Result Updates: Jyoti CNC

Strong growth in Order Book

Jyoti CNC Automation

Key takeaways from Q4 / FY2024 results:

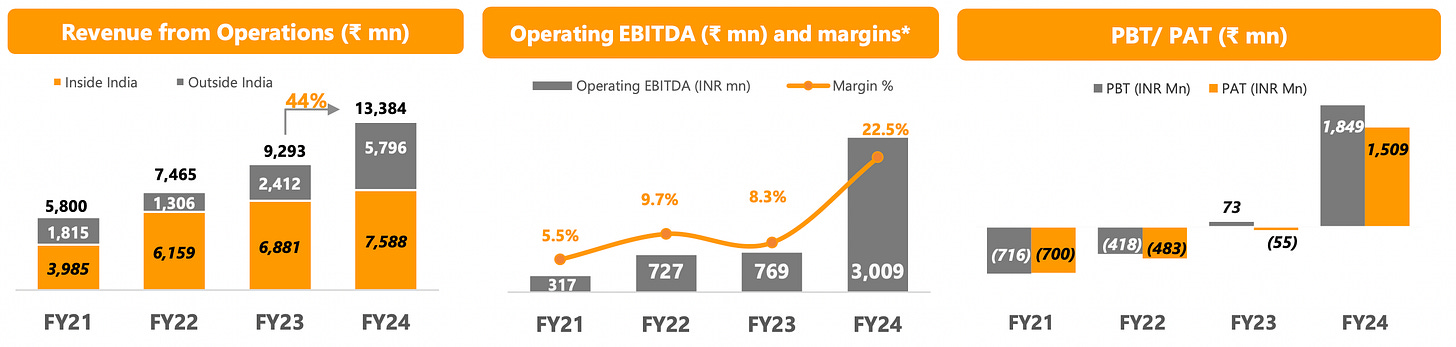

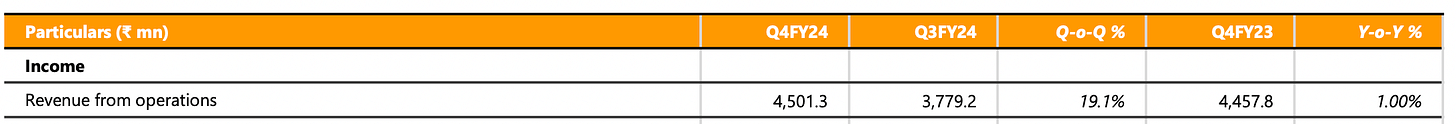

Muted execution in Q4 (YoY) but the full-year results are great:

Turnaround in FY 2024, from loss-making entity to profit. A huge jump in EBITDA margin.

The growth in Q4 (YoY) is just 1% but the whole FY24 is 44% up compared to FY23

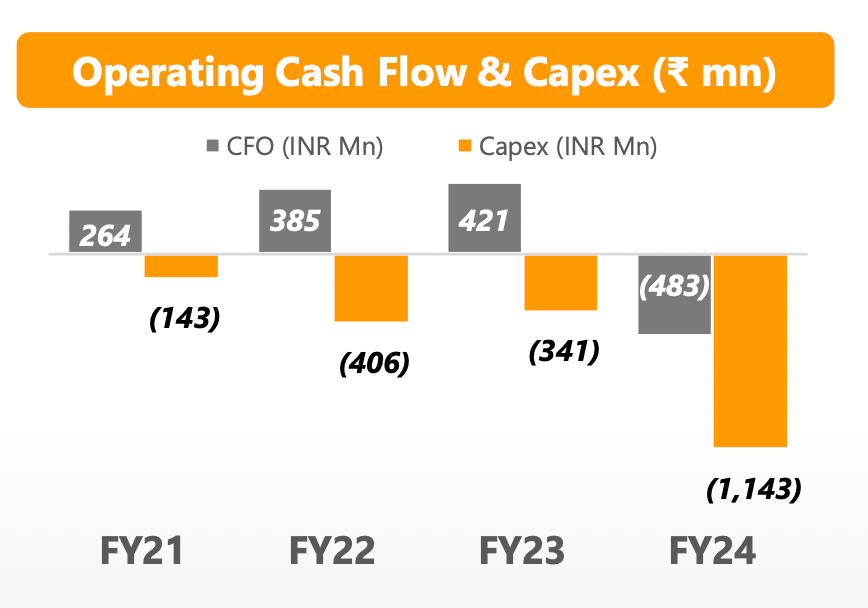

Because of the IPO and strong performance, the company has become a Net Cash entity

Strong Growth in Orderbook:

The order book, on the base of over 3200 crore grew by 635 crore (~20% Growth)

This growth in order book is backed by increased capex to fulfill the orders

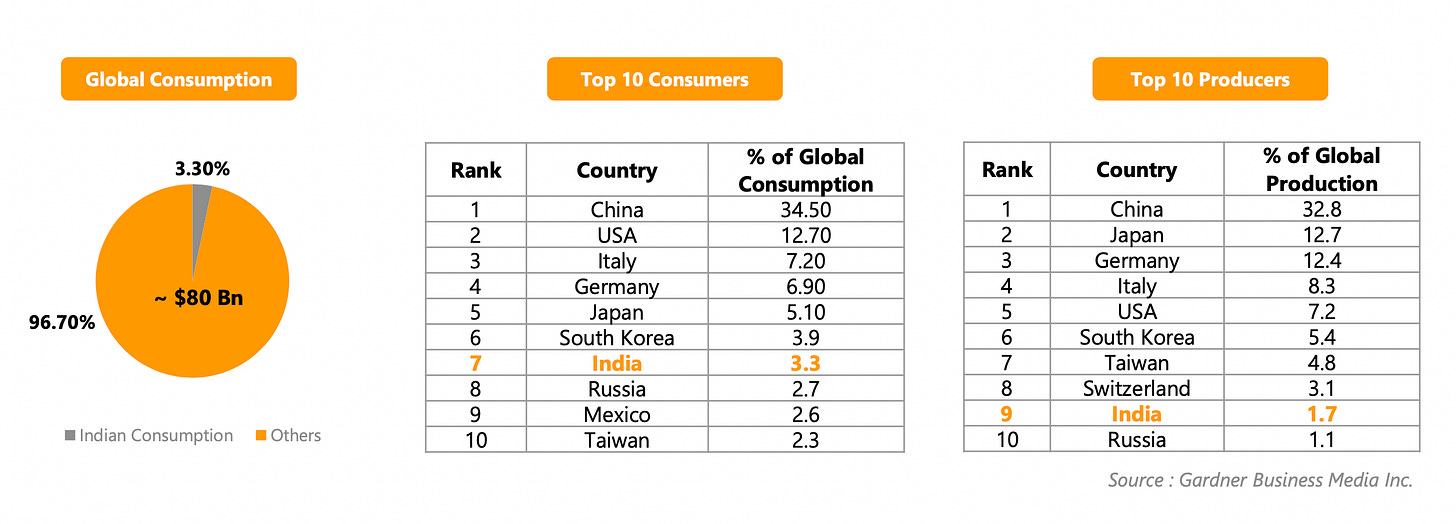

Huge Scope of Import Substitution

India consumes 3.3% of the global consumption but produces only 1.7% of global production.

Foraying into Semiconductor Space

Investing for Growth

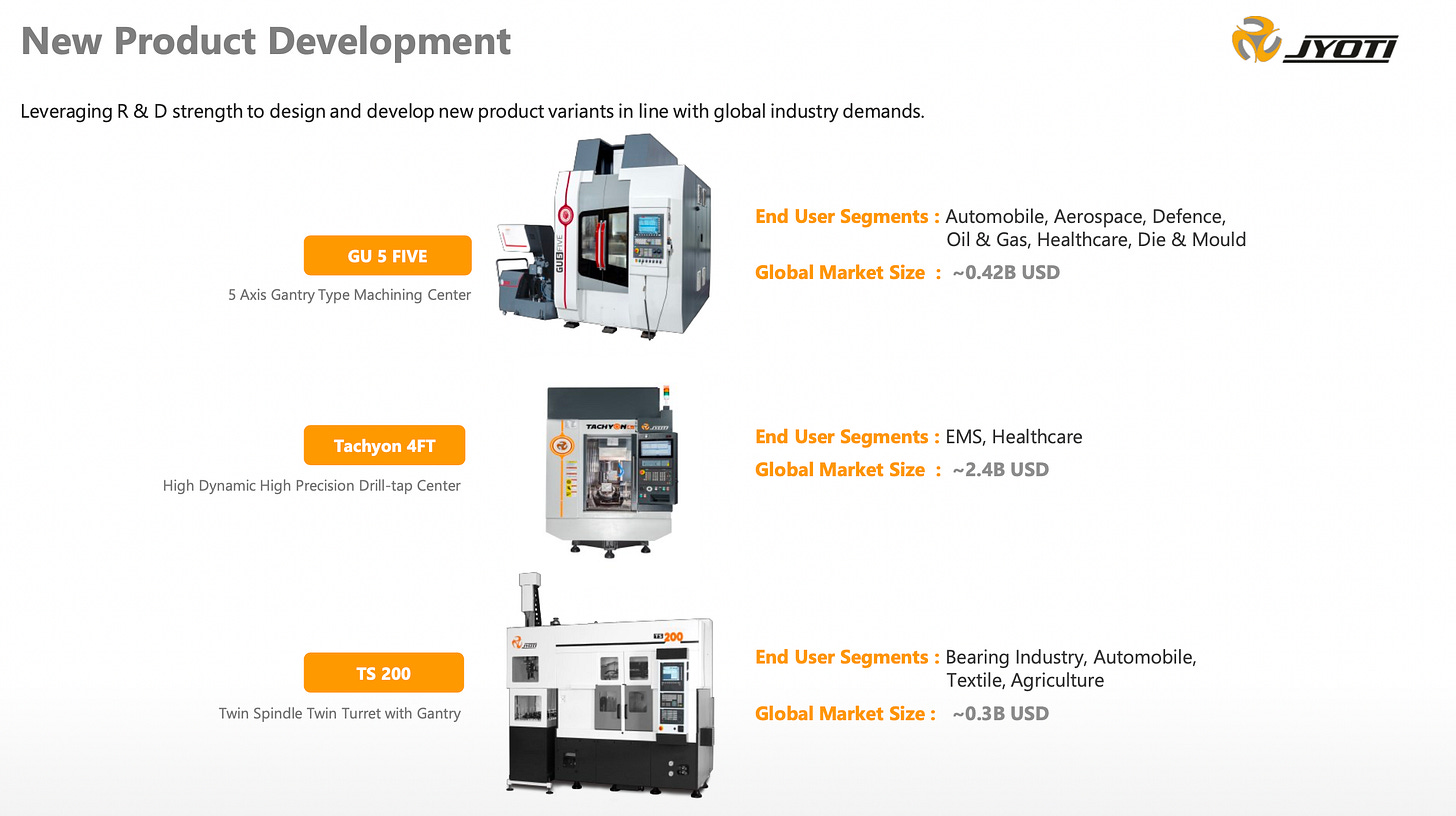

Jyoti CNC is foraying into new products and new markets

To support this growth increasing manufacturing capacity

What next?

The quarter performance in terms of revenue was sluggish YoY. However, the order book is a lead indicator of future growth and on this front, the company has done remarkably well.

However, this quarter has not given any substantial clue about the future of the EMS segment with only 2% of incremental orders, the share of EMS order book has reduced from 12% to 7%.

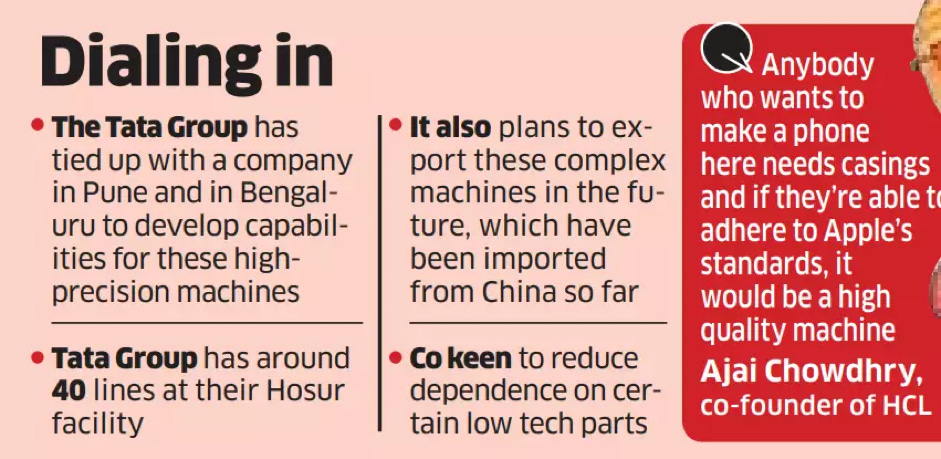

So the question of whether it will cross the chasm remains unanswered. However, there are green shoots in the industry with Tata Electronics looking for Indian Partners in the CNC spaceMarket Reaction - Cautious

Retracement to breakout zone on avg volume after results

*****

Invest in yourself…. be a learning machine

These communities have helped me a lot in learning the nuances of investing. Why not check them out? - Join the community of learners.

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.