Unimech Aerospace and Manufacturing Ltd

Niche Manufacturing in India: The Unimech Aerospace Story

Today's post is about the upcoming IPO of Unimech Aerospace and Manufacturing Ltd. This is a company that operates in aerospace tooling catering to export market. RANCHO Framework

“Kabil Bano, Kaamyabi Jhak marke Peeche aaeygi”

- Baba Ranchoddass aka Rancho

Translated as: “Pursue excellence, and success will chase you.”

The philosophy behind this framework is simple.

- Look for companies that exhibit excellence in the fields they are in.

- Solving problems by introducing new products/services or doing import substitution making imports unviableThis company fits in another framework or observation of our Country’s Strengths

Low Volume, High No. of SKU Framework

The idea is that India has an advantage where the number of SKUs is high while the volume is less, i.e., a huge amount of customization is required. This can be attributed to the country's skilled labor, adaptability, and cost-effective production capabilities, which enable customization and handling complexity at scale.

Examples of this framework:

- Indian textile manufacturers excel in producing diverse designs in small volumes, catering to global fashion brands and seasonal trends

- India is a global hub for bespoke and intricate jewelry, offering a vast variety of designs while maintaining low-volume production per design.

- India’s pharmaceutical sector produces a wide array of formulations and dosages, including niche generic drugs and custom orders for global markets.

Key Factors Supporting the Hypothesis:

Labor Intensive Manufacturing: India’s workforce can handle complex and varied tasks that are less reliant on automation.

Regional Specialization: Different regions specialize in producing unique products, allowing for a wide range of SKUs.

Cost-Effectiveness: Small-batch production in India remains competitive globally due to lower operational costs.

Unimech Aerospace and Manufacturing

Unimech Aerospace and Manufacturing Limited manufacture and supplies critical parts in the Aircraft manufacturing and MRO supply chains like Aero Tooling, Ground Support Equipment, and Electro-mechanical sub-assemblies. It also manufactures and supplies precision-engineered components for Aerospace, Defence, Energy, and Semiconductors

⚠️ 99% of the company's revenue was from Aero Tooling. So, although there might be good traction in the future for Energy and Semiconductors as of now its not meaningfulThe SKUs i.e. the products manufactured by the company are not mass manufactured

Complex Products- High Mix, High Precision and Low Volume

As per the prospectus have manufactured 2999 SKUs in tooling and precision sub-assemblies and 760 in precision components (till Sep 2024)

It engages customers in two ways:

Build to Print - Customer provides the design

Build to Specifications - Here apart from manufacturing, designing is also involved

The Products require very high levels of precision

Manufacturing Facilities:

Two manufacturing facilities - Scope of brownfield expansion in the second facility

Looking for inorganic expansion in the United States and warehousing also to reduce time to market

Customers

Include Safran, Nuclear Power Corporation of India, Brahmos etc.

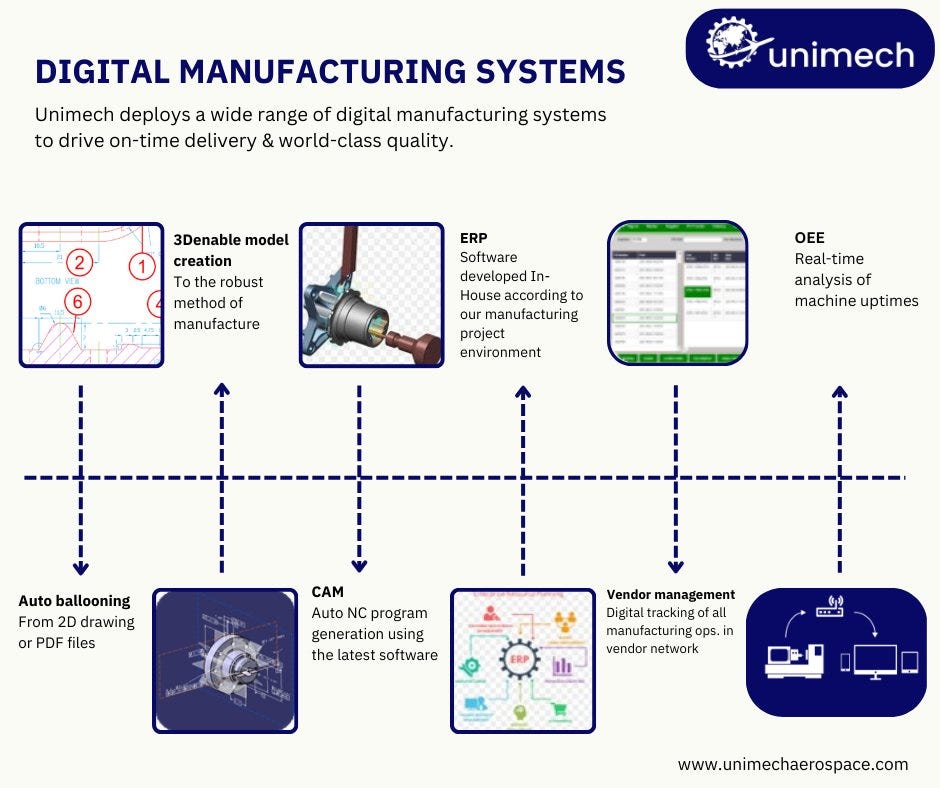

Digital Manufacturing Systems

So the crucial detail to follow is that the company has niche manufacturing capabilities. The industry structure is such that it takes a lot of certifications and licenses to supply components. Onboarding a new customer can take over 3 years.

Unimech supplies to 4 out of the 6 approved licensees globally responsible for manufacturing tooling equipment for aero engines used in narrow-body and wide-body civil aircraft. The company offers ground support tooling equipment for OEMs and MROs.Where will the growth come from:

My thesis is premised on

Increasing share organically. They have been increasing the SKUs and this is what will lead to growth. The growth in SKUs may come from other industries like Semiconductor and Nuclear as well.

Plans to double production capacity within 2 years.

The ecosystem in Aerospace & Defence in India is evolving:

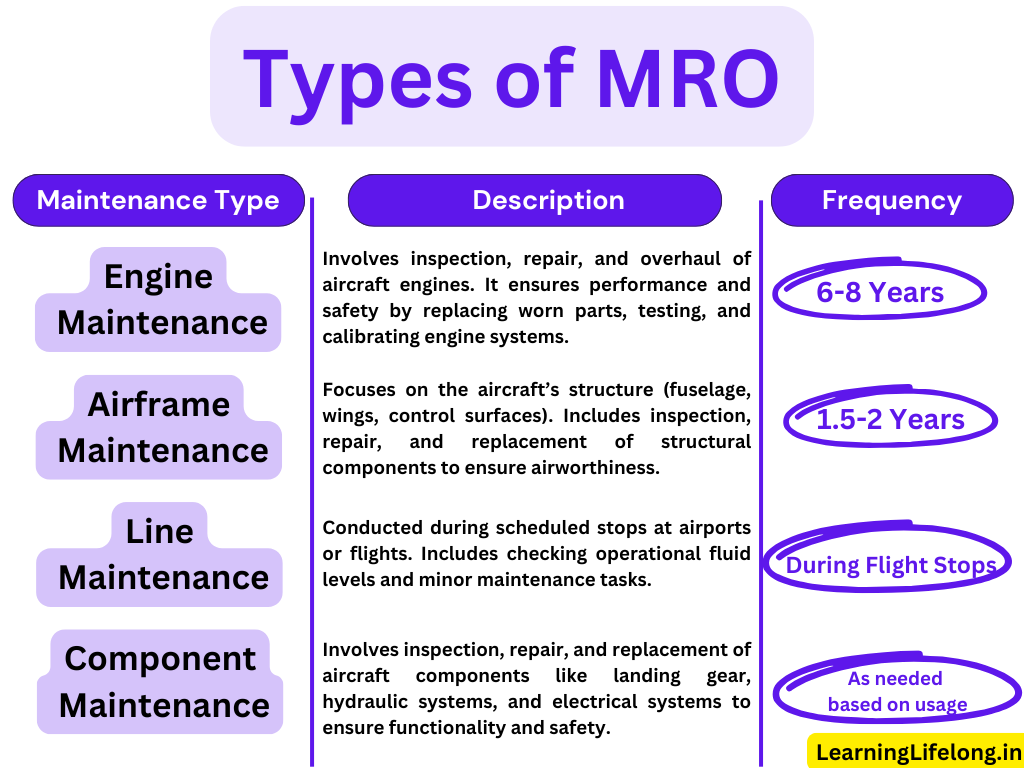

The growth in MRO indutry

This point was covered in the previous post on the industry. Link below

Thinking here is that the aviation industry is getting stronger. India is one of the leading countries ordering aircraft in record numbers. All these aircraft will need maintenance.

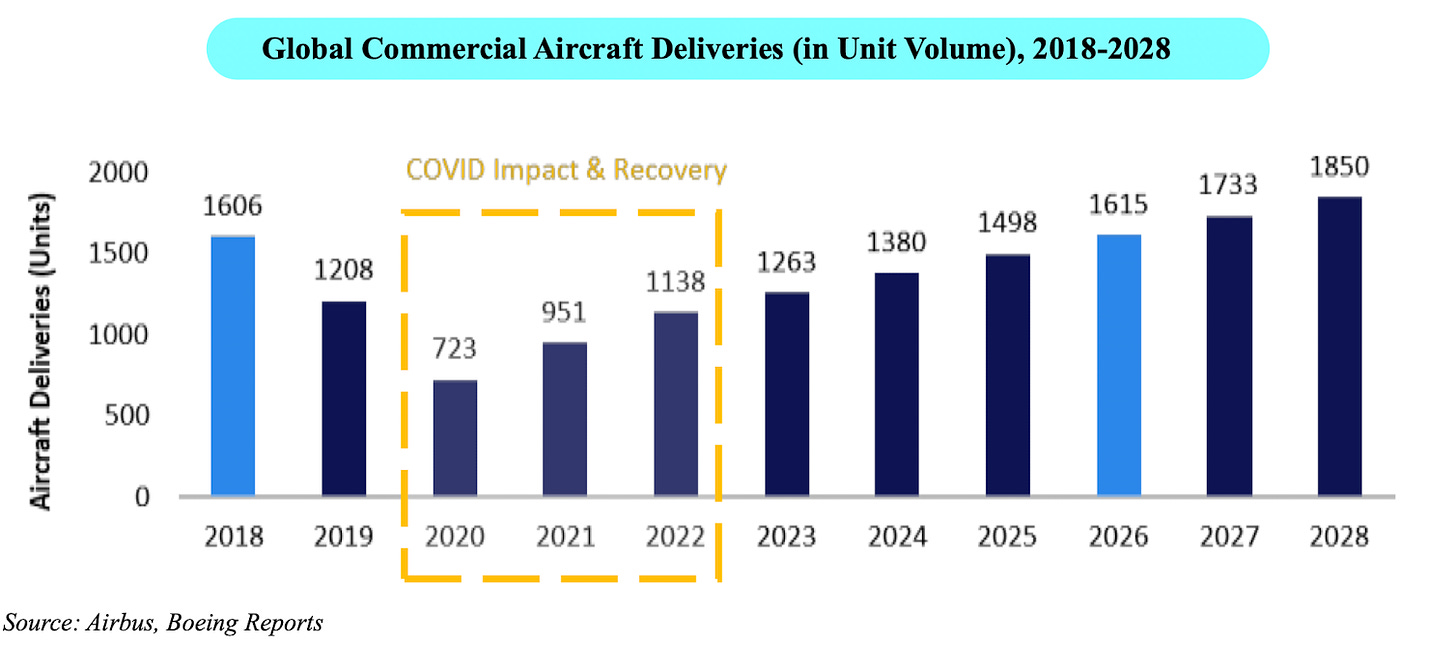

Tooling/precision component is a pick and shovel play to (1) the Overall aircraft manufacturing ecosystem (2) the maintenance ecosystem i.e. the MRO ecosystem.Engine MRO is one of the most complex and Unimech is providing tooling for the same.Commercial Aircraft manufacturing supply chains have hit the most during. There is a pent-up demand. Production at Airbus and Boing to ramp

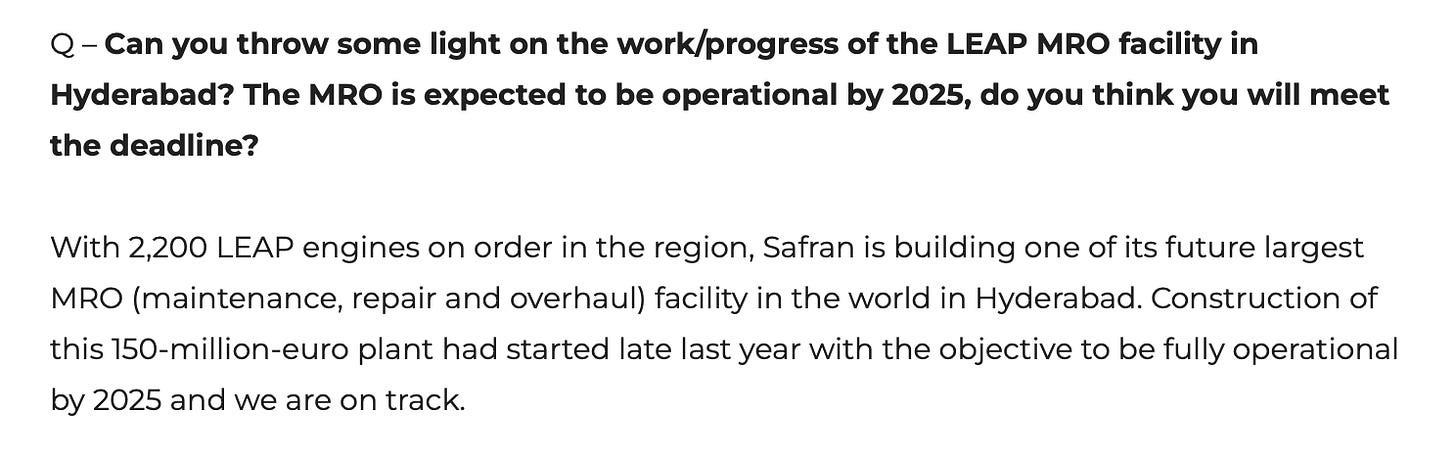

A big trigger would be SAFRAN’s MRO facility in India.

Link to full interview

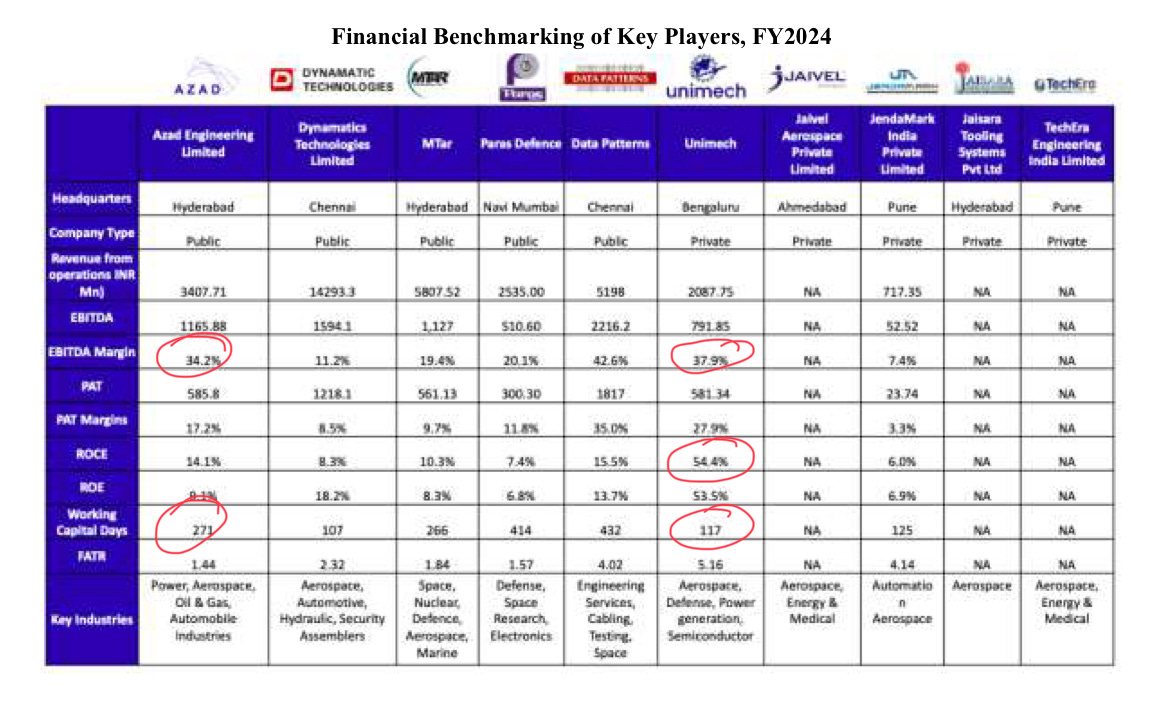

Financials and Benchmarking with other players

(Note data sourced from Industry report / DHRP)

Key Risks

Businesses operate in Probabilistic Space - thinking through what can go wrong.Based on my limited understanding. Not an exhaustive listExecution Risk - To give an example of execution risks - remember the IPO of MTAR. It was again similar niche player, operating in hi tech industry like electrolyzers, space etc. But so far they have not been able to perform (vis-a-vis the valuations) and have since corrected a long. So execution post listing/walking the talk is of paramount importance

Shift in dynamics and India not able to set up as a MRO base can be big negative.

Geo-political issues

To Sum Up

Aerospace is a challenging industry to crack. It was set up in 2016 and within 8 years they have made good progress. It is good for the markets to have companies from different industries getting listed. Surely, I will be tracking it!!

Not SEBI registered. Do your own diligence and let me know your thoughts :)P.S. - Thanks to Vineeth Bhai…for bringing this company to my attention!!

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

Resources for the post

Industry Report (Frost & Sullivan)

Currently exploring

Start reading habit…check out the top 10 trading books

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.