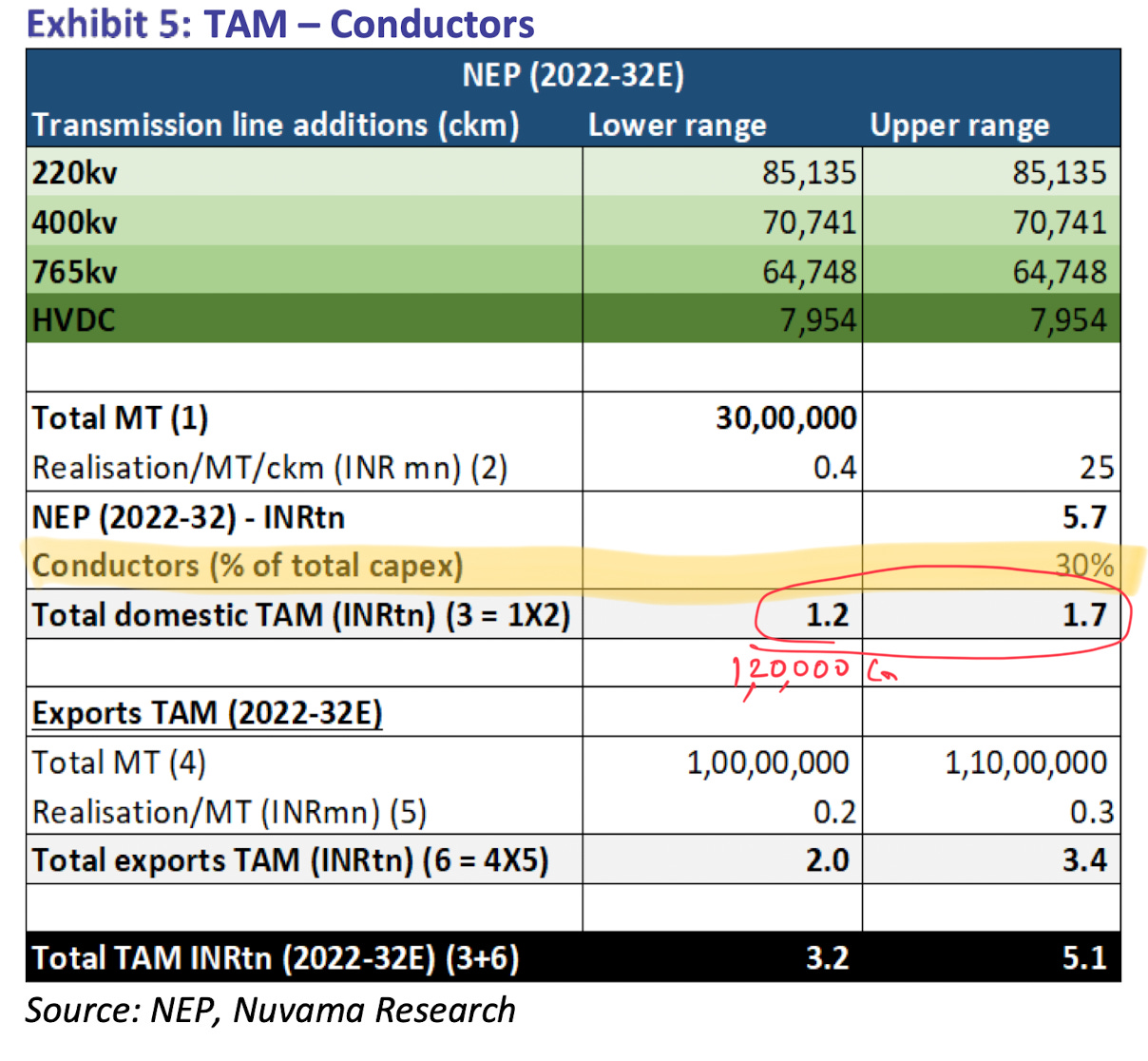

~30% of Transmission Capex is Conductors!!

Well-positioned to benefit from this capex super-cycle, given its extensive portfolio in conductors, specialty cables, and transformer oils.and transmission infra investments have to be made proactively in advance- the time for setting up a power plant especially for renewables is less than required for setting up the power evacuation infra

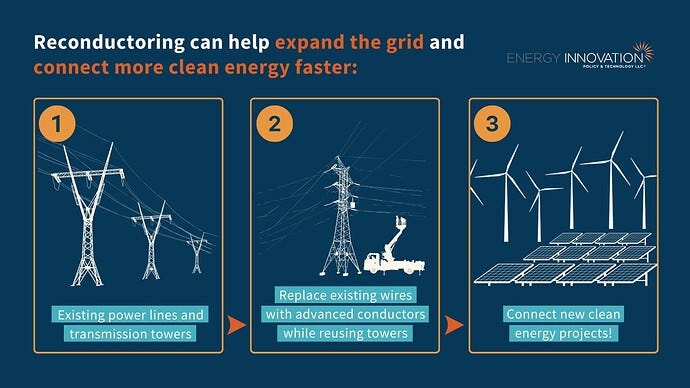

For APAR since they supply to both Transmission Infrastructure as well as Solar Cables and Wind Cables, i.e. the generation side infra, the best case scenario is that power evacuation is planned well in advance otherwise one segment will perform while the other will suffer.Part of this opportunity will be reconductoring to increase the transmission capacity

One of the major issues in putting transmission capacity is the Right of Way, so if you can increase the capacity of the existing infrastructure, it becomes the most preferred solution. 2) Opportunities in cables for renewables

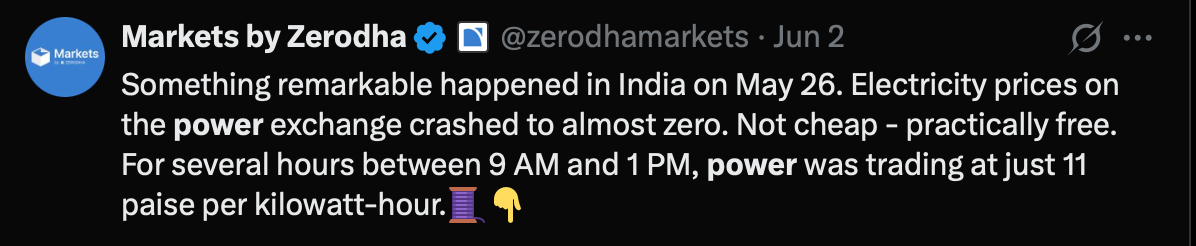

APAR’s market share in wind and solar cables positions it as a leader in the renewable energy cable market. I’ll not go much into the opportunity here (which is tremendous given India’s target of 500GW renewables by 2030), but a caveat here is that, because of the slow pace of evacuation of power from the renewable assets, reduced investments are probable here.

Case in point

The management however feels that Windmill Sector is poised for growth

Addition of Wind Power and Modernization of existing Windmills

To understand more about windmill modernization, I found this interesting explainer

3) Opportunities in Data Centers

Supplies to major data center companies in India

and now in global vendor list for Microsoft

How is APAR Navigating these Challenges and Opportunities

1) Gearing up investments: Demand will come but can’t time the demand - so putting up capacity

Capex plan of 1300 cr to be commissioned in 18 months: 800 cr cables, 300 Cr Conductors and 200 cr Oils (building a storage terminal at JNPT)

To give context the planned investment in cables in next 12-15 months (commissioned in 18) is greator than cumulative investments from FY18-FY25 (741 cr) 2) Premiumisation

Move towards premium products is expected to boost profitability, benefiting from lower competition and higher margins in this category. And innovation / premiumisation is the strategy to keep competition at bay3) Focus on improving efficiency

Technical Analysis

Still over 30% down from ATH. Has a good bounce (over 80%) from the bottom. After an urgency shown in the run-up from the bottom, it is consolidating tightly in a ~10-11% range.

I've outlined the broader contours around APAR. The plan here is to follow price action and news, especially on the India-US Tariff deal. I am invested (had purchased in recent pullback- the anticipated volumes haven't come, but the SL is yet to be triggered). To conclude let me quote Howard Marks

You can’t predict. You can prepare

– Howard Marks, in The Most Important Thing

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Make your stock scanning easy with ChartsMaze

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Hi Pankaj - I wanted to understand how do you write these articles. I just love to read them and they are so well structured every time. Can you please tell if you create these during the time you do company analysis or do you take help of AI to structure your content ? and how much time does it take to create 1 article.