APAR Industries

Pick and Shovel play to Electrification theme

Electrification is the theme of this decade. Check out previous stacks on this theme to deep dive:

Power consumption is a mega-trend. Amidst this electrification trend, APAR Industries is standing in the middle capitalizing on India’s rapidly expanding power infrastructure. The following slide from their corporate presentation encapsulates this:

And a prominent global player with a presence in 140+ countries...which is befitting as Electrification is a Global Phenomenon.

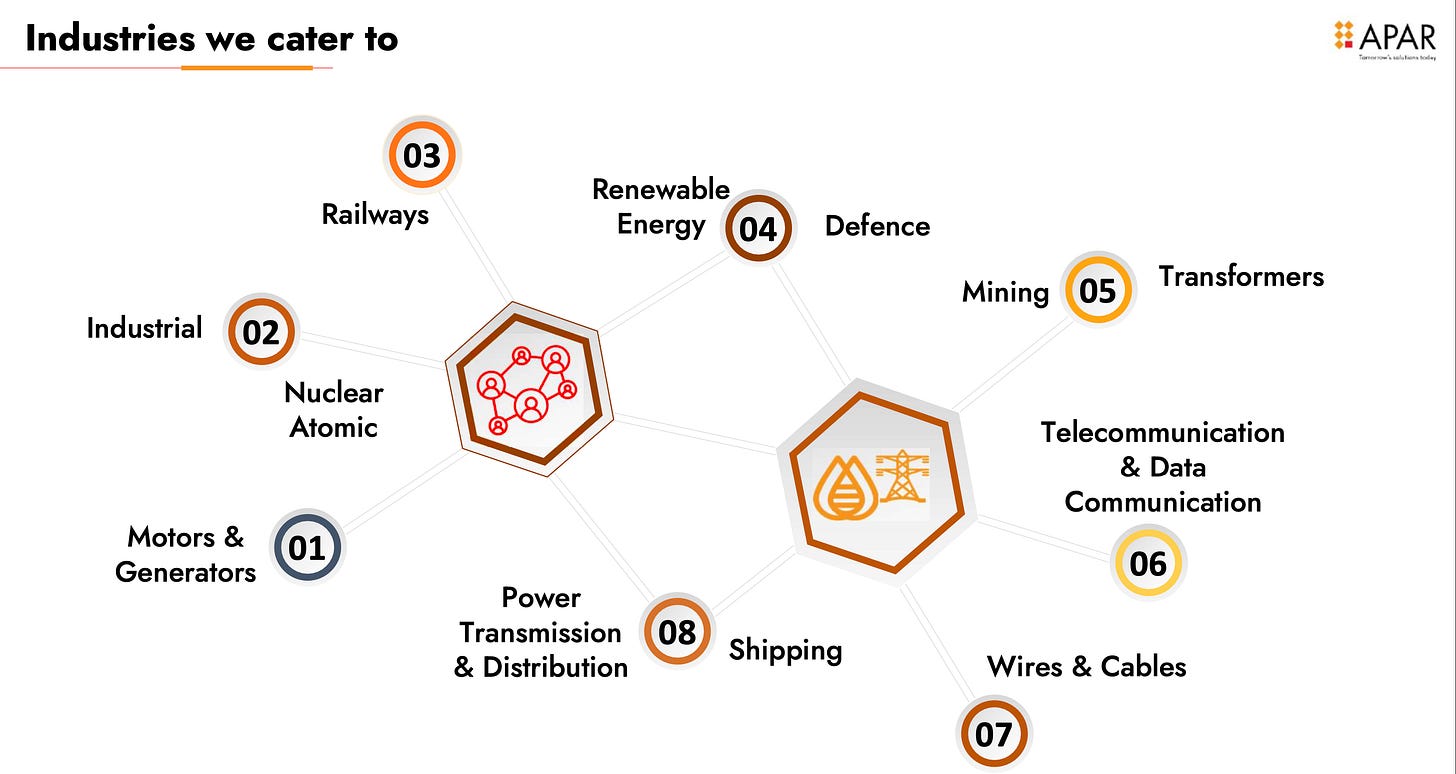

INDUSTRIES CATERED

Caters to the industries in the growth cycle - where capex is happening globally driven mostly by govt. Capex.

BUSINESS SEGMENTS (Quick Overview)

1. Conductors (47.7% FY 24)

One of the largest global manufacturers; Pioneered turnkey solutions for reconductoring with HEC (High Efficiency Conductors), live line installation with OPGW

OPGW (Optical Ground Wire) conductors - the current trend in the industry where a single line carries both optical fiber and overhead power conductors for communication and power transmission purposes. 1st to develop copper-magnesium conductors as per R.D.S.O. specification

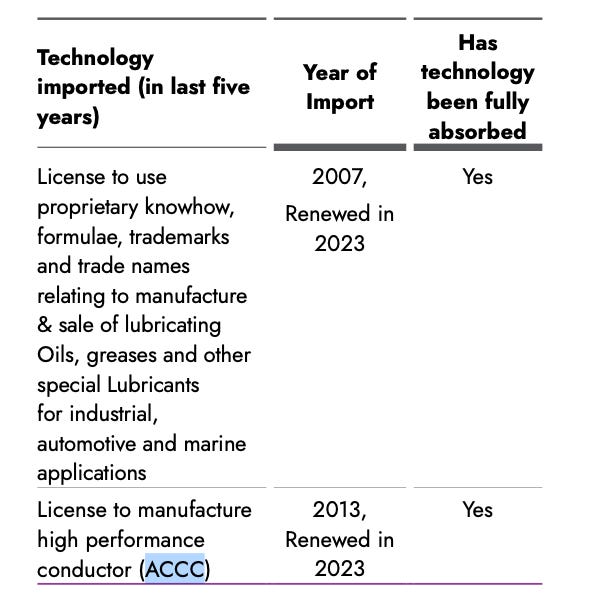

Technology tie-up with CTC-Global, USA, for ACCC conductors.

A transition is happening from ACSR to AL-59 alloys.

The upgrade in the specifications ACSR to AL-59 alloy has created a win-win situation for APAR (especially in domestic market) as well as for transmission line owners. This transition results in a reduction in the total cost of ownership of the transmission lines. So, this effect may play out over the next few years. Few players are there in AL 59 products. Higher technonolgy is involved in providing those products, the competitive intensity is lower. This product has lower weight and less corrosive properties. It’s already become now the default product.

Product-wise ACCC conductors carry twice as much current as a traditional aluminium-conductor steel-reinforced cable (ACSR) cable of the same size and weight, making it popular for retrofitting an existing electric power transmission line without needing to change the existing towers and insulators.

A caveat here, is that the tie-up is not an exclusive one. Think of CTC as an innovator while APAR is one of the many generic manufacturers. As on date in India the competition is less. But is there an advantage APAR globally in this segment...I don't think so.

There are multiple manufacturing partners for CTC Global globally.Opportunity in copper transposed conductors used in transformers

So transformer demand has been growing, and we supply 2 products into the transformer. One is the copper transposed conductors, which come from the Conductor division, which also has been growing. And in fact, in the INR 350 crores capex, we are putting in a substantial capex for growing the copper transposed conductors.

2. Cables (22.9% FY 24)

The Cables division started in 2008 with the acquisition of Uniflix.

One of the world’s largest manufacturers of specialized cables and a key exporter from India in this space.

Unlocking new opportunities like:

Guidance OFC for torpedoes & tether cables for surveillance systems. (Defence Industry)

Specialized wiring and wiring harness solutions for EVs 3. Speciality Oils & Lubricants (23.1% Spec Oils and 5.6% Lub. FY 24)

3rd largest global manufacturer of T-oils and 1st globally to supply the entire range of T-oils compliant with new corrosive Sulphur standards. It is the 1st in India to have T-oils approved for ultra-high voltage transformers. Production capacity of 7,50,000+ KL in India & 1,75,000+ KL in UAE.

APAR is a definitive beneficiary of expanding transformer capacity. Has higher market share in power transformer oils than distribution oils. It is prefered oil in higher capacity transformers. 800 kV HVDC which is the highest voltage type of transformer, APAR has more than 90% market share.Lubricants

A leading domestic player in auto lubes and has Licensing agreement for auto lubes from ENI, Italy for ENI brando Over 150 BIS-certified grades. It is the 1st in India to create affordable, high-quality products for the injection moulding industry.

Other Pointers:

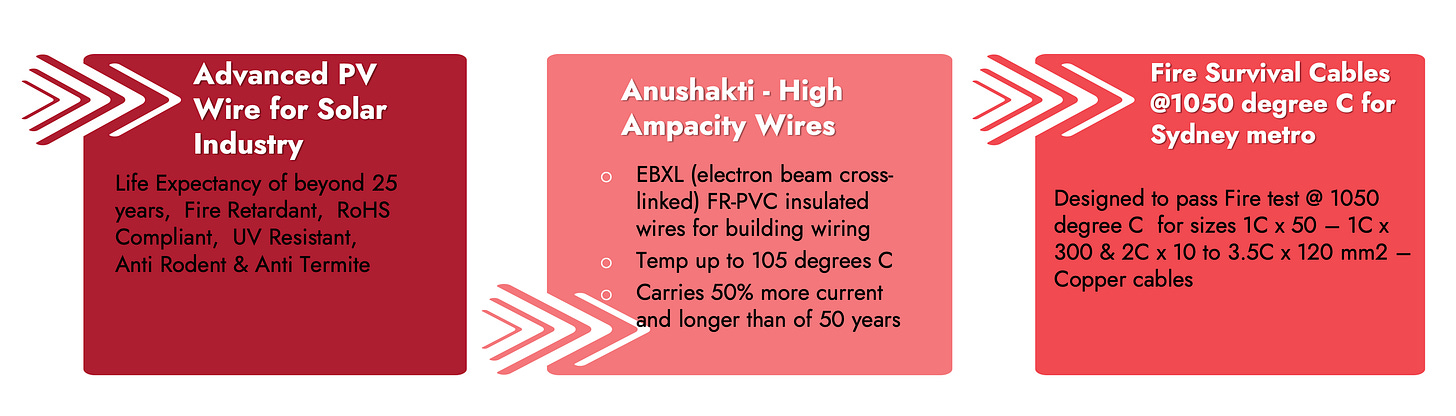

(1) Leader in Cables for Wind and Solar

Leader in the domestic solar cable segment and wind market (~70% share). Have products for US market in this sgment as well.

There’s a big revival happening in the wind sector. There is a renewed focus on Wind Energy. Government has recently come up with a scheme for upgrade of old wind farms which had smaller capacity.

The Offshore Wind is also at nascent stage in India.(2) Foray in new product segments for cables in Railways and EV Industry:

The company plans to foray into public transportation (incl Mobility).

(3) In Capex Mode after QIP

Raised 1000 crs through QIP to invest in the emerging opportunities. Capex plan of 350-400 cr/year. It will be Combination of brownfield expansion and debottlenecking.

Example, in the Conductor division, operating at ~90% capacity utilization. Increasing capacity by 10-15% YoY.

(4) Premiumisation in the end industry

Shift from conventional conductors to High efficiency conductors. Premium products in Indian market and standard products in premium market leading to optimised margins

Competitive advantage in EPC turnkey solution for reconductoring High transmission low sag conductors

High Temperature Low Sag Conductors (HTLS) can withstand operating temperatures of up to 210 °C, thus carrying higher power compared to conventional conductorsIncrease in mix of elastomeric and special application cables used in varied industries viz., Solar, Wind, Shipping, Mining, Defence, Railways etc.

(5) One of the key contributors of Company’s success is innovation and Technology absorbing - key being the ACCC conductors from CTC Global

(6) Focus on US, EU and Australian Markets:

The new tarrifs on Chinese Aluminium Products bodes well for APAR. US is a strategic market which imports cables worth of $19 billion, hence a huge opportunity. APAR can cater to real estate sector and low voltage segment. It has the approvals in place (UL approvals, the Underwriters Laboratories approval).

APAR is largest exporter to US, Polycab is close second. KEI caters to Australia.

In Europe, APAR is focused more around the renewable energy side. APAR has contract with Enel (Italian utility)

Australian market is important in terms of export markets, good presence in Australia on a Specialty Oils, with over 35+ % market share for transformer oils, 50% market share for white grade oil of pharmaceuticals.

Final Thoughts

IMO, the management is honest and conservative. They believe in under guidance and over deliver, have always underplayed their growth forecast and margin guidance. Future growth is highly correlated with industrial tailwinds that should be strong and long-lasting. Although, they downplay the growth prospects look at their action - capex of 350-400 cr/year.

In the nutshell, the domestic part of business is going the India Way….solid tailwinds for the business from renewables, emergy transition, need of more transmission infra plus need to increase capacity of existing infra, Railways (especially the upcoming growth in high speed). Internationally, US looking for alternatives to Chinese supplies and EU have to fill the void created through its own de-industrialisation.

I used to think of this purely a commodity play - however the way business is progressing it is actually a mix. A lot is still commodity but there are premium products in the portfolio and in this industry where there are shortages even the commodities can fetch outsized margins (don’t take these for granted)

This is derivative play in the Energy Transition Theme, guiding 15% growth in Conductors over a long term, 25% in Cables and double digit growth in Oil and Lubricants Space.

Attention Readers ⚠️

This is not an investment advice. Just consolidating my thoughts. Follow your own process.

Not SEBI Registered. Invested and Biased.*****

Invest in yourself…. be a learning machine

These communities have helped me a lot in learning the nuances of investing. Why not check them out? - Join the community of learners.

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.