TA Case Study: HBL

Trade Analysis #4: Peek into my Trade Journal

Decisions are made in real time. I am trying to understand my trades better, dissecting the why behind the actions, and looking for inherent weaknesses in my trading.

I am not a teacher but a fellow learner...idea is to document and reflect...let me know if my rationale aligns with yours! HBL ENGINEERING (Formerly HBL POWER)

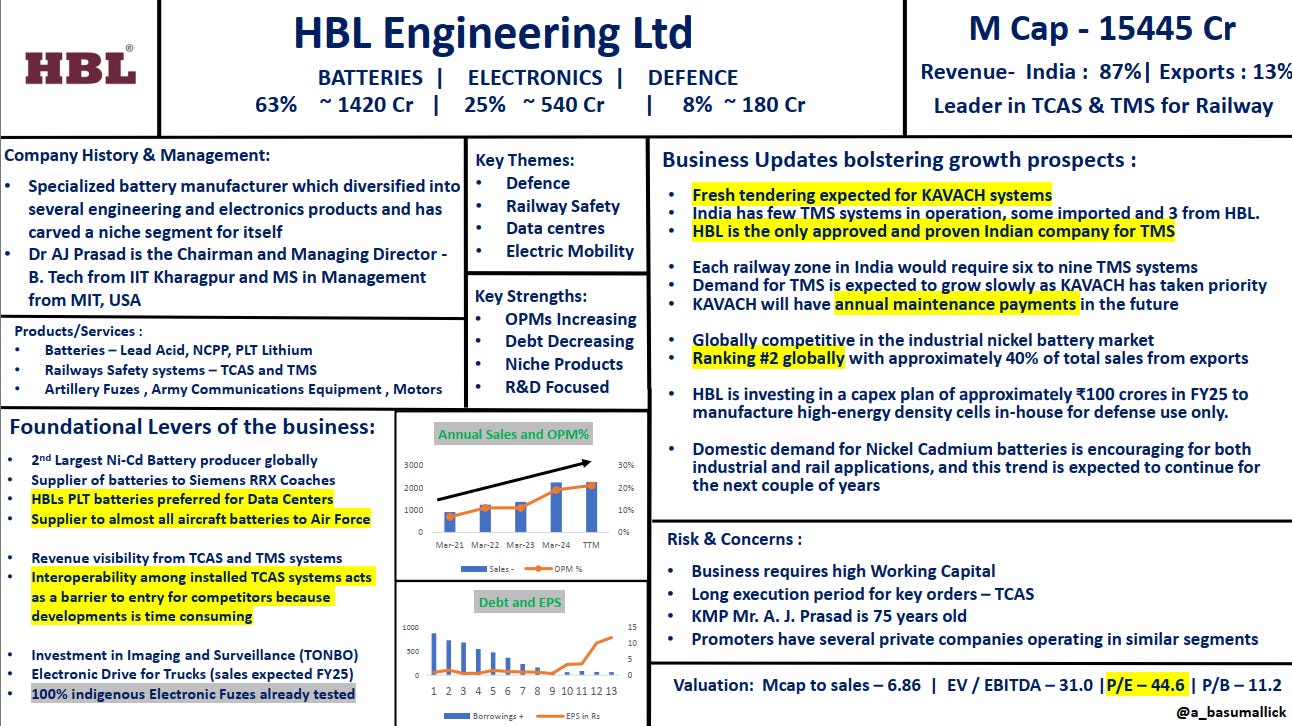

So HBL essentially operates in three segments, i.e., Railways (Kavach), Batteries (for defence applications, mainly naval and for data center applications as well), and Electronics (Retrofitting trucks to make them EV, investments in TONBO, electronic fuses, etc.).

Here is a quick overview of the company from Abhishek Basumallick Sir.

The information might be a bit outdated but gives a broader overview of the business(1) ENTRY - 27 Nov 2024

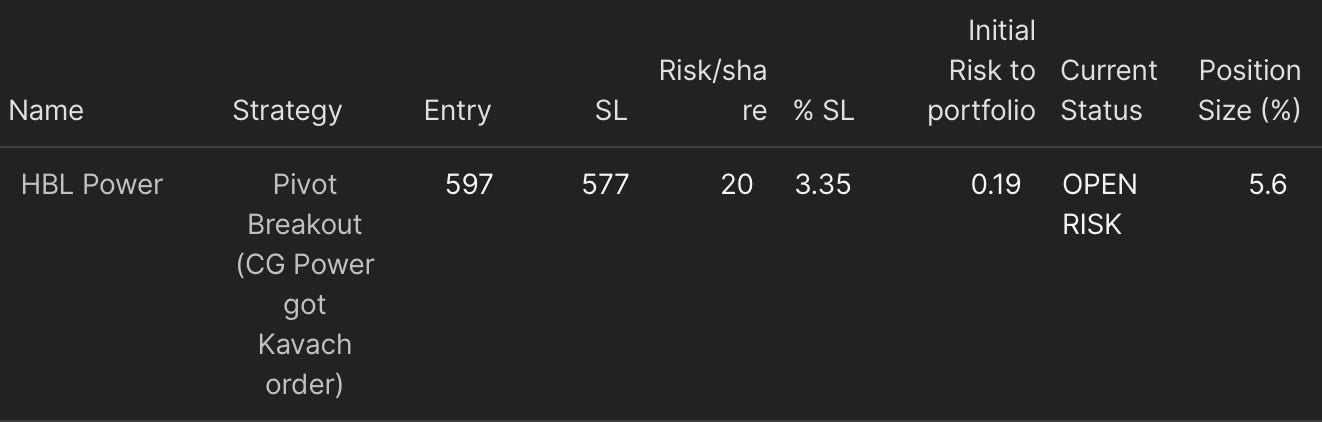

The trigger to entry was not anything happening to HBL but rather a fundamental trigger in the sector. GG Tronics won an order for Kavach and HBL is the first name that came to my mind.

(In hindsight the position size and Risk look very low for an optimum position but at that time market was coming out of the correction and it was progressive exposure at play…testing out the positions before meaningful positions could be taken)

Looking back, it had closed very strongly, and the volume was high. The one sign that the trade is going to be good and boosts confidence is that….it is in profit right from the entry

As sir Dan Zanger says:

Learning here is

(1) Sector-wide triggers can lift many boats - so second-order thinking is to look at different stocks in the sector.

(2) Leaders move much ahead of the news - I was triggered by the news but the smart money had already lifted Kernex (the pure-play Kavach company). (2) ADD On - 04 Dec 2024

The trade was profitable…there was an opportunity to derisk and add at the same time.

Added 1/3rd of the previous position (qty wise) at 641 - taking total position size to 7.64%

Avg cost increased to 611 while SL moved up to 610 making the trade essentially a Breakeven Trade in worst case scenario.

It is important to distinguish whether you are looking to trade or you are looking to invest...both these require a different mindset.

Here the mindset was that of trader. Knowing the catalyst act as additional edge giving conviction to pull the trigger.

IMO the foremost job of trader is not of making money - it is a byproduct. The first job is as a risk manager. I didn't had room to increase risk...hence the position size was not what I consider ideal i.e. 10%

It is my personal goal to fine tune the optimal position size - which may increase in the future...the first target is to start positions at 10% size (3) 06 Dec 2024: Blast on HV1 (Highest Volume over 1 year)

No matter how much we say that markets are efficient…what led to this price volume spurt. Markets react before the news!!

This is why I believe it is good to blend technicals with fundamentals as Price Volume action can be a leading indicator SL moved to the HV1 candle low. Well can't chase or add as SL here was over 8% and addition here would jack up purchase price.

Add-on should either be on pullback or breakout from a tight area. Reflecting on core point - we have to manage risk. What the stock will do after purchase is not in our control - but what position size we buy, what is the % SL, what setup we trade is in our hands.

Focus on what you can control!! (4) 13 Dec 2024 (Friday): Solid candle in a tight range

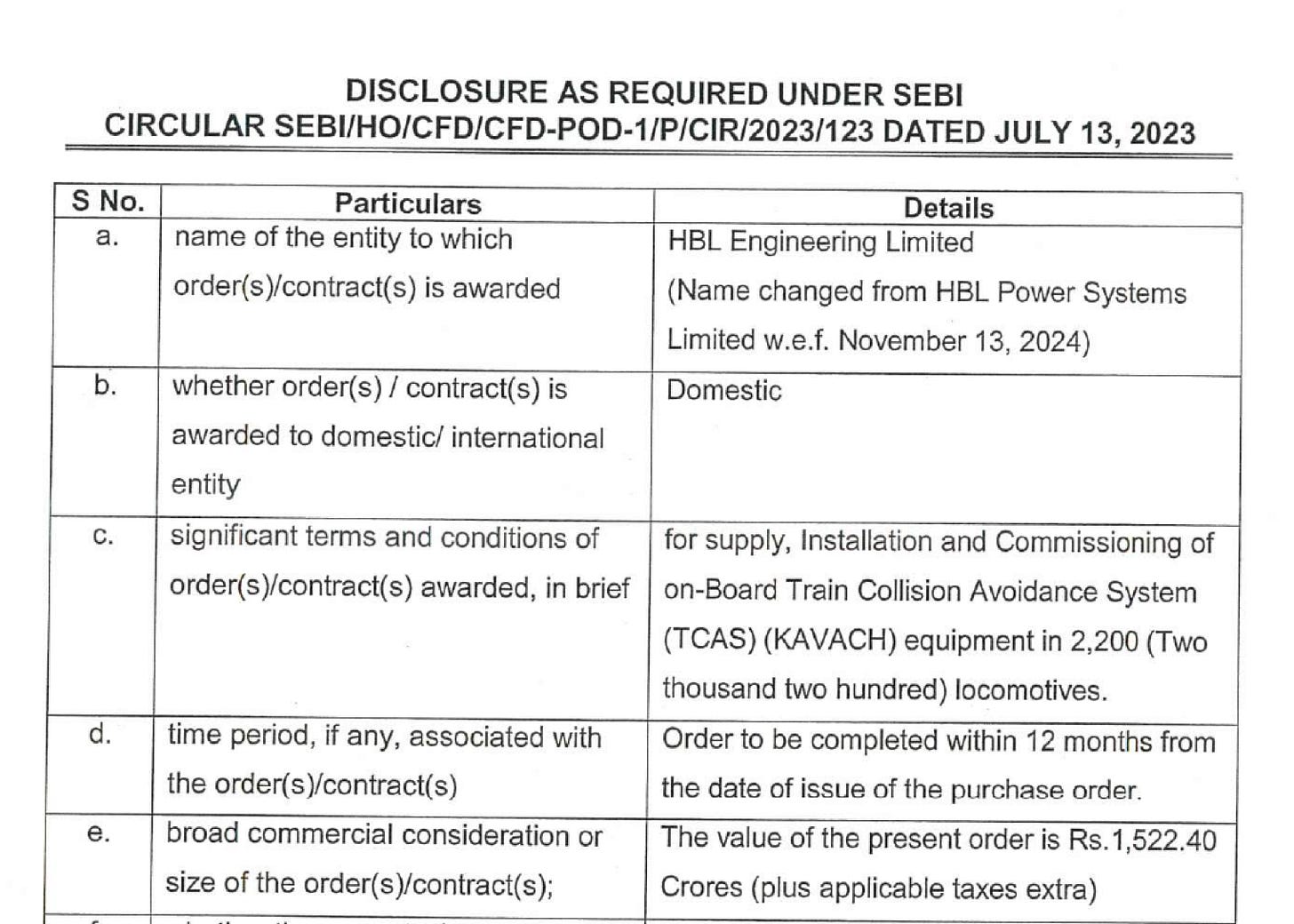

(5) 14 Dec 2024 (Sat): Order Win

Saturday 14th December I published about kavach and same day HBL notified receipt of Kavach order of ~1500 cr (ex GST) for 2200 locomotive Kavach.

I must admit...knowing the fundamentals is not always a boon because it can make us biased and can lead to inaction.

One way out is to plan in advance. Follow that Price Action is Supreme especially if it is a trading bet. Be flexible.So here is what happened…

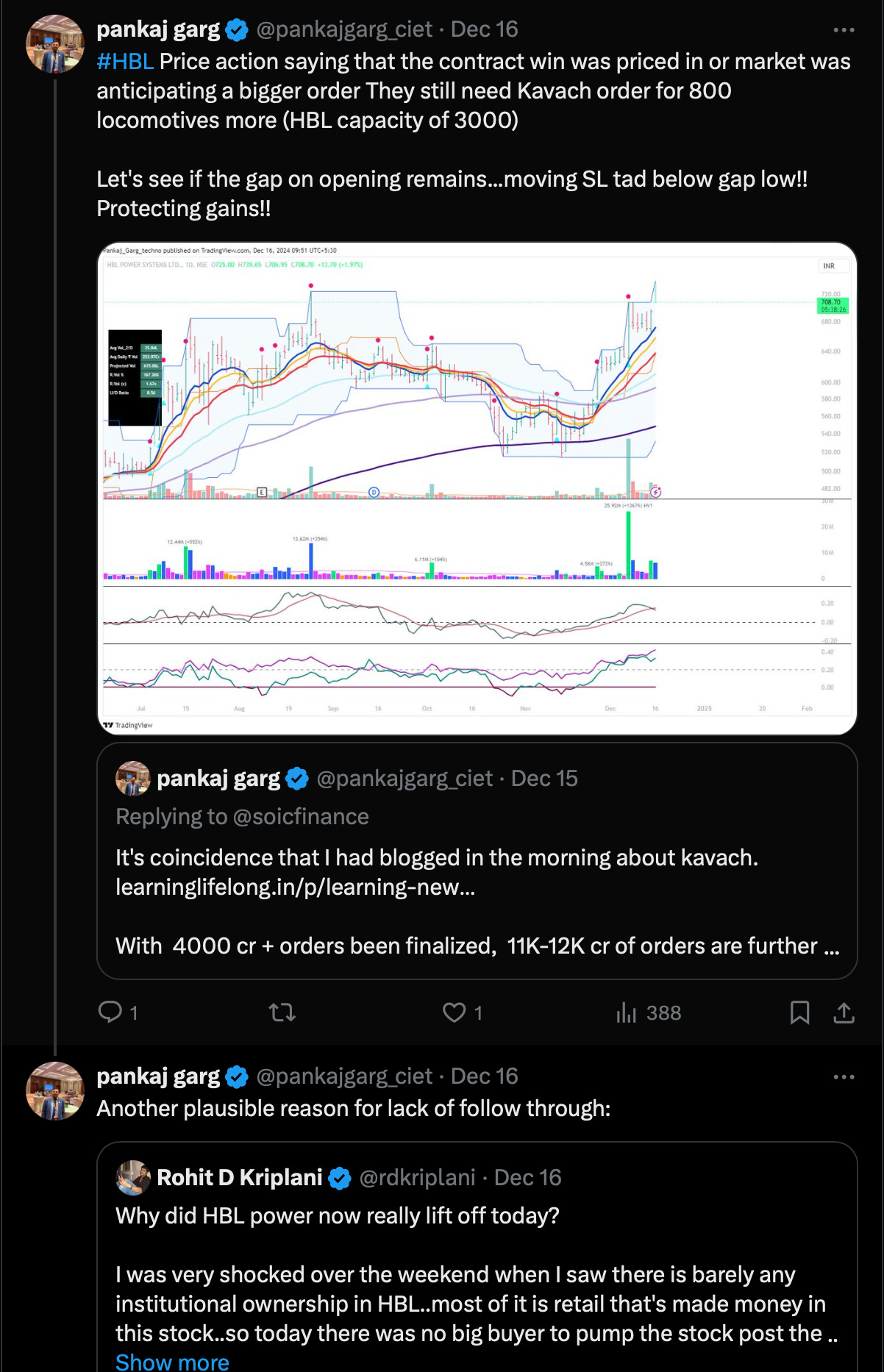

(6) 16 Dec 2024 (Mon): Gap Up - but could not sustain

Note: To reduce the number of data points most of the time I use Bar Chart. Having additional data points with candles (the plethora of candle stick patterns) confuse me rather than giving any objective insight. For review of trades, too lazy to change the template 😂So the focus moved from looking at returns to protecting gains. One reason for same was looking the chart at higher time frame….let’s look at the weekly chart:

HBL here reversed from the All Time High Zone

Looking through the lens of incremental risk reward...what I was looking at

(1) For the upside scenario - the gap should act as a strong support. If it acted right it would have made sense to increase the position size further...given (a) fundamentals (b) we could have low risk entry either as pullback on volumes from the gap zone or breakout from ATH zone which acted as resistance.

(2) For downside scenario - given the strong rejection. Fair amount of profits are on the table. Can always re-enter if it sets up. In case the gap support is broken then we will have two resistance zones - the gap area and the ATH zone(7) 17 Dec 2024 (Tue): Gap Low acted as support

(8) 18 Dec 2024 (Wed): Gap support breached - Exit

Exit triggered as it moved below the Gap low. Trade squared-off!!

What Next?

Well the position is exited now. One good thing is that once you are out…you can think even more objectively.

It can set up again. The fundamentals are strong. Kavach in itself is a strong theme on top of that the company is in themes like data centers and electronics/defence.

I’ll be tracking it for sure!!

Trading is a journey of constant improvement. I’ve shared my trades and the thought process behind them.

Please share your feedback or suggestions to take it to the next level?

PS: I have fair share of losing trades as well. However, the playbook of a losing trade is generally simple...the SL hit and out of the trade. The common mistakes here are entering at a wrong time, chasing extended stocks or SL too tight etc..

I just don't want to give a wrong impression that I only have winning trades. The truth is that the trades posted here have survivorship bias. *****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

TradingView Affiliate Link

What I am Reading this Month:

Finished reading Co-Intelligence: Living and Working with AI

It is a book on how Humans and AI will colloborate in the future.Supporting my work

If you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

Good thinking, but how much time did you invest to move in and out? What is amazing the net in 4/5 week, and the guts to quit and perhaps reenter. Adding at what points as you mentioned is for a seasoned trader and to be articulate about it is really good learning for all readers.

I am new to investing and learned a lot from your post. Simply Superb...Keep Posting.