Permanent Portfolio Approach

Strategy for long-term asset allocation

Continuing from the last post on Asset Allocation

What does asset allocation look like in practical terms?

“Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes.” - Jesse Livermore.

Times change but human nature doesn’t. We all suffer from biases. One of the biases we suffer from is the recency bias, We tend to give more importance to recent events than the historic ones.

Although it is difficult to diminish these biases, we can strive for better decisions by being aware of these biases in our decision-making through deliberate thinking (Daniel Kahneman Type 2 thinking).Why did I bring up recency bias in the conversation? Because asset allocation requires a balanced approach. Just because an asset class is doing great currently should not lead you to relegate others.

In financial markets, Trend Following works so does mean reversion. For long-term wealth creation, you must strike a balance between offensive and defensive strategies based on your circumstances.

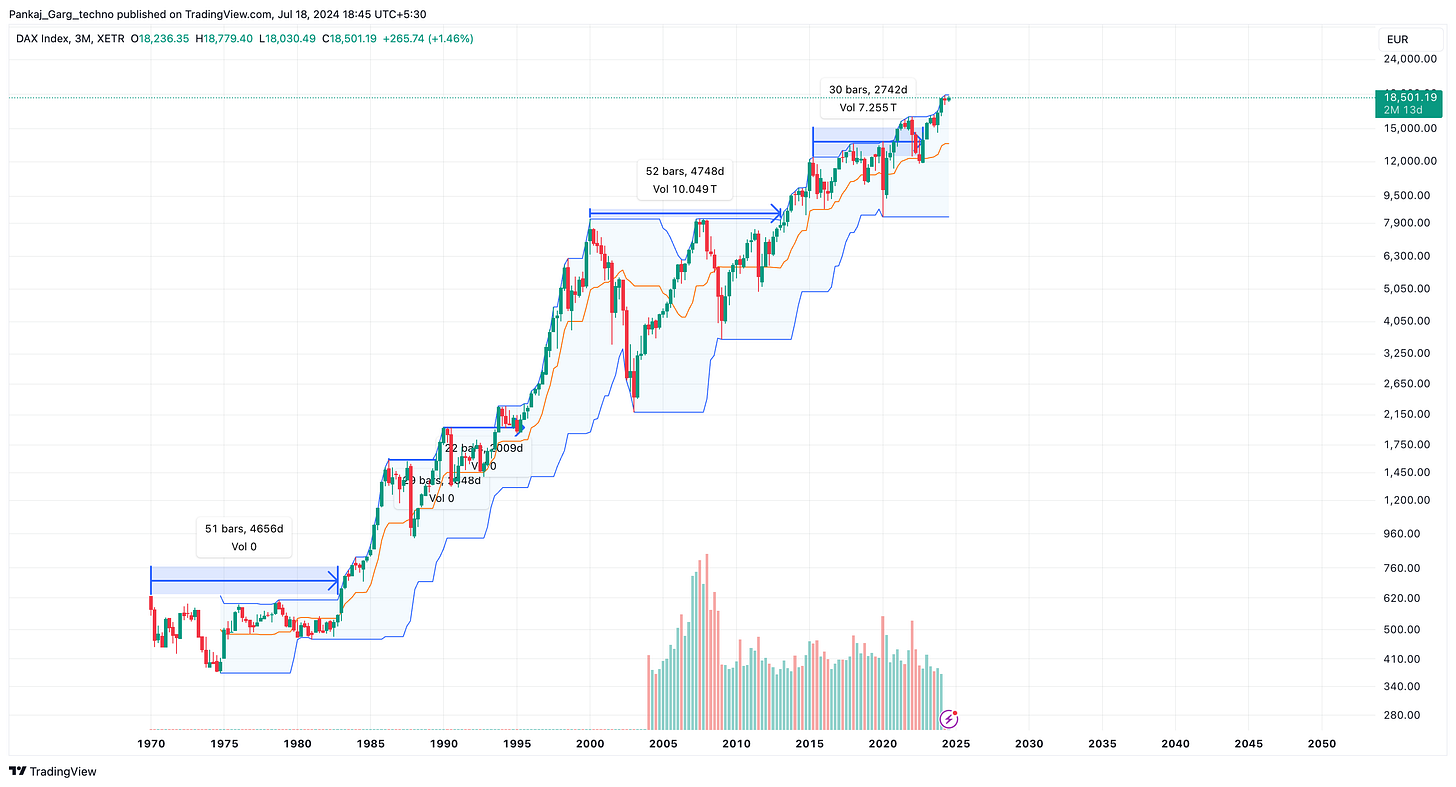

Look at the chart below (3-month chart from inception till date)….even the Sensex has had periods where it has not moved for a decade.

Just Think 💡💡 Are we immune to this kind of market character? Imagine you are 100% invested in equity and the needle does not move for a decade.

We can't rule out that this will not be repeated in the future.There are other examples across the globe:

S&P 500

DAX

NIKKEI

The crux is don't take the recent run-up in the stock market for granted. Have an asset allocation plan.Investments are more than numbers. They are savings representing the hard work of the past and promise to be able to do things in the future.

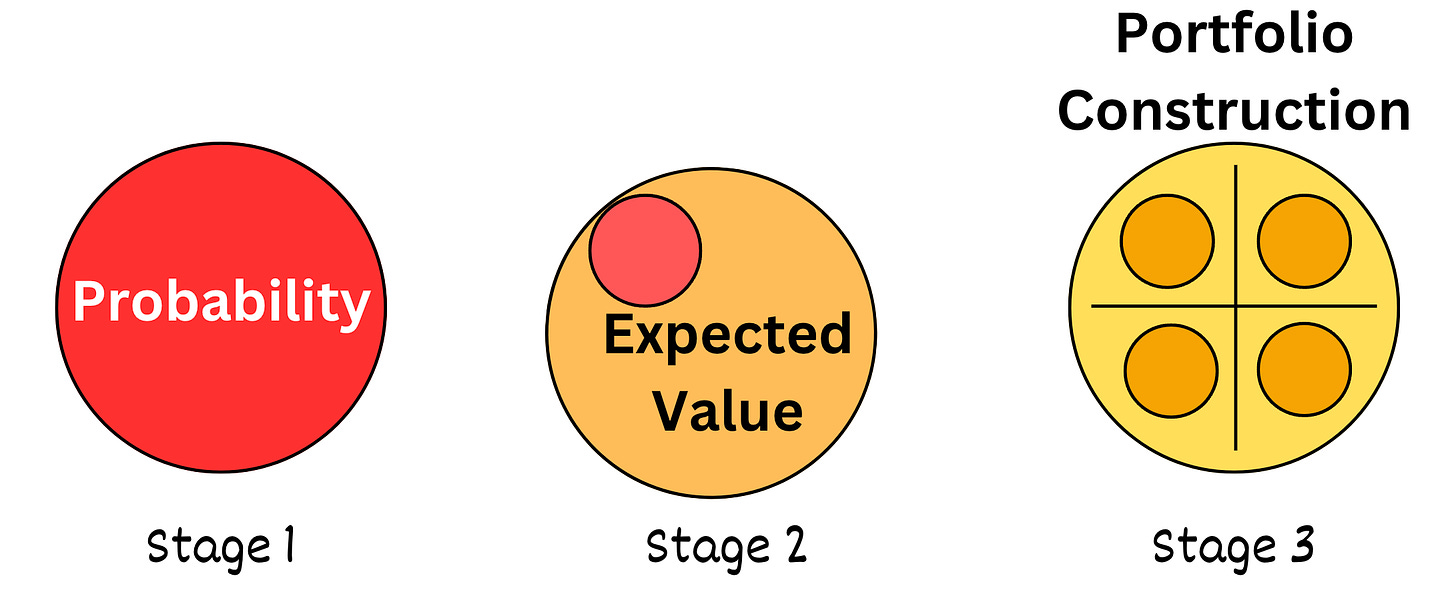

Expected Value: First layer of decision-making

Expected value is an important lens for thinking about investment decisions. But it is the starting point for filtering decisions.

In real life, however, the outcome is not expected value, it’s far from that. You get what you get. A high probability is not a certainty.

Let's say over a long period Indian Equities will deliver a 15% average return. But this average return doesn't guarantee that you will make 15%. What if you get a 50th percentile return let's say a 5% return (hypothetical number) you will end up with a return less than the risk-free rate.

You don't get average rate of return. You get what you get.

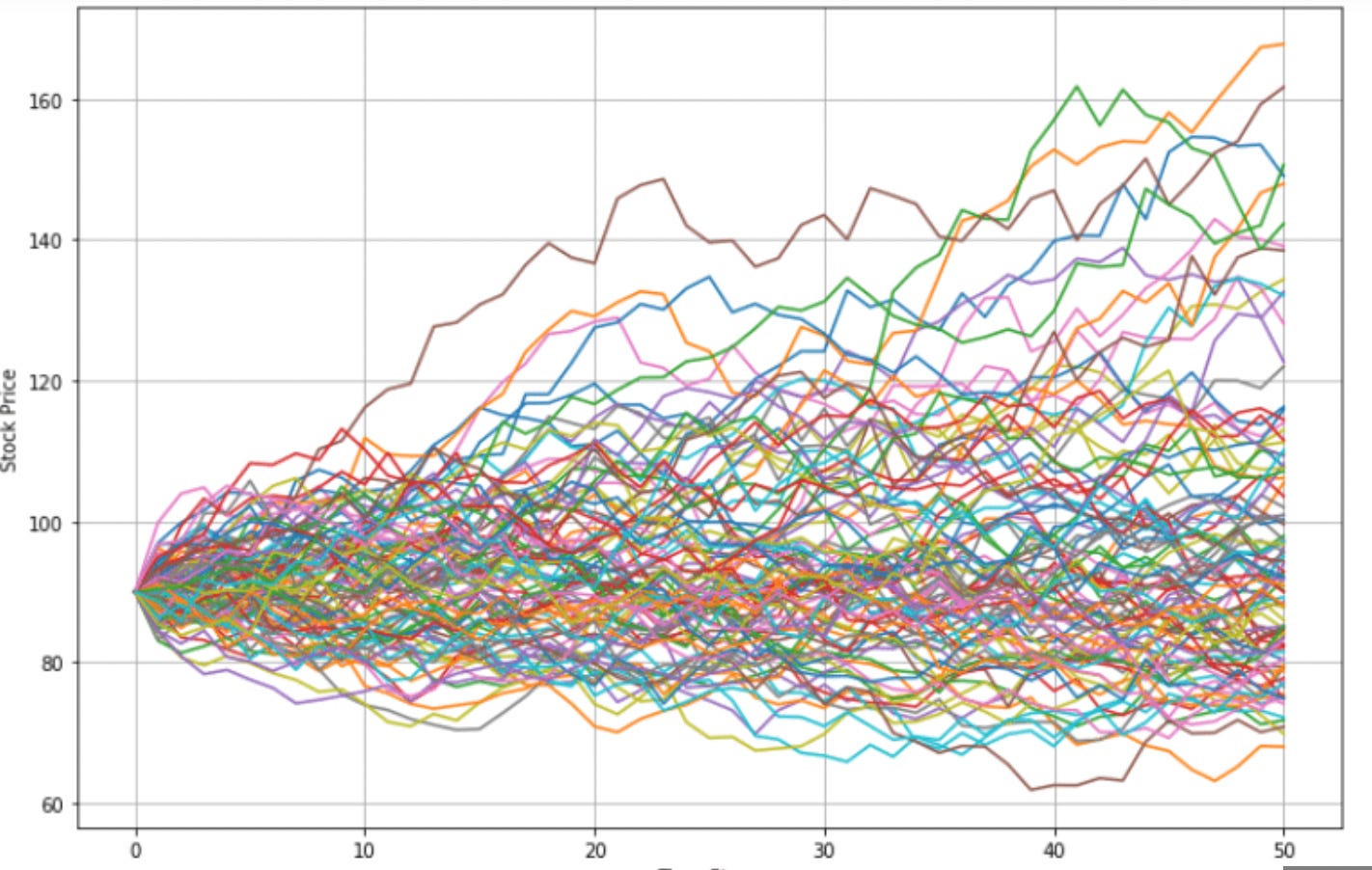

This depicts how volatility impacts the portfolio.

The expected value metric maximizes equity allocation, may even suggest an all equity portfolio. However, it will not protect against, if we get below-average returns.

So focus is on downside protection as well. Don't Die Tryin'If different asset types/strategies in the portfolio are individual players…would you pay attention to only the start player or the whole team?

There is a great lesson from the book/movie Moneyball on how as a team even group of mediocre players can ace a game. While skill in picking individual investments helps, it matters within the context of broader portfolio. Downside protection is paramount

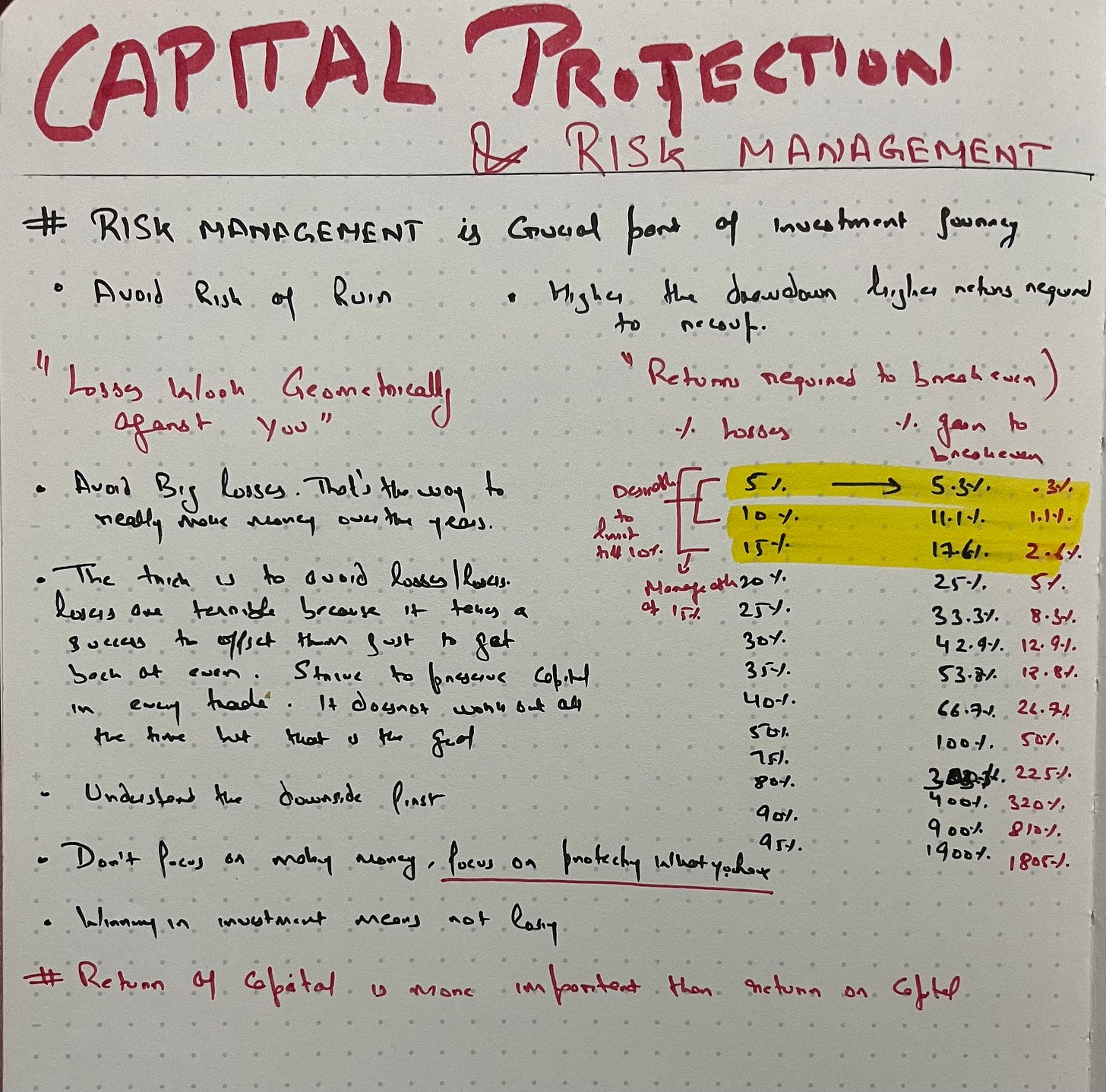

As your drawdown starts increasing, you need more returns - just to get breakeven.The higher the volatility of a portfolio, the worse the portfolio’s long-term CAGR.

Reducing volatility at the portfolio level helps in having a higher long-term growth rate and at the same time protects the downside.

Stage 3 - Portfolio of Different Positive Expected Values - The Permanent Portfolio

The idea here is not to predict the future but to be prepared for different macroeconomic scenarios i.e. Growth, Decline, Inflation and Deflation.

Don’t over-optimize for recent macroeconomic situation rather the combination to weather different macro-economic realities. The whole Permanent Portfolio is greater than sum of its parts.

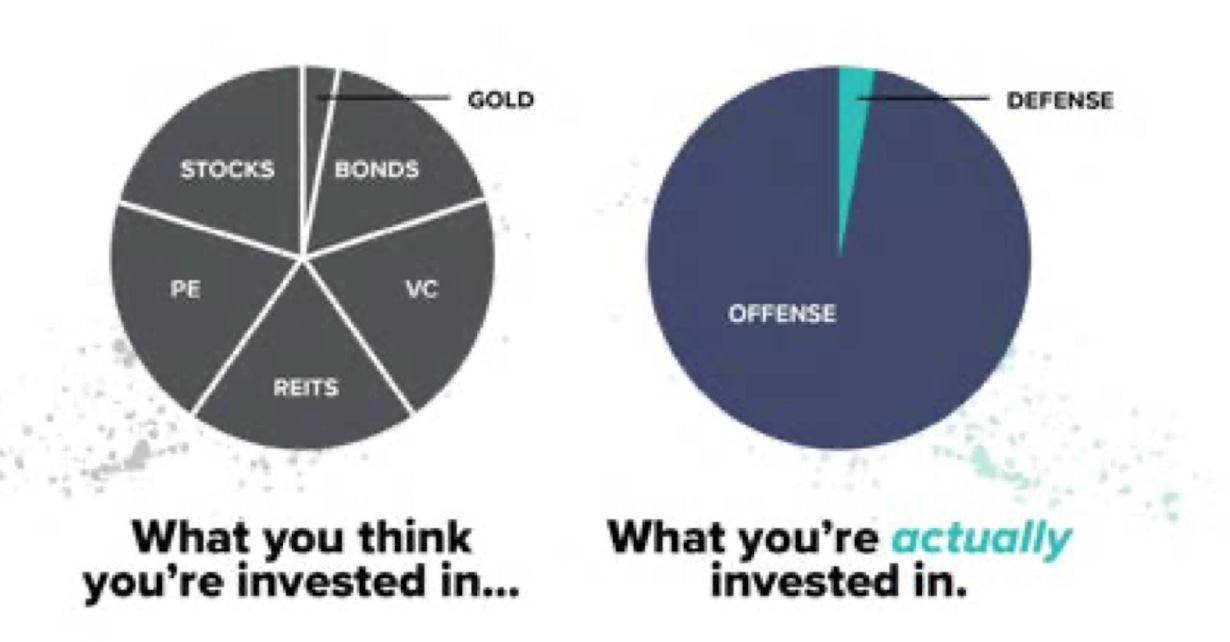

Offensive assets typically include Stocks, Bonds, Real Estate, Private Equity, Venture Capital etc…i.e. the assets that thrive on growth. Defensive assets include Gold, commodities and strategies like Trend-Following.

Equities and debt are more correlated than you think. So a 70/30 or 60/40 portfolio is basically betting on continued growth.

To conclude:

Don't miss the Forest for the Trees- You are responsible for your whole wealth/your net worth. Don't be blinded with one Asset Class. Have an holistic view of your total portfolio.

Calibrate with your goals and risk appetite.Resources: The Cockroach Approach by Mutiny Funds

***

Invest in yourself…. be a learning machine

These communities have helped me a lot in learning the nuances of investing. Why not check them out? - Join the community of learners.

Free course by Vivek Mashrani

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

👌👌