Radico Khaitan - Premiumisation Trend

Indian Consumer moving up the value chain

Dear Readers,

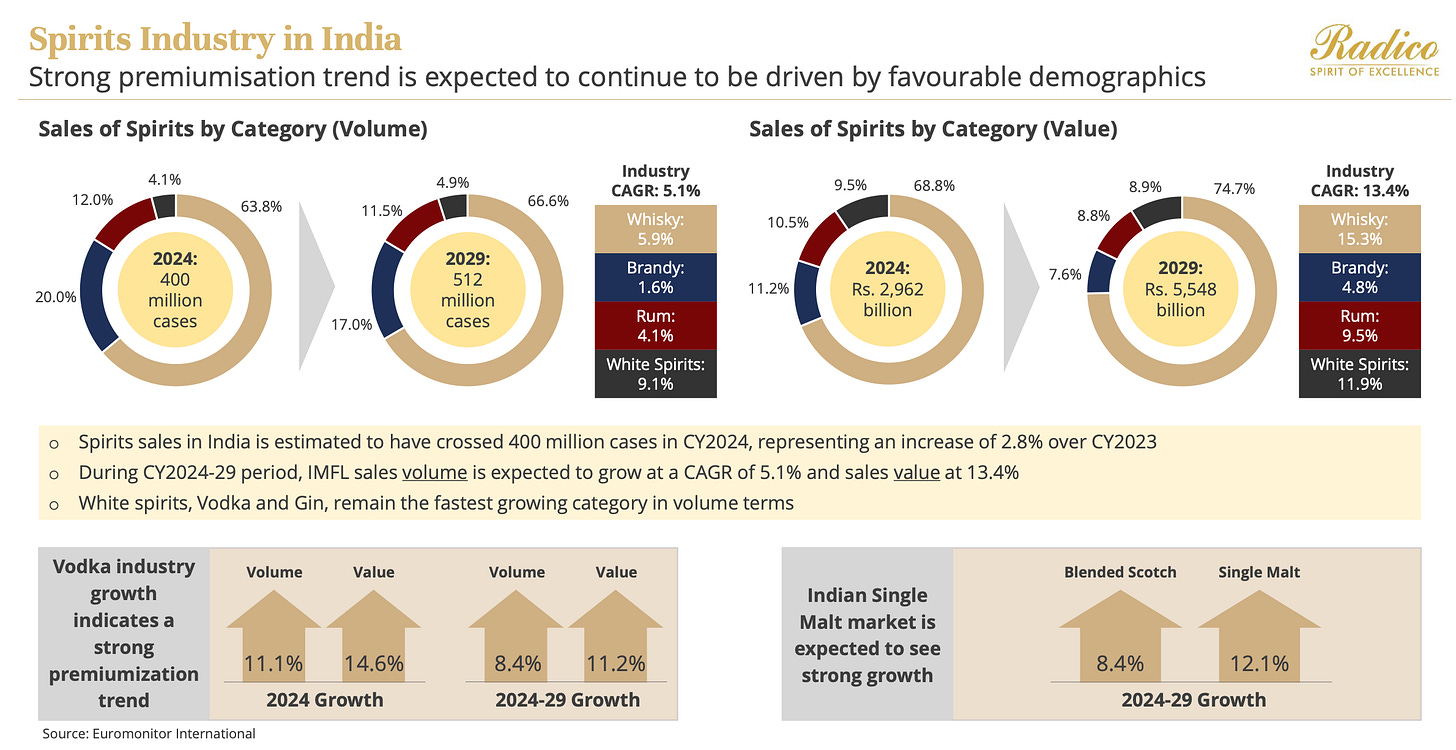

Today’s post explores the impact of changing consumer habits, rising disposable income, and the trend of premiumization in the Alcohol Industry. We will also discuss more about the fundamentals of Radico Khaitan (Known for Magic Moments Vodka and Rampur Whisky).

The post has been inspired by a webinar by Team SOIC on the premiumisation theme in India’s consumption boom. I’ve personally learned a lot from the free and paid resources by SOIC/ SOIC Finance. If you are looking to start your journey, from my personal experience, this is a great value-add.

“After per capita income rises above $4,000, countries typically industrialise and urbanise, creating a strong, and sometimes disproportionate, relationship between further economic growth and extra commodity demand”

— Javier Blas, The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources

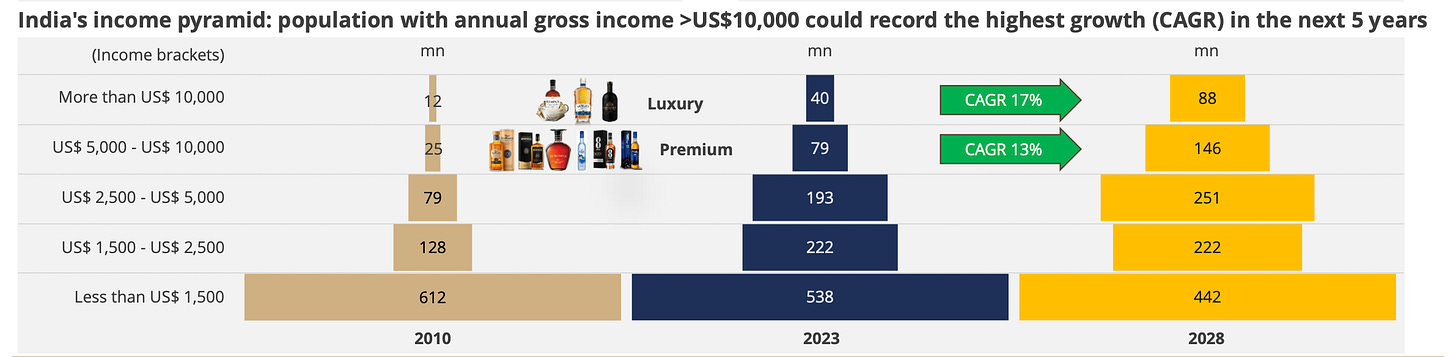

So, India’s per capita income is around $2900. In terms of GDP, which is around 4 trillion dollars.

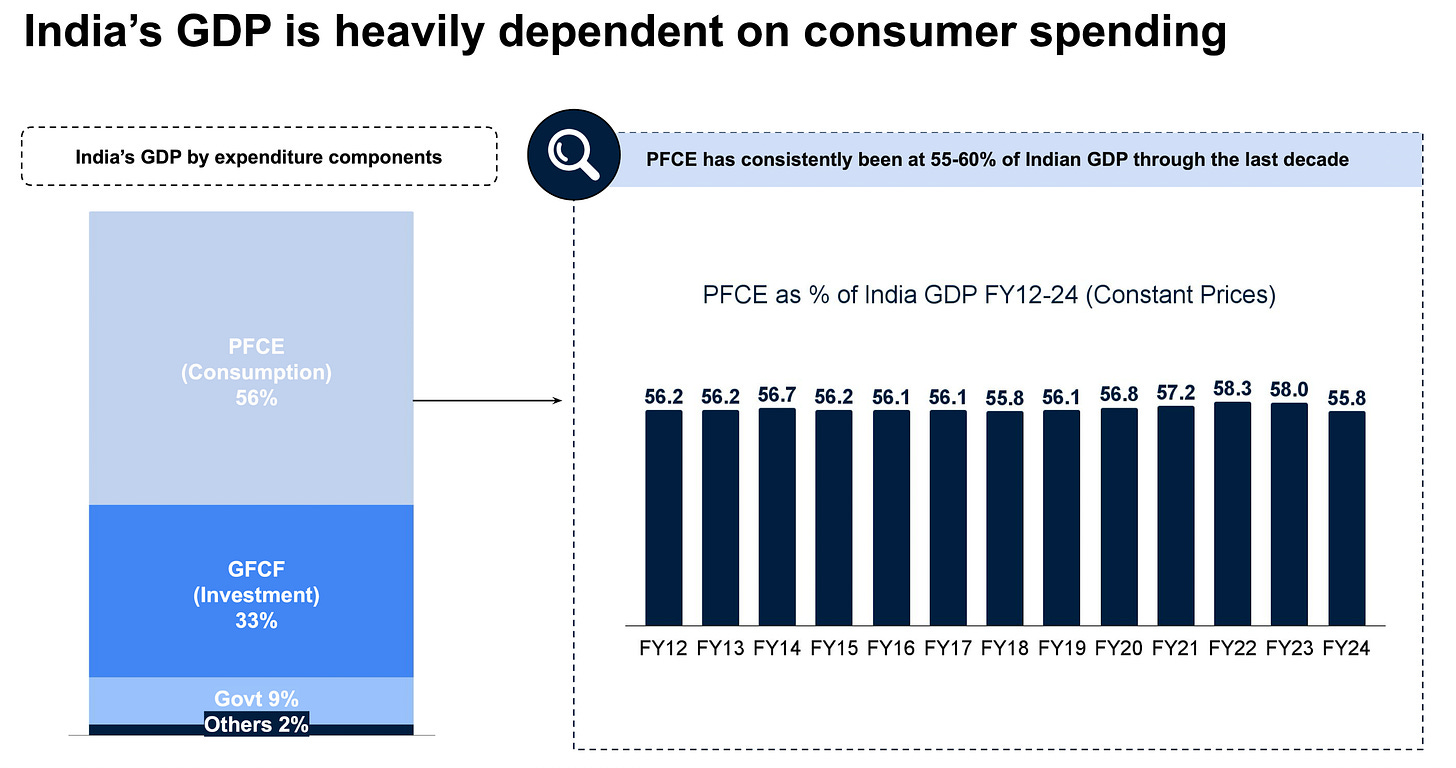

Although we have not reached a typical inflection point, we can’t compare India vis-à-vis other economies, given (1) India is a consumption-driven economy and (2) given the large population base, the averages/per capita statistics doesn’t show the true picture.

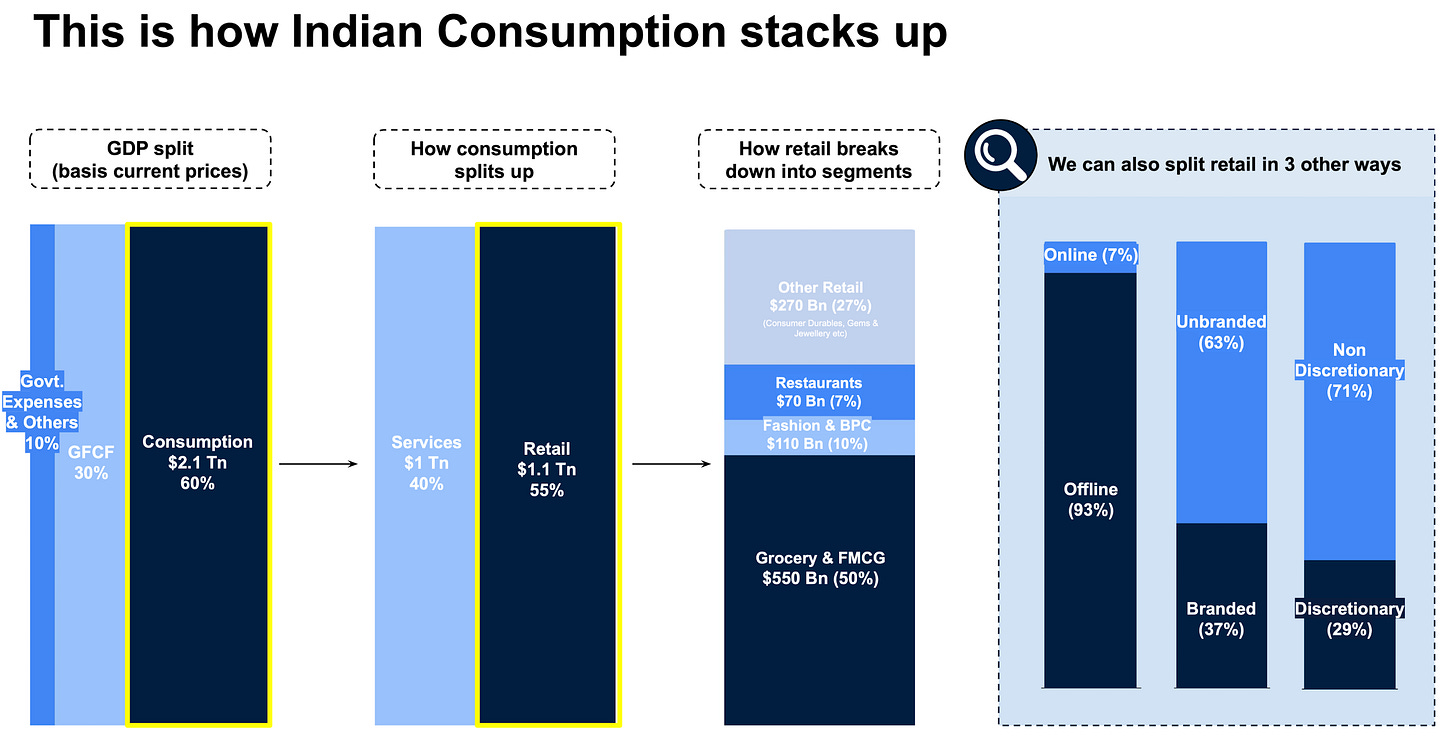

Over 55% of consumption is retail consumption. The question is how this will expand. In my opinion, there will be increased penetration of new products, i.e., today’s luxuries will be tomorrow’s necessities, and second, premiumisation of consumption.

The premiumisation is already underway - this is evident in SUV sales, Air travel overtaking railways, and D2C brands providing niche consumption avenues.

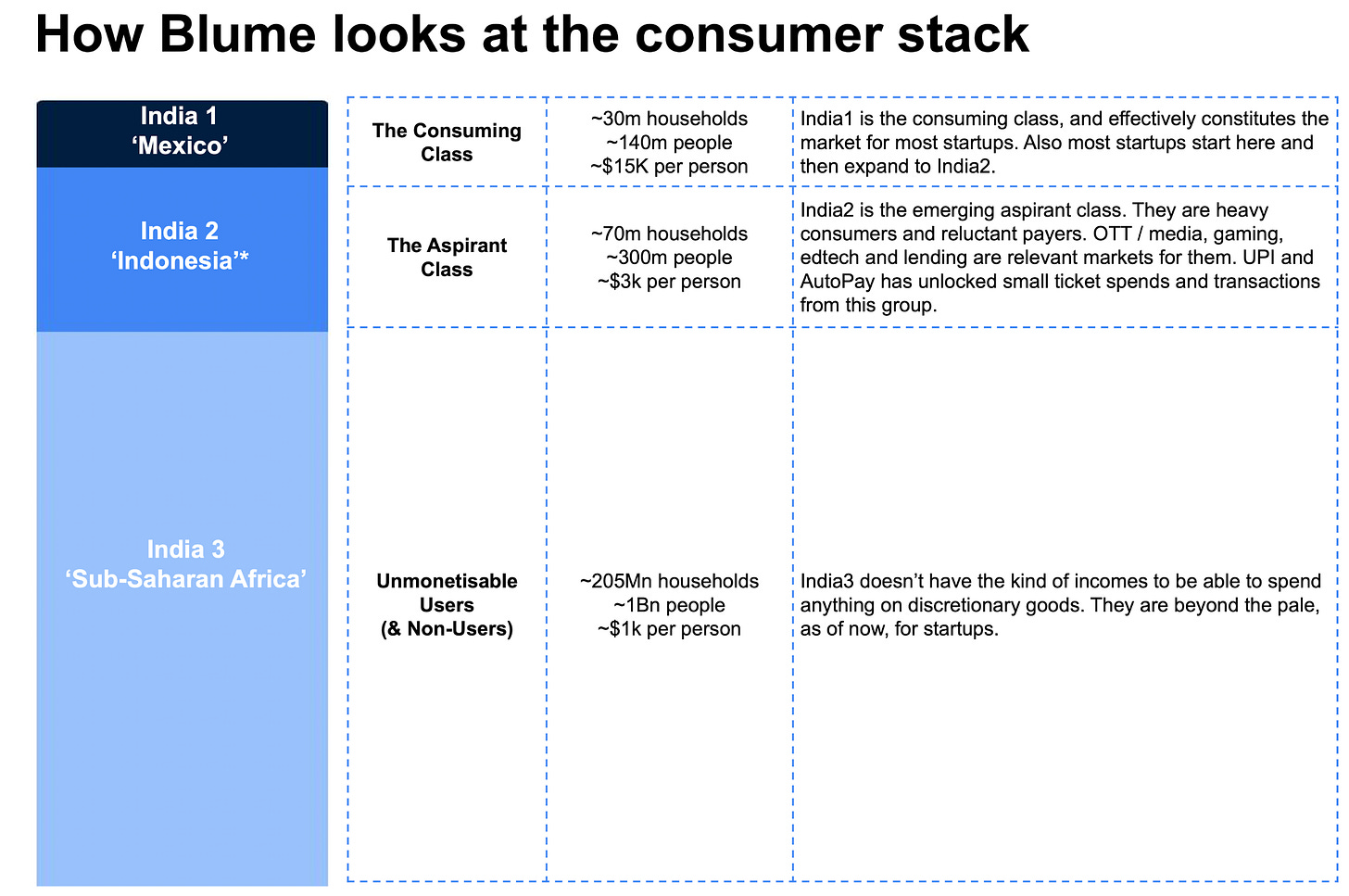

Blume Research gives an interesting analogy of comparing different cohorts of consumption classes with different economies. The Consuming Class and Aspirant Class is the one which very well can absorb new class of products and very much receptive towards premiumisation.

The next trillion dollar in Indian economy will be be added at a faster pace...sheer compounding. The question is how will this impact consumption - (1) democratisation of nascent categories and (2) PremiumisationRadico Khaitan

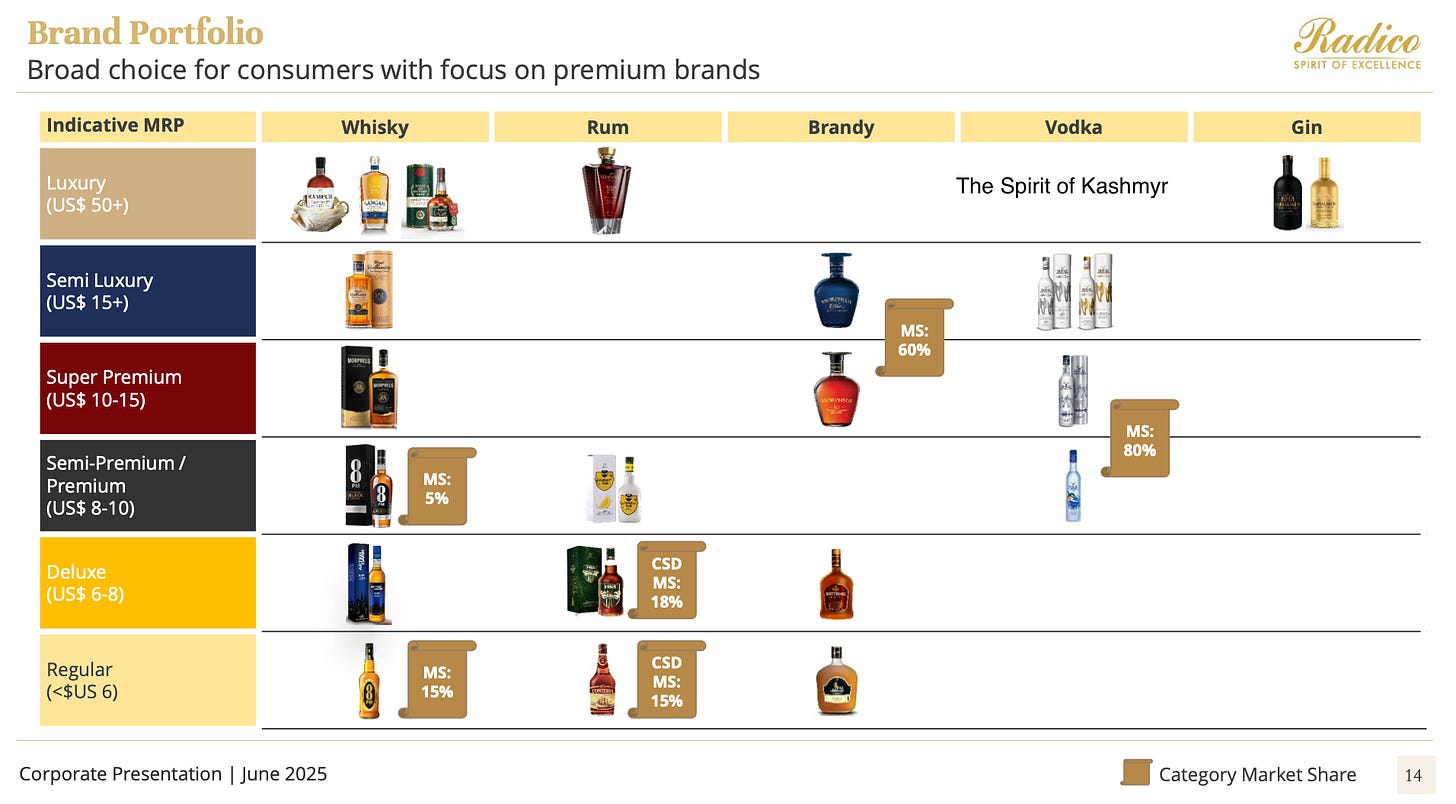

Among India’s leading IMFL (Indian Made Foreign Liquor) companies.

Originally known as Rampur Distillery Company, it began by distilling and bottling for branded liquor firms and armed forces canteens.

Known for brands like Magic Moments in Vodka, 8 PM Whisky, Rampur Single Malts, Jaiselmer Gin, Royal Ranthambore Whisky, and Sangam World Malt, etc.

This is not a recommendation. Please do check if it fits your framework before investing. Thesis Pointer No. 1 - Premiumisation

The Indian AlcoBev industry is undergoing a structural shift from traditional consumption patterns to a more lifestyle-driven category. With rising affluence, evolving preference, and increasing demand for elevated experiences, we see substantial long-term opportunity in the premium and luxury segments.

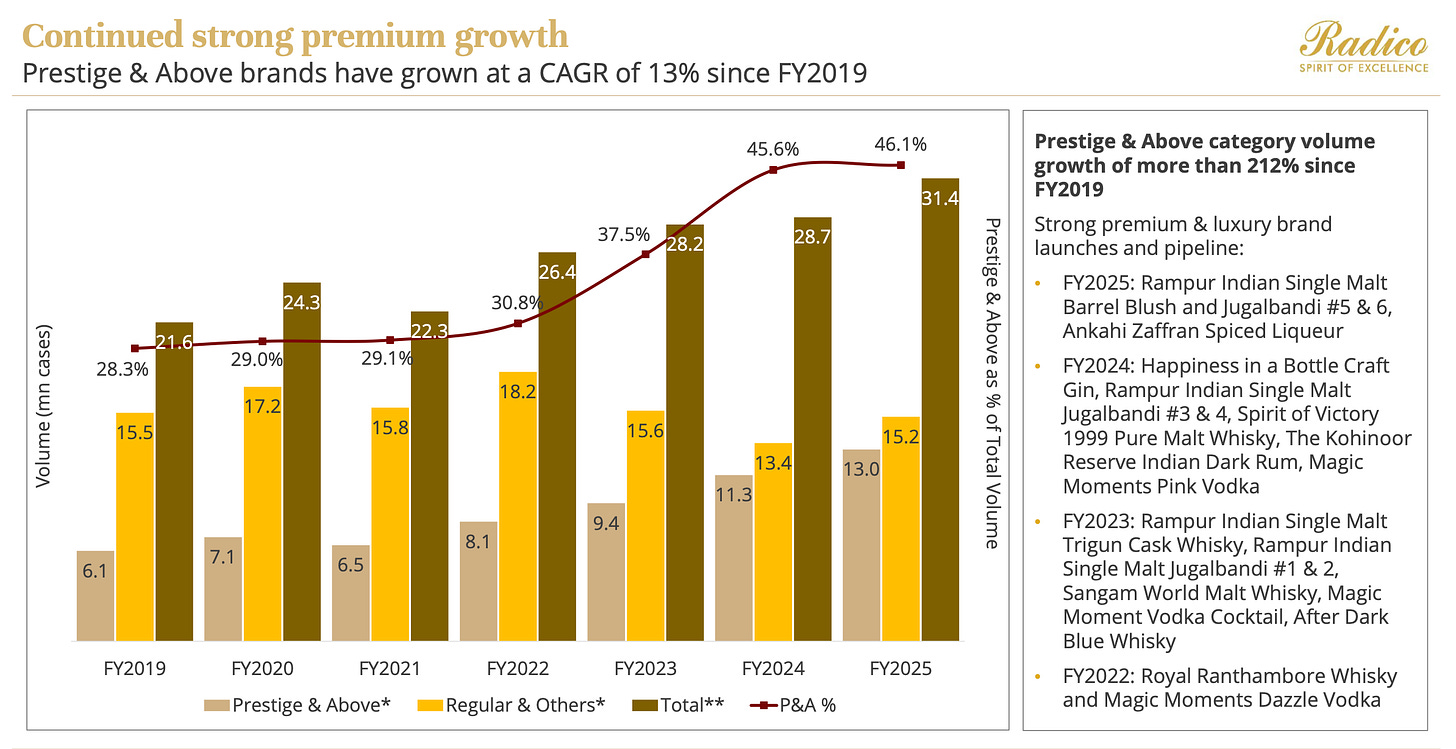

Company is walking the talk on premiumisation as well. Evident from the increasing share of premium and above brands in volume terms (and offcourse in value terms as well). Also, series of launches suggest the same.

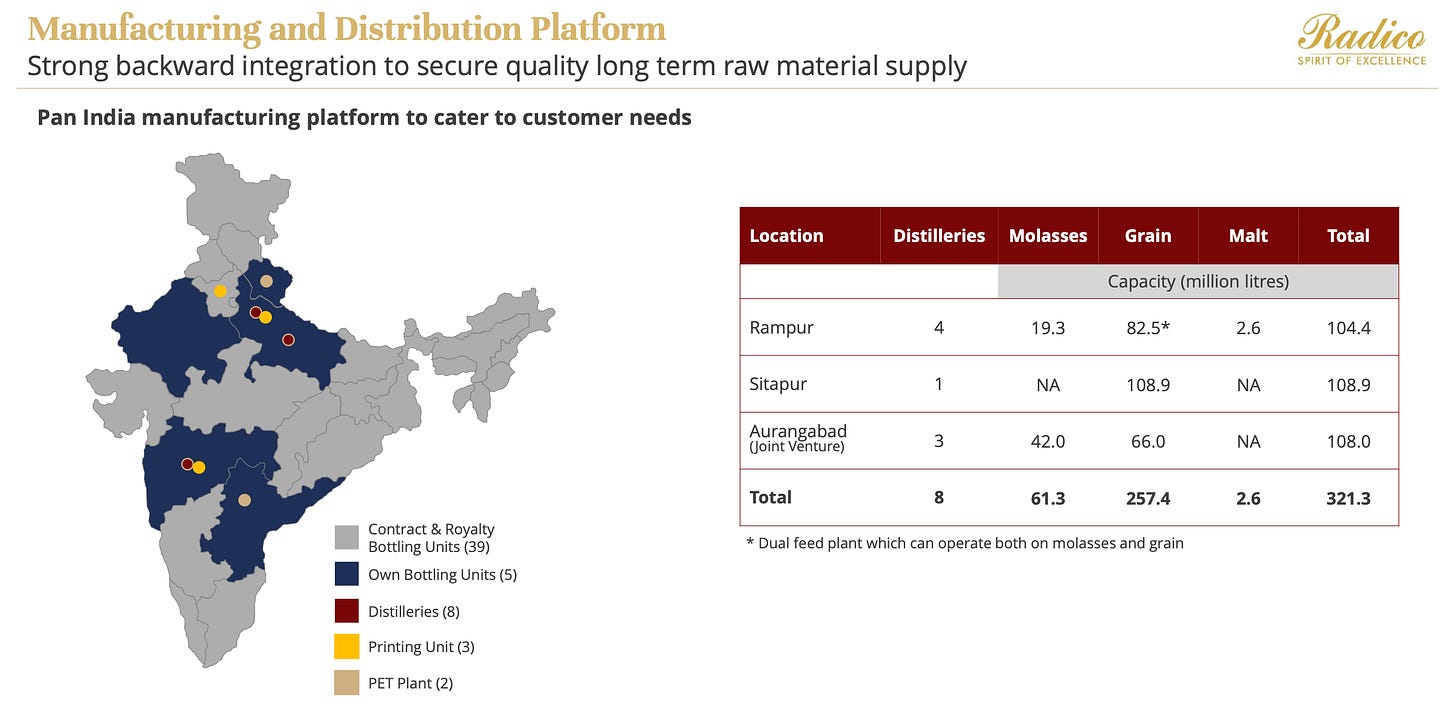

Thesis Pointer No. 2 - Backward Integration

Backward integration for quality control and margin expansion

Backward integration is crucial for long-term ENA supplies as ethanol blending policy is expected to constrain molasses availability and increase the demand for grain-based ENA.

Radico's in-house ENA already commands a 7% to 10% premium over other manufacturers due to its quality.

State Governments e.g. UP State Excise Policy, mandates grain alcohol in the 42.8% category (representing 25% of the overall country liquor industry), is a significant development. Radico's dual-feed conversion and new grain plant allow it to produce for this segment, improving profitability.

Radico Khaitan expects significant margin improvements from its backward integration initiatives, alongside its premiumization strategy and price increases.

Direct Cost Savings from ENA Production: Manufacturing ENA in-house versus buying from external sources provides a cost delta ranging from ₹10 to ₹17 per liter. This backward integration from the Rampur Dual Feed plant is expected to yield a 150 to 200 basis points gross margin improvement.

Thesis Pointer No. 3- Margin Expansion

Management has consistently guided for a continuous improvement in EBITDA margins, expecting an expansion of 100 to 125 basis points year-on-year for the next three years (from FY25).

This trajectory is projected to lead to mid-teens margins by the end of FY2024 and late-teens margins in two to three years (by FY2026 or FY2027). The company has an aspiration to reach "20% easily" in five years.

The improvement is attributed to a combination of factors: backward integration benefits, product premiumization, and price increases.

Reduced working capital:

"The best thing that has happened in UP with the new excise policy is that you have got composite shops, which have come up which have expanded the universe of outlets by almost 40%. Another big advantage that has accrued to the industry is that in IMFL, the wholesalers are now paying the excise duty, which means that the industry is lowering its working capital requirement, which is a big plus. This also means that any established player like Radico will reap huge benefits because the traction for fast-moving brands will be much more, because wholesaler would like to take cash and rotate it faster. So, that's a very big plus which has happened."

Thesis Pointer No. 4- UK FTA Advantage:

Radico, for its brands (except single malt), imports Scotch from the UK.

The FTA cuts very high Indian import tariffs on UK whisky/gin (from ~150% → 75% immediately, with further phased reductions to ~40% over ~10 years)

With the reduction in tariffs, they expect significant cost advantages:

“ We have estimated our Scotch requirements valued at over Rs. 250 crores in FY26 and we expect significant cost advantages from this development. In three years, we expect the import of scotch of Radico to cross Rs. 400 crores.”

-Q1FY2026 Concall

I may be wrong, they were expected to import 100 cr scotch + 150 cr duty i.e. 250 cr. The tarrif will be reduces to 75 cr. i.e. 75 cr addition to PBT. Let me invert - will not the duty decrease lead to increase in competitiveness of Scottish brands in India?

Customs-duty savings are real but will only translate into small-to-moderate retail price drops (industry expects roughly ~10% fall in retail price for imported whisky) because India’s state excise/VAT and retail margins are the dominant cost components.

The deal unlocks sizeable untapped demand (premiumisation + low import penetration) so UK brands will increase competitive intensity — but non-tariff barriers (state excise regime, licensing, labelling/FSSAI, distribution access, advertising limits, minimum price floors) remain significant gatekeepers.

On top of that - this business is about building brands with recall. Consumer preferences matter a lot!!

Personal Anecdote - Amazed by Radico’s reach

I recently met CEO of a Japanese Company, and in our interaction he mentioned how he was introduced to Rampur and now always look forward to someone coming from India to bring Rampur Whisky for him.

I was surprised not just because this kind of feedback was from Japan but the fact that this was not in Tokyo or Osaka, but rather a smaller city of Japan. 😲

Love the way they have created some fantastic global brands.This is intial read on the company. Other companies to look in the same sector are Tilaknagar (entry in Whisky Sector), Associated Alcohol, Som Distillaries, Allied Blenders and Piccadily Agro (Indri).

Across the companies, premiumisation drive seems to have taken centerstage.Risks

Political Risk - Gujarat is a dry state. Bihar also became a dry state. There is always a risk in this industry in this regard. However, on the contrary, with the GST, there are few direct sources of revenue for states, and excise on alcohol is a key revenue item for states’ finances.

Changing consumer preferences - There is increasingly awareness about side effects of alcohol on health. The growth of GLP may also play a role in reducing consumption of alcohol.

*****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Make your stock scanning easy with ChartsMaze

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.