Reflections: January 2025

Broader Markets this month

We are certainly in a tough market environment. We have seen days of heightened volatility - Nifty witnessed a range of 6% from top to bottom, while Midcap and small-cap index a range of 13% and 18%. The pain was paramount in individual stocks.

There is a debate in social media about the broader market-oriented approach or stock setup-based approach. In my experience, your own trades and watchlists act as situational awareness tools. The answer to which approach one should lean on depends on the individual. I am not the one to say that only this or that approach is right. I am inclined to find pathways for myself, the ones that I can follow in the long run. Looking at my PnL over the past years, it is clear that I need favorable market conditions to be profitable in my trades. I am not a full-time trader, so I’ve to take into account the time limitations.

On the other hand, these periods provide one of the best investing opportunities.

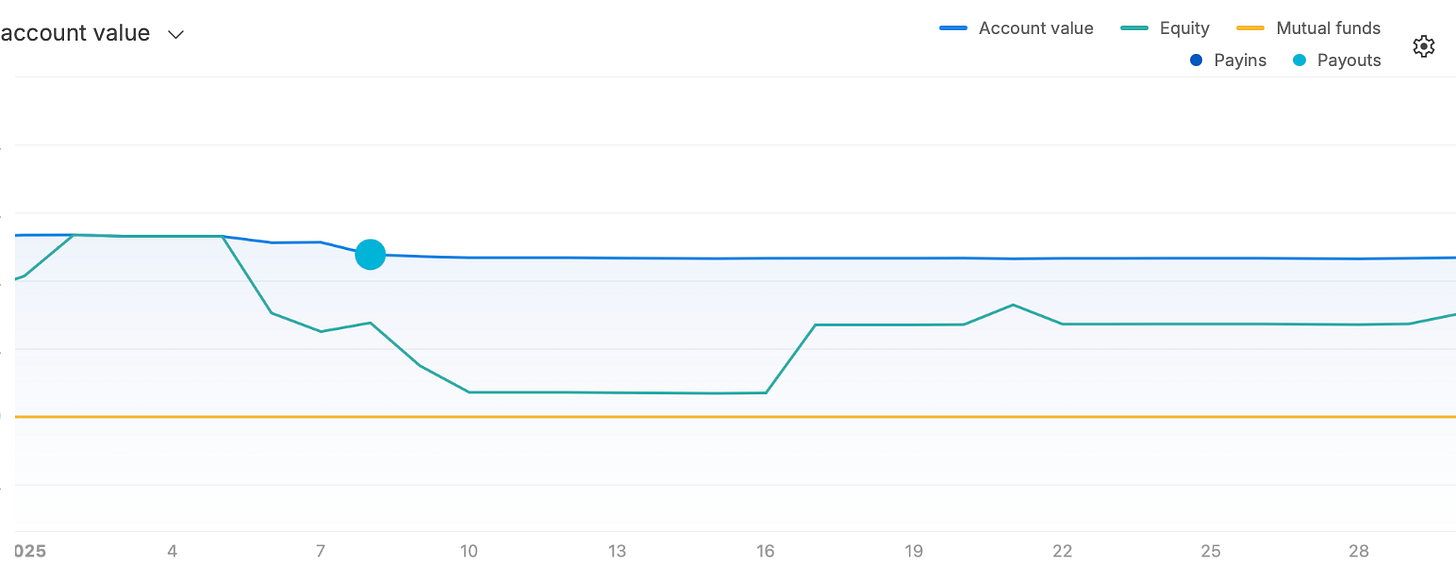

In periods like this, we appreciate the importance of overall asset allocation. This is a good time to start rebalancing.

In terms of learning and execution, this was one of the best months. Pat on the back to put your thoughts aside and exit with discipline when the stoplosses hit.

The whole account was liquidated in 3-4 days as and when the SL hit. The relatively newer positions were the first to go as they had tight Stoplosses. The last ones to get exited were fairly profitable positions like Zaggle, Zomato and Kaynes.

The best way out is to keep monitoring markets but keep FOMO in check by not participating unless the market structure changes. For trades, it is better to look outside equities for instruments like gold.

This was a very lean month with very little activity after the liquidation, or I can say a very cautious approach.

17th Jan 2025 - Initiated position in Gold (for trading in trend-following portfolio), via Goldbees (33% position)

20th Jan 2025 - Test buy in Genesys. Failed breakout. Exit same day. 0.05% Risk to the portfolio

21st Jan 2025 - 10% Position in Biocon. Why? In pharma shares, any positive news like new approval could decouple from rest of the market. Here after a long time it broke out to new high. An aggressive position with stoploss at previous day low. SL triggered next day with 0.35% loss to portfolio.

29th-01 Feb 2025- SRF

The setup itself is very strong - a big base (see weekly chart below). As we move to a lower timeframe (daily), in this weak overall market it had gapped up on the Highest Volume over 1 year. Supported by triggers like an increase in the price of refrigerant gases.

Here acting on HV1 + Gap setup felt like a good thing to do as there has been a long consolidation of 3+ years and hence the volume footprint is sign of accumulation

01 Feb 2025 - Gold exited with 1% positive impact on the portfolio.

Overall, the month was characterized by a cautious and selective approach. Now the budget event is over and the mandate is for consumption, the idea is to complete the scanning process (1) stocks with strong earnings (2) Stocks with relative strength - the ones that are bucking the downtrend and can emerge as new leaders.

We are treading below EMA 200, which can act as strong resistance. In any case, this is now not an easy environment as we lack our trend filter criteria of Price>EMA 50>EMA 200 SUM UP

The idea of the post is to sum up thinking in the present without having mind clogged with hindsight. Budget has now given a consumption boost, but will it be able to change the trend remains to be seen.

Time to keep the reading discipline on track. This month I read two books:

Focus: The ASML way - Inside the power struggle over the most complex machine on earth

This book exemplifies how critical ASML is to the global semiconductor industry. How semiconductor supply chains are intertwined and subject to geopolitics

A classic by William O'Neil. CANSLIM formula *****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

TradingView Affiliate Link

Supporting my work

If you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.