Result Updates: Waaree RTL

Quarterly miss....but strong visibility over the year

Please check out the detailed note:

Key takeaways from Q4 / FY2024 results:

(1) Commissioned 704 MW in FY24 i.e. only 231 MW commissioned in Q42024 against management guidance of 400-450 MW.

Updated order-book bridge

(2) The yearly execution is a record high at 704MW implying 3X FY 2024 required to be executed in 1.5 Years.

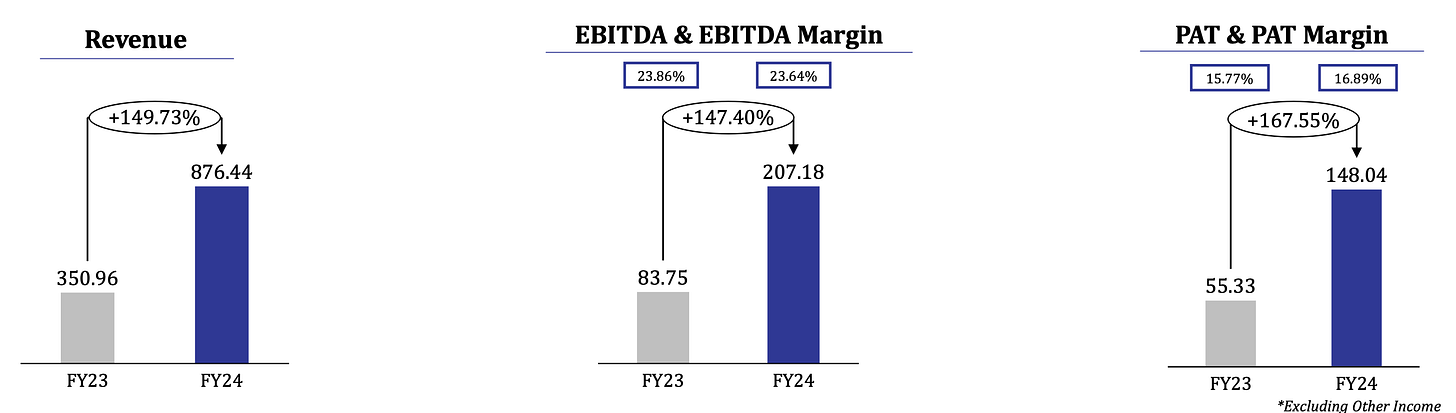

(3) Margins at the same level.

(4) Receivables grew 2X Revenue.

In the EPC business, the developer retains part of the project cost typically 5-10% as a performance guarantee/retention which is released to the EPC company after 6-12 months of commissioning of the project. So this amount is reflected in receivables.

(5) There is a lot of chatter on Social Media about 5B Maverick which is a Solar deployment system - Have not done any project yet.

(6) Deployment of Green Hydrogen Project: The company has completed the Green Hydrogen Project.

(7) Increasing share of PSU orders

"Last year, the share of PSUs in our order book was just 10%. Now, in terms of volume, it has gone up to 15% and in terms of value, it has gone up to almost 35%. We see the share of PSUs increasing as the government is coming up with a lot of investments in this sector”

(8) Increased bidding pipeline

In FY24, the company's bidding pipeline stood at 10GW. This has increased to 13 GW this year. So, the growth rate momentum is increasing by more than 30%.

(9) Looking forward to benefiting from Rooftop Solar opportunity. Preparing an organizational structure for the same

(10) Looking to participate in the BESS sector. Govt. has 47 GW plan. 5% BESS is mandatory with Govt. policy as of now, which may be hiked gradually

We are waiting for govt initiatives/ actions on this front

What next?

Should one focus on 1 quarter of subdued performance compared to expectations or at large order book in hand?

In my view, the valuations WaareeRTL trades at give no room for error. This quarter signifies that there are scaling issues and execution challenges. However, the business has serious tailwinds and from a long-term perspective should be accumulated at lower levels.

The trigger to watch is new order wins. Given the company has a lot on its plate and coupled with the fact that solar projects are short-duration projects, it will be interesting to see developments on the new order front.

Always keep in mind that it is a lumpy business and the key risk is execution. *****

Invest in yourself…. be a learning machine

These communities have helped me a lot in learning the nuances of investing. Why not check them out? - Join the community of learners.

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.