Swiggy: Another new age company hitting the bourses

Can it replicate Zomato's Success?

To the already heated Quick Commerce Space, we are about to witness the IPO of Swiggy. The offer comprises a fresh issue of ~4000 cr that will be utilized for expanding dark store networks, tech upgrades, marketing, and debt repayment.

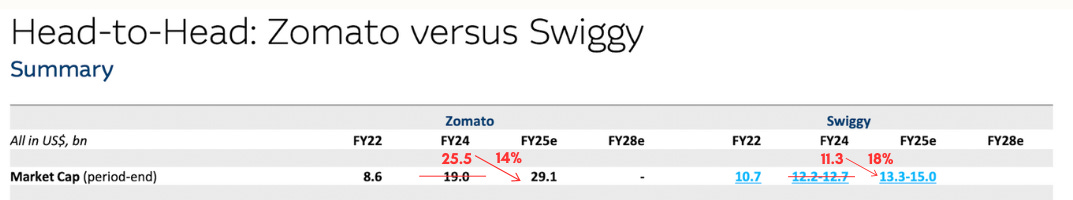

Valued at 11.3 Billion USD ( compared to 10.7 Billion USD as per the funding round in 2022). FY 2024 GOV of 24,700 Cr in Food Delivery (15% Growth YoY); 8100 in QC (58% Growth YoY). As with Zomato, the principle thesis is that QC business is a growth engine,

A net loss-making company. So the question is what is the path to profitability? Food delivery is profitable. 1000 cr EBITDA FY 24 i.e. a 4% EBITDA Margin.

I will make my views clear. If they focus on profitability they will not be able to scale. But if they have to scale, they have to pull out a rabbit and forget about profitability for some time.

So this is a game of building business to position for the long run rather than cashing out when the category pioneered is deemed viable and desirable.Q: Is it worth investing in Swiggy? How are expected returns stacked against Zomato?

Macquarie had posted a detailed comparison of Swiggy vs Zomato. Swiggy is definitely behind Zomato in both food delivery and QC. To add to the problem, the key growth driver, i.e., the QC is entering a high competitive intensity phase.

Swiggy has been losing out to Zomato? Even if we don’t talk about competitive intensity from other players…will Swiggy’s position change after IPO

QC is a capital-intensive business. One has to invest in technology as well as in Dark Stores. So one factor of growth is the availability of capital to grow.

IPO is predominately an offer for sale with only 4000 cr Fresh Issue. Compared with Zomato’s QIP of 8500 cr (pending approvals) it falls short in the gunpowder given Zomato’s existing cash balance of 10,800 cr.

On the business side, Swiggy has lost market share.

Zomato is way more profitable. They chose not to focus on profitability in QC rather putting incremental growth at near 0 margins i.e. scaling without negative effect on profits. It’s a good thing that they have hunger and a sense of delayed gratification. Swiggy should follow suit.

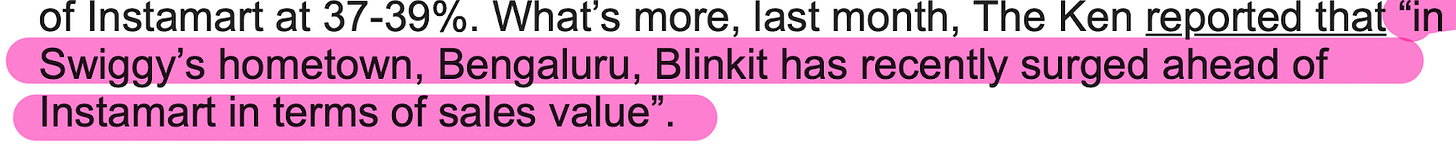

Blinkit has far better unit economics than Instamart

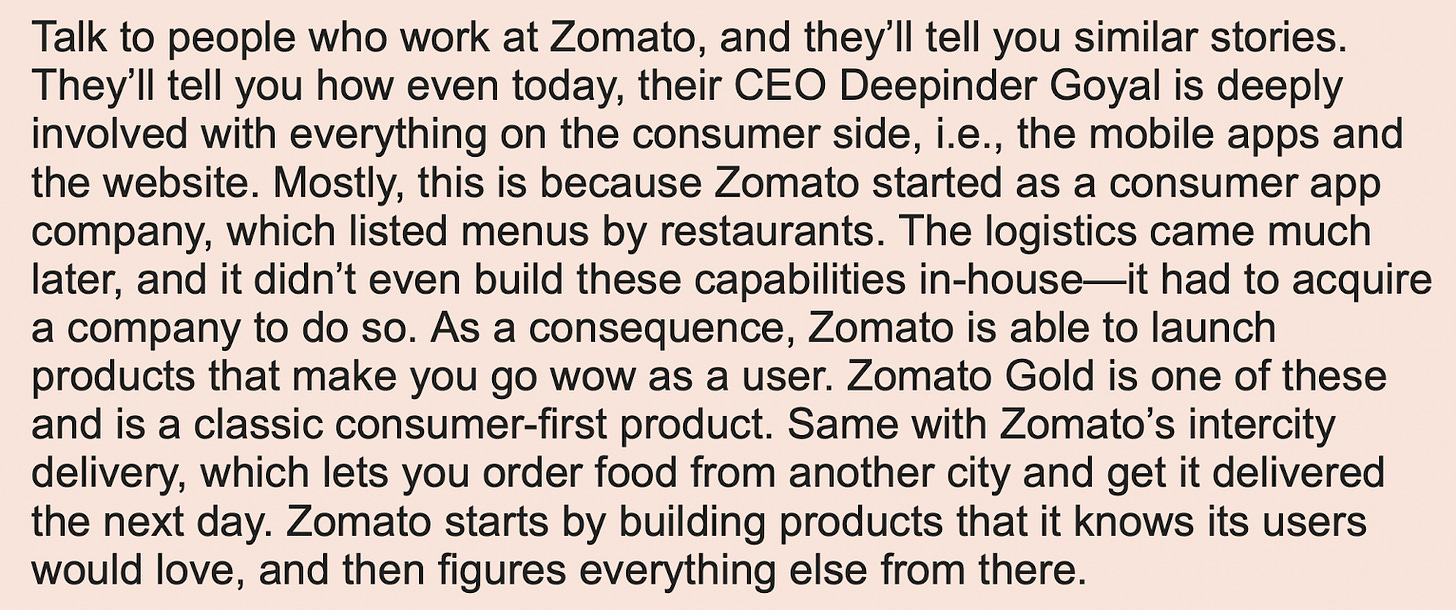

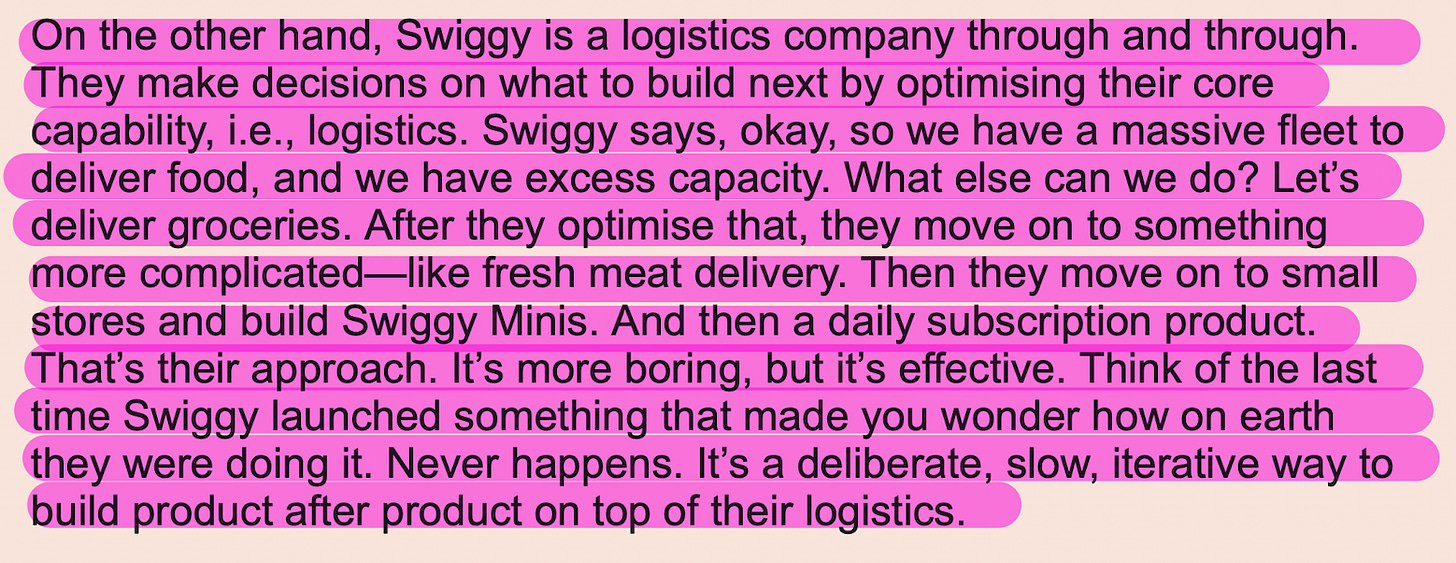

In terms of business, the key strategy difference is Unified App.

In theory, this should be positive for Swiggy. However, this strategy does not seem to be working on the ground. Contrast this with Zomato, which apart from Zomato and Blinkit App is planning to launch another app for Dine Out and Events.

From a product and marketing standpoint, Zomato and Blinkit differ from Swiggy in one key aspect-Swiggy is integrated, while Zomato is fragmented. Swiggy offers food delivery and grocery on the same app, delivered by the same fleet. On the other hand, Zomato does food delivery. You want groceries? Please download Blinkit—another app altogether. (another delivery fleet).

I know I am ranting between Zomato and Swiggy but this is the best explanation for their business models, I have come to so far:

I know this might be flawed and biased logic, given its dependence on a brokerage report. However, the business metrics of Zomato and Swiggy are very different. Swiggy has been losing market share even in the food business and is 4-6 quarters behind. In the current scenario, given the rising competition, the pace of growth is of the essence.

Hence, IMO Zomato is still the better bet.Broader Macro: Consumption Slowdown?

Private consumption is experiencing a noticeable slowdown. So far the growth is resilient in the QC space…but how long will it take to trickle to QC retail?

Technicals

Swiggy is to be listed..but how is Zomato behaving technically?

Almost 20% off the highs. The Q1 FY2025 Gap is acting as a support. The superb growth this Quarter has failed to lift up.

This is a testament to the multiple factors alluded to above or I am mistaken and mean reversion is playing out given that Swiggy IPO is at a much lower valuation.

Overall, as a space, it is time to be cautious and as always follow the process.

Subscribe or Avoid??

For me, it is an Avoid

Already invested in Zomato. Alluded to this above as well.

Will look at it if it sets up technically

I don’t prefer investing in IPOs as you can’t size the position

This is not a recommendation. My decision has been arrived at based on my personal factors. Do your Due Diligence. Not SEBI Registered and views are personal. Book/reading recommendations

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Good as always