Sona BLW Precision Forgings Ltd

Riding the EV Wave

“The Internal Combustion Engine (ICE) is a 'dead technology' and the way forward is electric, pushing for EV makers to make India the biggest manufacturer and exporter of electric vehicles.” - Amitabh Kant, the G20 sherpa and former CEO of NITI Aayog.

The whole thesis is built on the assumption that EVs are the future. If this assumption goes for a toss...the thesis goes out of the window.

IMO, we may argue on how fast or slow the transition will be and what final shape it will take, but a transition is underway.I am a biased enthusiast of technology, inspired by Tony Seba (https://tonyseba.com) and books like “The Future Is Faster than You Think”, “The Coming Wave” etc., I am a firm believer that we are on the cusp of a Great Leap in the history of mankind.

EVs are also a jigsaw in the Energy Transition Puzzle.

⚠️ ATTENTION

This is not a recommendation. I am not SEBI Registered. I am biased and invested in this company. SONA BLW PRECISION FORGINGS

Sona BLW is an Auto ancillary company, that designs, manufactures and supplies engineered automotive systems and components.

PRODUCT RANGE

With a meaningful presence in the Global Automotive Value Chain:

Dominates the Indian Market and relevance at the global scale

THE STRATEGY

The focus is on Battery Electric Vehicles (BEV). The same is visible from the growing share of BEVs in the company’s turnover.

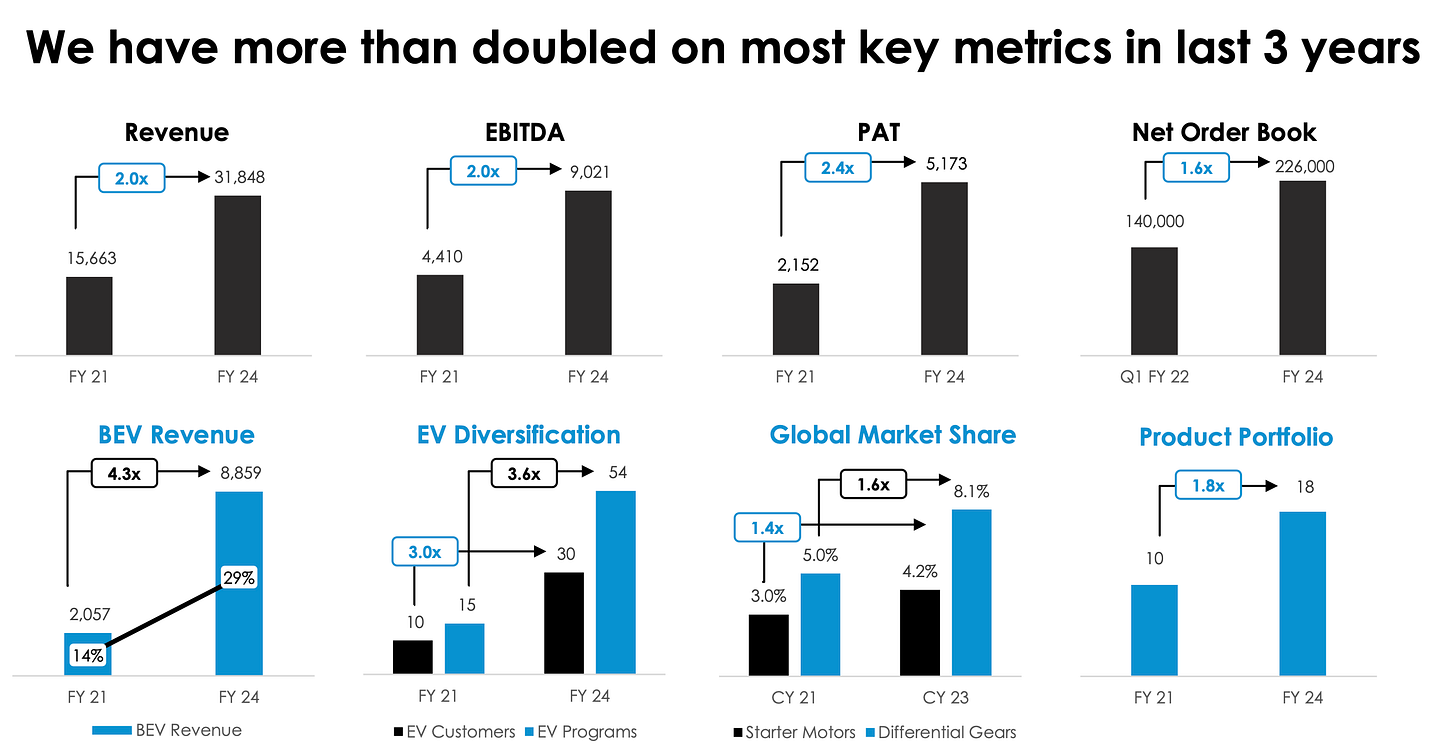

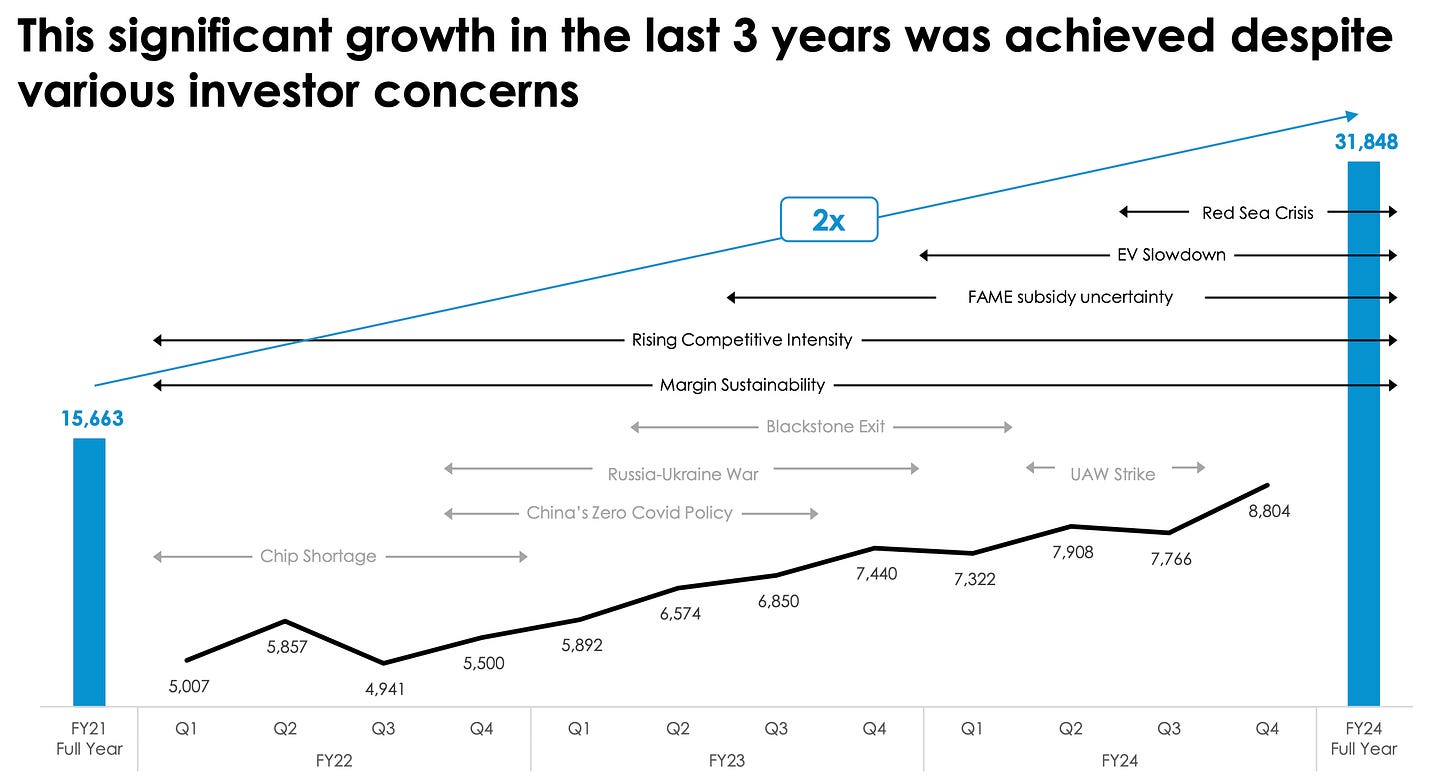

Walking the Talk….Growth in the last 3 years has been great despite headwinds.

Note to Self

2X in three years is a great compounding story. If you find a company that compounds at this level....ignore the noise and stay putThis is not an aberration for just the past 3 years….has delivered tremendous growth since inception…

Why do I believe that they will continue the past trajectory of compounding

The short answer is their vision and product development.

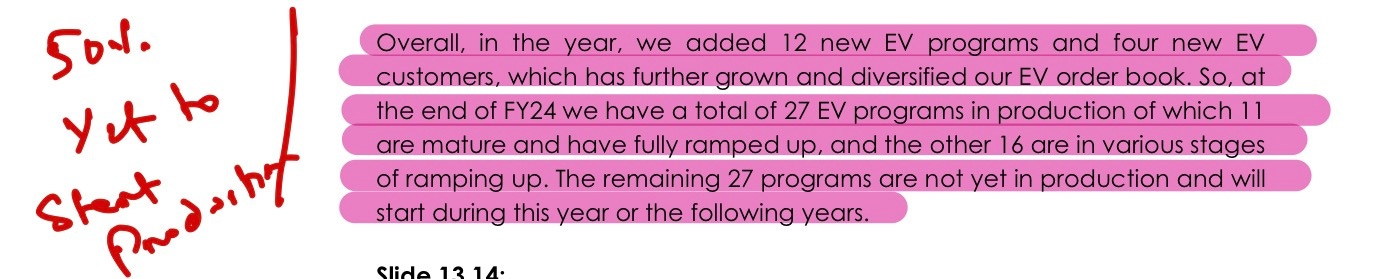

(1) Industry tailwinds and the power of adding new products

(2) R&D focussed company

Case in point:- products like Integrated motor controller and other new recent order wins

(3) Operating leverage

Only half of the total programs are active i.e. a great headroom with the current wins itself to continue the growth path. Further, over half the active programs are in the ramping stage.

(4) Favorable policy environment

PLI Scheme and Govt. EV Push

Key Risks

(1) Reduction in Policy Support

(2) Slowed EV adoption

(3) Raw material inflation

Margins are sensitive to commodity prices. Steel is the main raw material. Copper is passed through completely. In domestic business passed on to the customer after a 1-month delay, in international business average of 6 months is taken and passed through the next cycle.(4) Competition

(5) Battery

The tailwinds in the EV sector are now contingent on one technology i.e. battery tech. Batteries account for over 40% of the BEV cost. Hence this is a high-impact external factor.

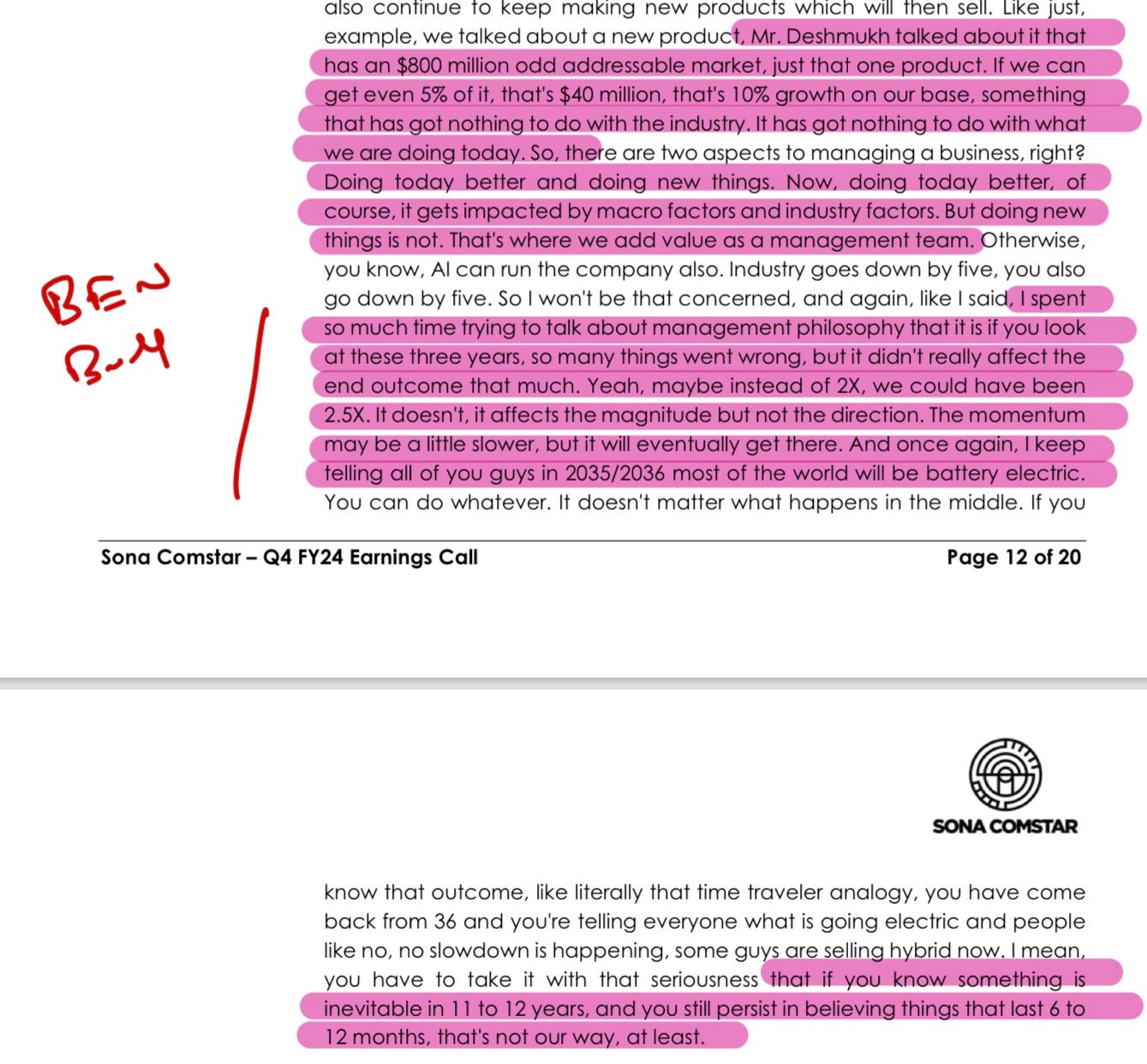

I would like to sum up the post with this Management Interview.

2035 ICE will be single digits

1/6 workforce is in R&D

We add new products and take them to global relevance

a. Make the best product for that category

b. Make that product as cheap as possible for the customer

c. Deliver that product as fast as possible

The key thesis is that this is a product innovation company - as long as they can execute the strategy I see no reason to worry. I would rather not emphasize individual quarters as long as the business continues on the right track.

Technical Analysis

The growth in public EV charging connectors is a good proxy for underlying growth in the sector.

Attention Readers ⚠️

This is not an investment advice. Just consolidating my thoughts. Follow your process.

Not SEBI Registered. Invested and Biased. *****Invest in yourself…. be a learning machine

These communities have helped me a lot in learning the nuances of investing. Why not check them out? - Join the community of learners.

Free course by Vivek Mashrani

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

There are peers of company, how are they going