Quality Power Electrical Equipment Ltd

Beneficiary of Transmission Capex

Dear Readers,

The way Energy is generated and consumed is undergoing a massive shift - this change is dubbed Energy Transition. This is a topic that I have been reading, writing, and learning about for over a year. Previous posts on this very topic can be accessed here:

This post covers two interconnected topics

1) A primer on HVDC and FACTS - especially their significance in the GRID with the increasing renewable component especially solar and wind capacities

2) We deepdive into Indian Power Equipment Manufacturer: Quality Power Electrical Equipment Ltd

Its a long post...so bear with meHVDC and FACTS

What is HVDC?

HVDC: Long-distance transmission using a high-voltage Direct Current.

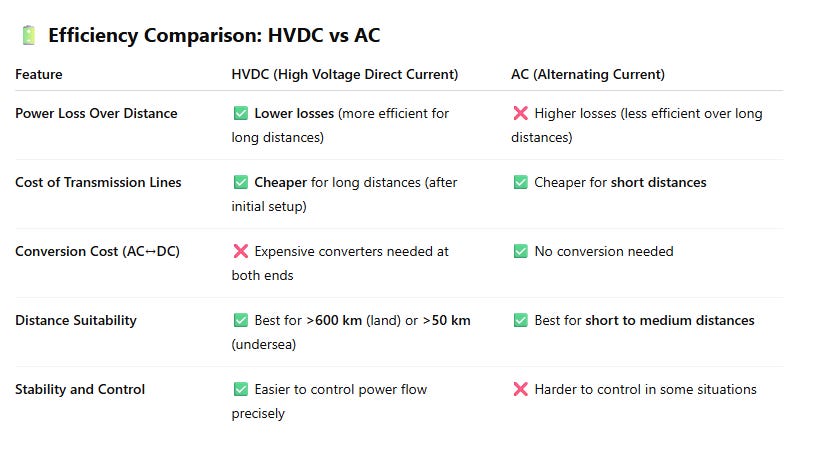

The grids are generally AC (Alternating current) and operate at a specific frequency. For long-distance transmission, it is better to convert it into DC and transmit.

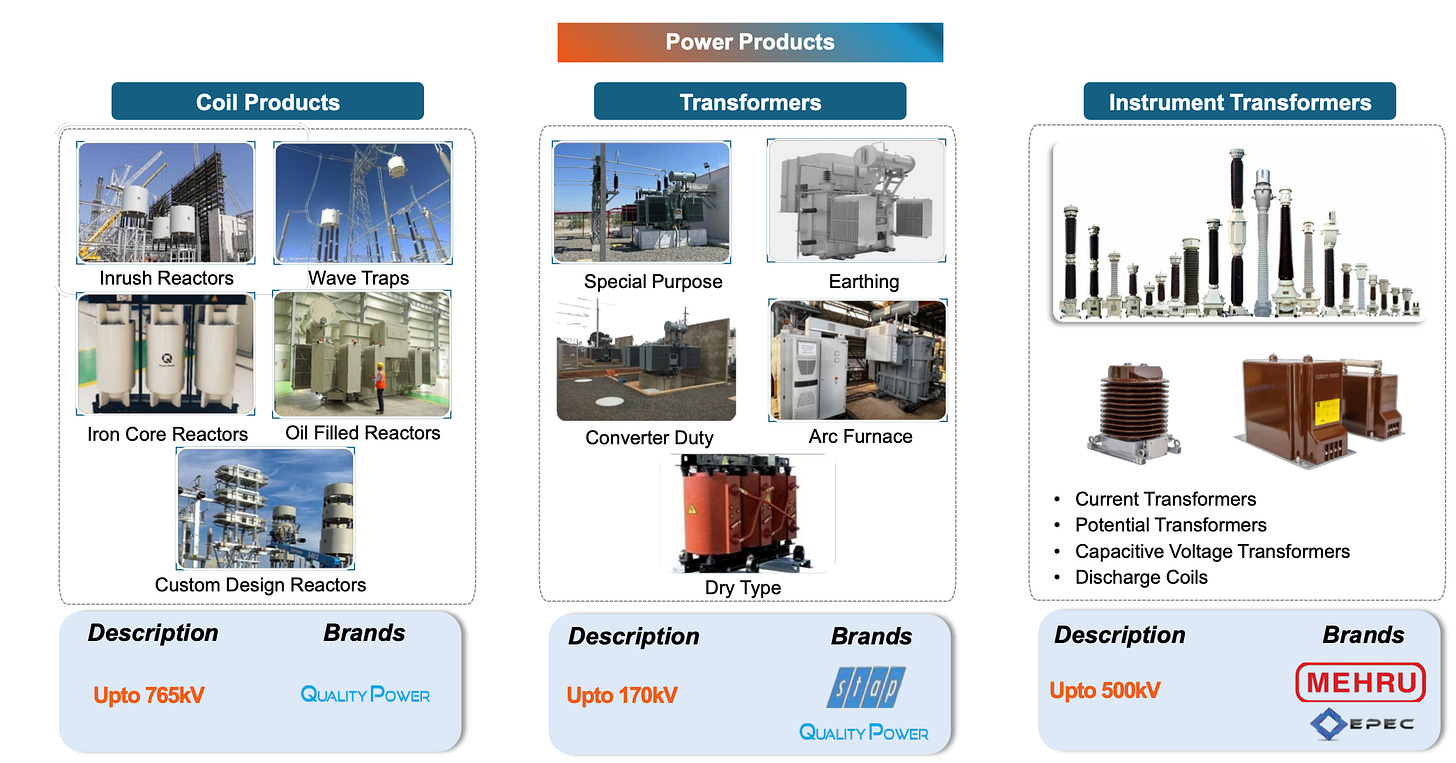

HVDC is more efficient - (1) Long Distance Transmission (2) Connecting different grids whose frequency is not the same (3) Undersea transmission (between countries)Quality Power has 4 products that go into HVDC i.e. reactors, line traps, instrument transformers and medium-voltage oil-filled transformers (for special applications, like zigzag-connected earthing transformers).

Also attempting to add more products in that same segment.What are FACTS ?

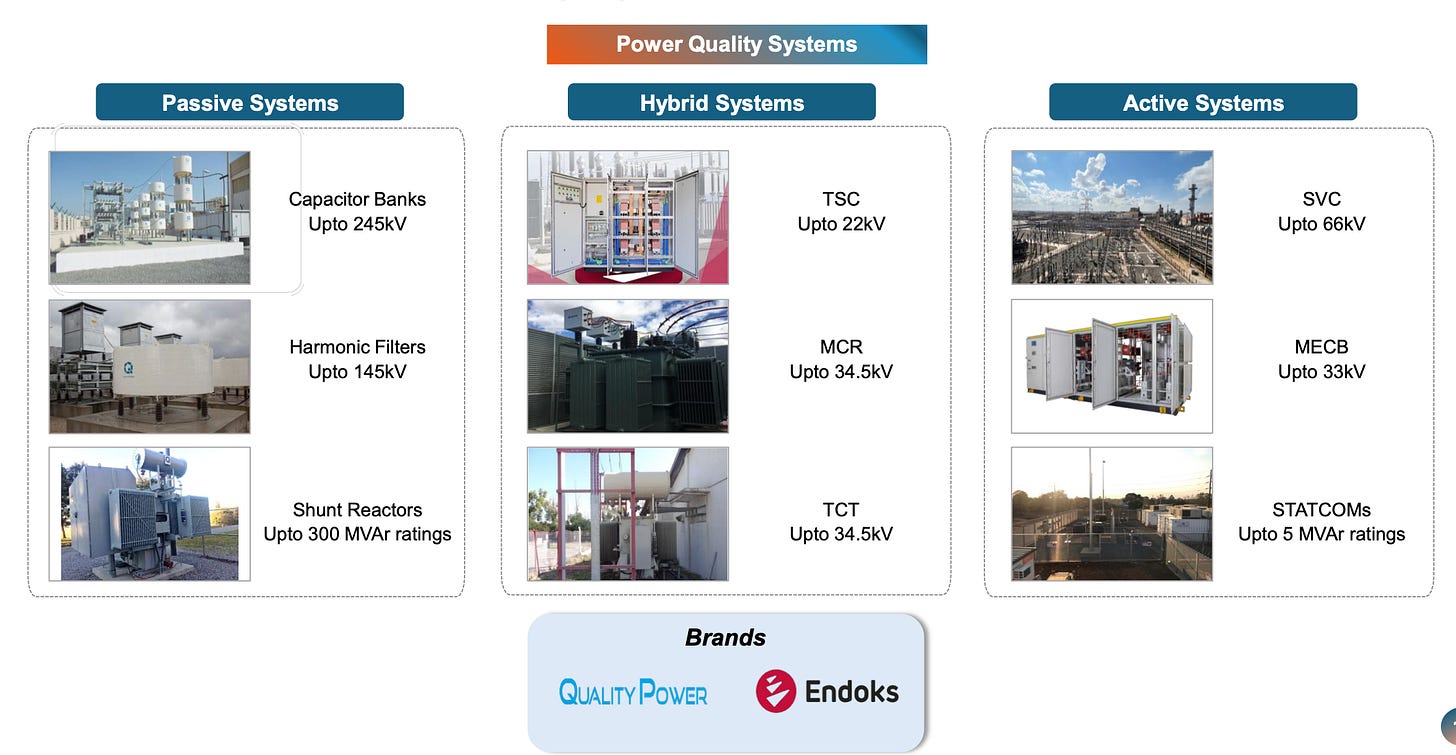

FACTS- Flexible AC Transmission Systems

To understand why FACTS are a critical component of the Transmission System, especially when the renewable component in the grid increases, we need to learn about Reactive Power.

Reactive power is power that is reflected back to the grid, while active power is the power consumed by the load.

To give you an analogy, active power is like fuel that makes an engine run, while reactive power is like the lubricant that keeps the engine moving smoothly—it doesn't make the engine run, but is essential for proper function.

Reactive power is essential for voltage control and system stability, as insufficient reactive power can cause voltage drops, while excess can lead to over-voltages and increased transmission losses.

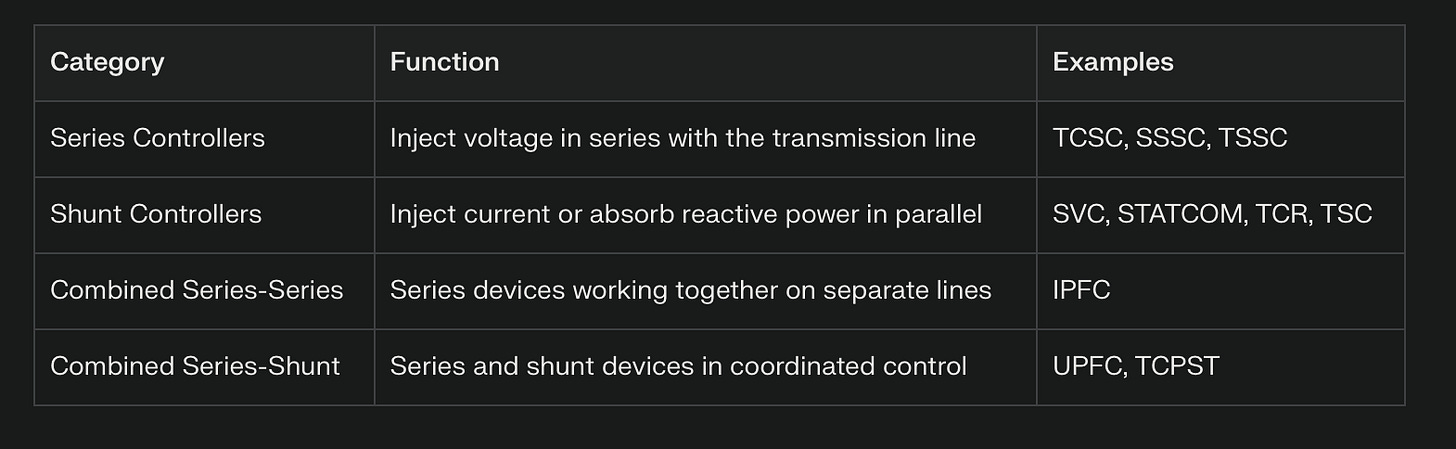

There are different types of FACTS

More renewables in the Grid require more FACTS to stabilize the grid. Why?

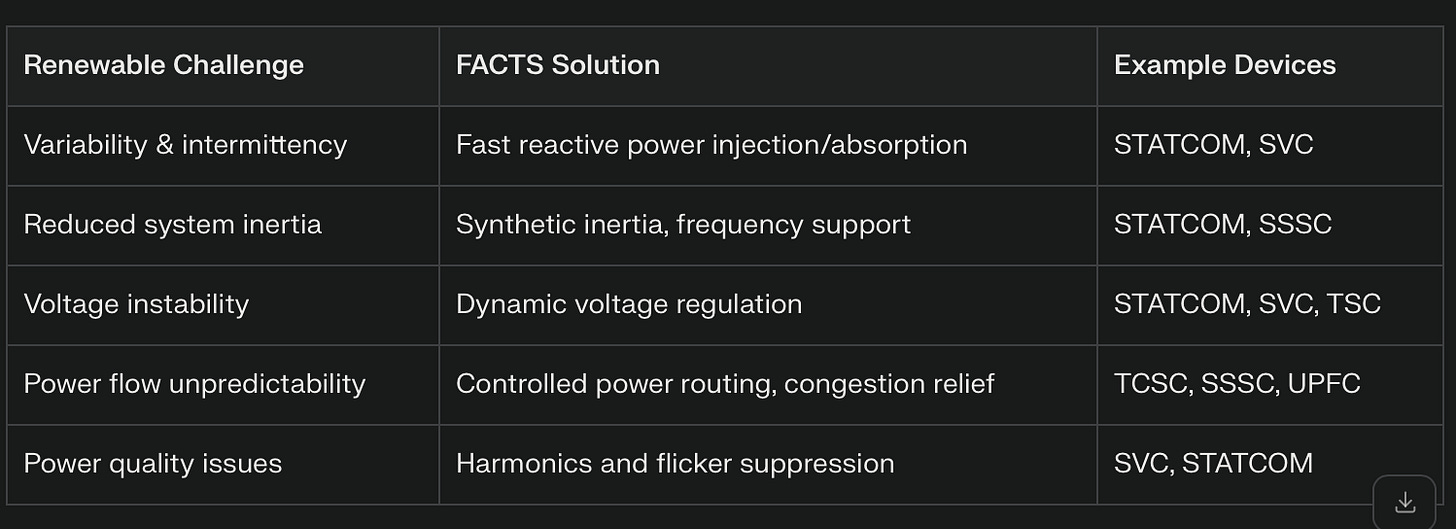

Renewable energy, especially Solar and Wind, is Variable and Intermittent - the unpredictability stems from both weather and day-night cycles. The unpredictable output from renewables can cause voltage fluctuations, surges, or drops, potentially damaging equipment and degrading power quality.

Further, these power sources are usually decentralized, which complicates the power flow management and increases the likelihood of congestion and transmission losses.

Traditional power plants use large rotating machines that naturally stabilize the grid. Renewables lack this inertia as well, making the grid more sensitive to disturbances and increasing the risk of instability.

…. the solution is FACTS

Further reading

I would also like to draw your attention to the post “Transmission Challenge and Opportunity”.

The key point I want you to remember is that the grid needs to be more flexible to cater to intermittent power generation by renewables.Quality Power Electrical Equipment Ltd

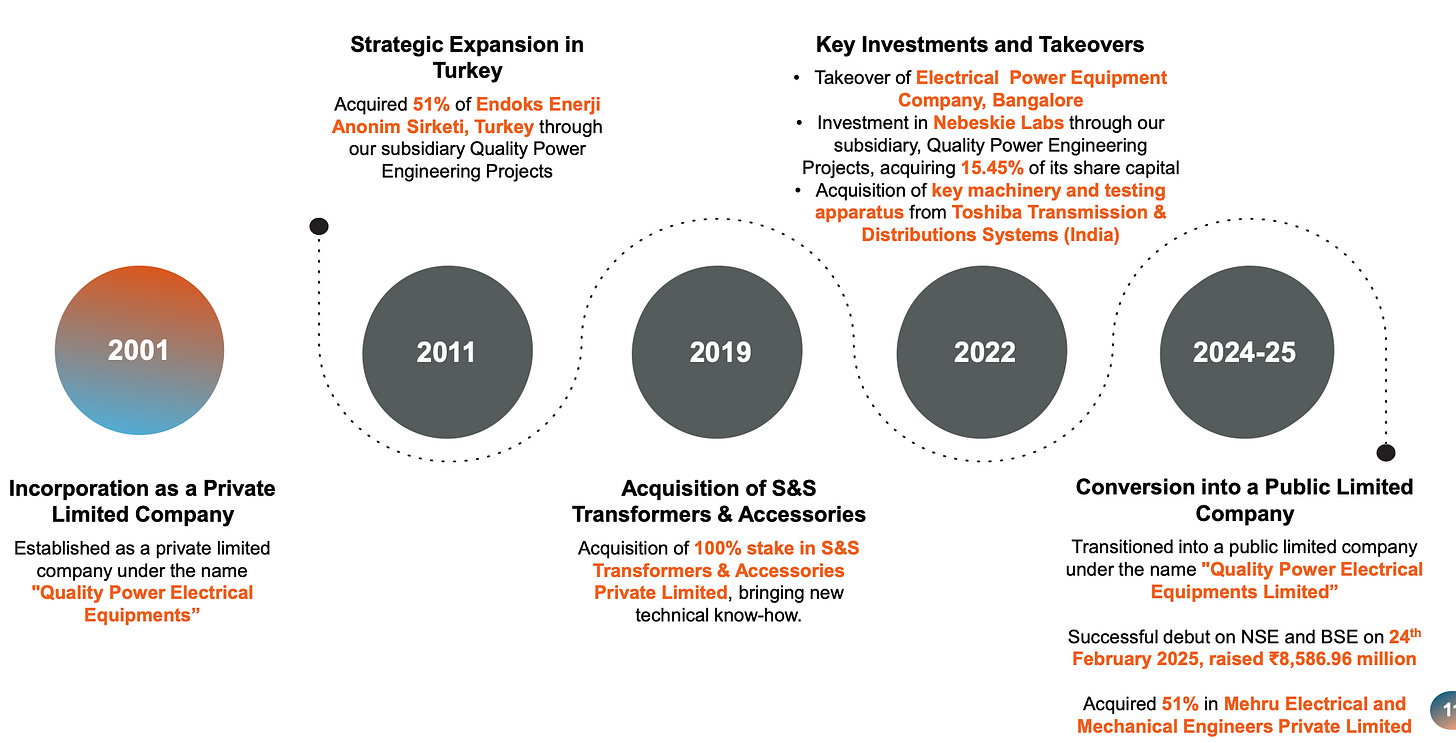

Established in 2001. IPOed in 2025. In this journey, they have grown inorganically and added capabilities via acquisitions

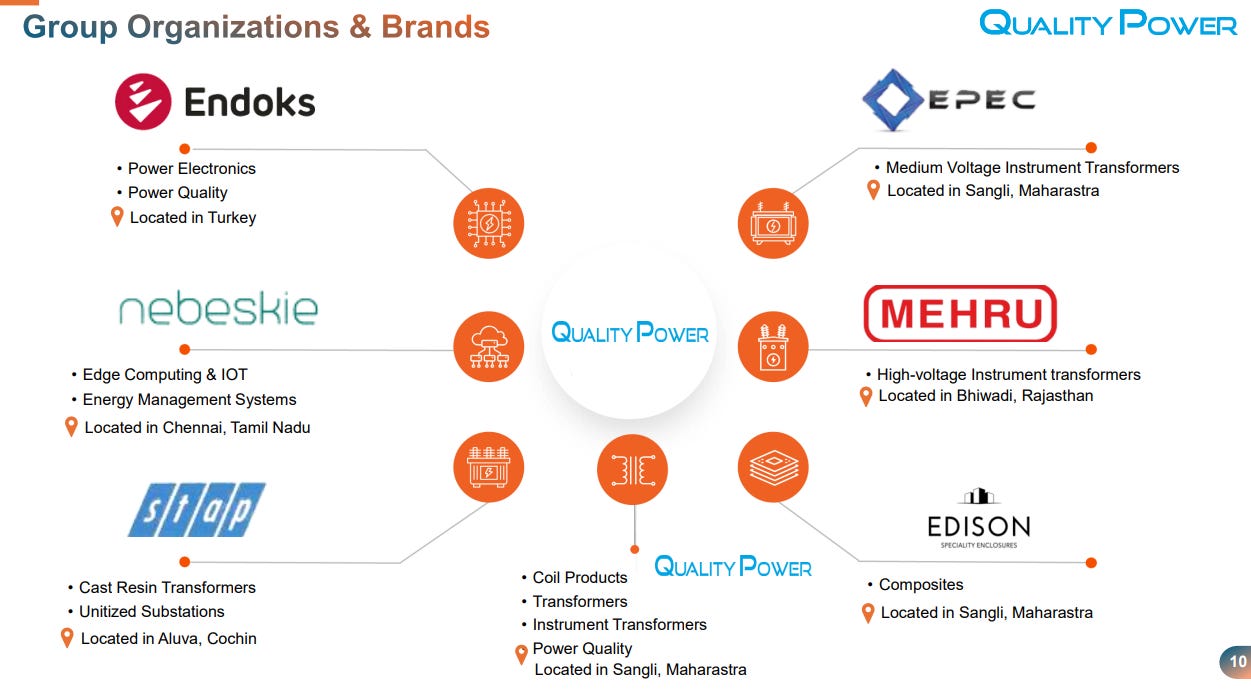

Manufactures High Voltage Power Products (Coils, Transformers and Instrument Transformers) and Power Quality Products (Static VAR Compensators, STATCOMs and Harmonic Filters, Capacitor Banks and Shunt Reactors)

It is not a domestic market-oriented company but rather supplies globally (to over 100 countries in the past 2 decades). Has manufacturing facilities in India and Turkey.

Also focused on R&D - Sangli facility is NABL accredited. Investment in Nebeskie, which specializes in real-time monitoring and analytics capabilities (which could be a smart grid solution)

Scaling Capacity to Drive Growth

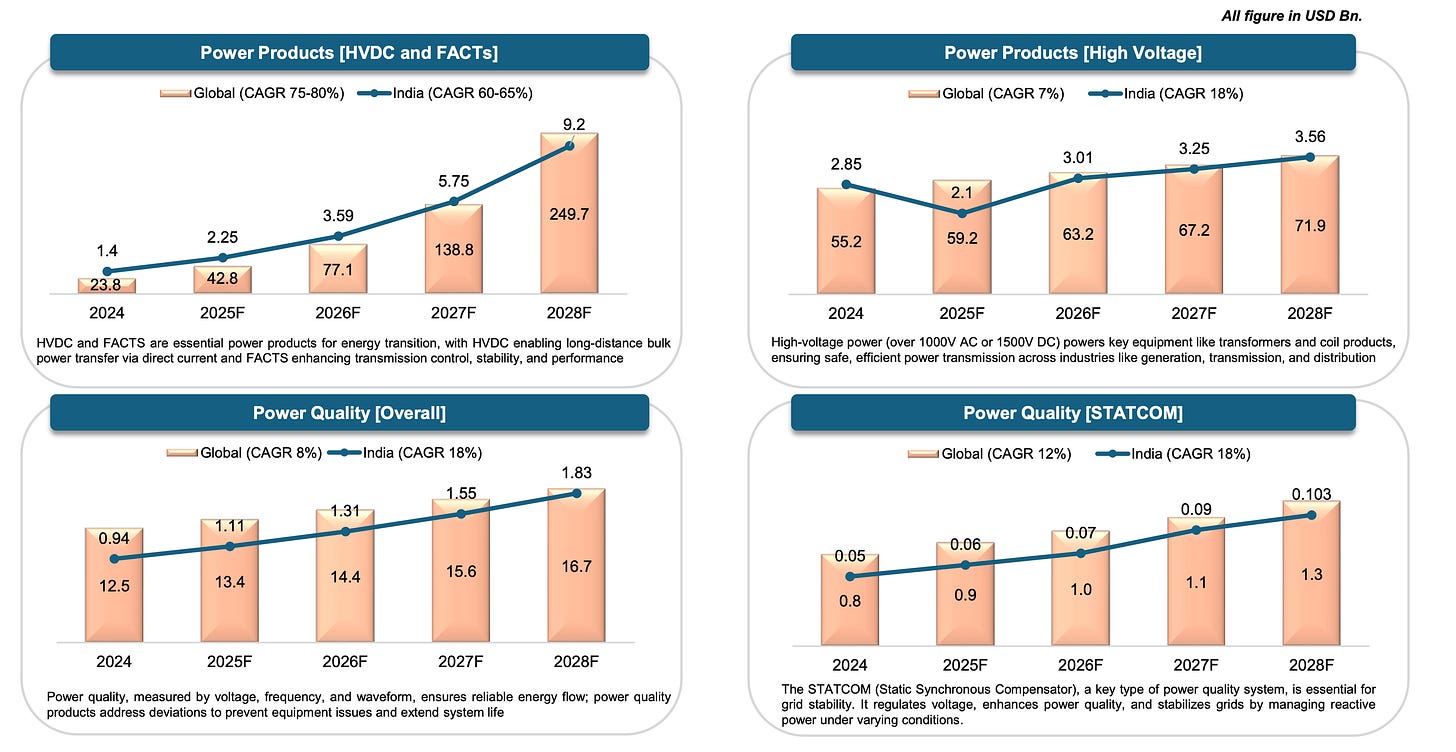

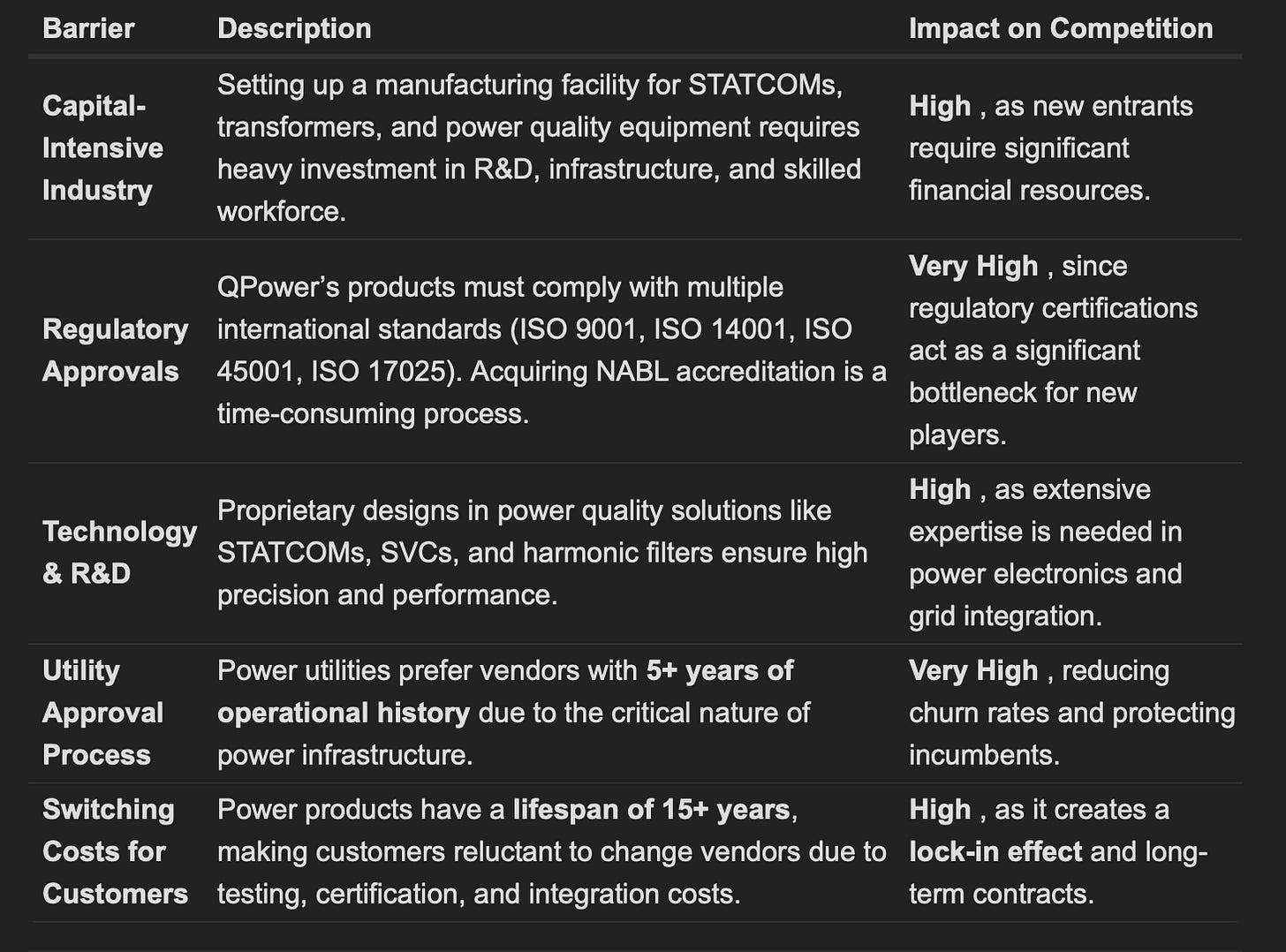

The industry in India is expected to grow at 15%+ and HVDC and FACTS at 60% plus. This is an Industry where a lot of technical know-how is required, and there are not many players.

Looking at through the Lens of Capital Returns by Edward Chancellor

The key idea is to look at from the perspective of Capital Cycle and to look at Supply Side DynamicsFrom the demand side, we are clear that it is a booming market. But on the supply side, there is a need for substantial capacity to meet the demand.

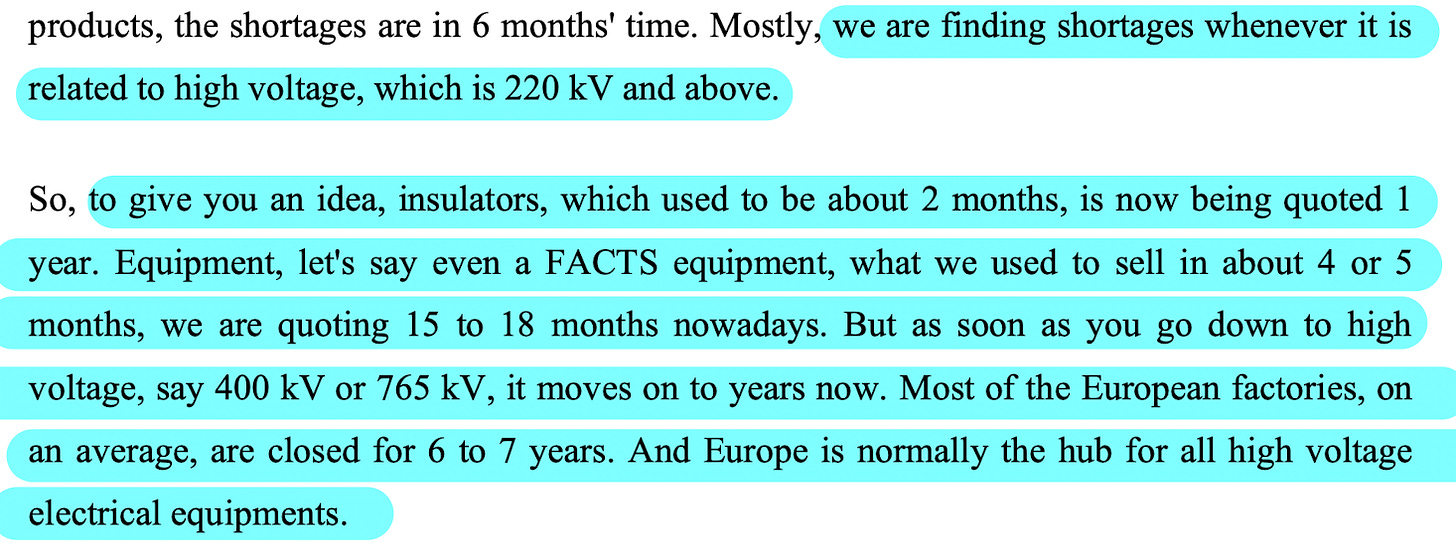

This is accentuated more in the high-voltage projects, where delivery timelines have expanded to a great extent. We can gauge the supply coming in when the timelines start shortening.

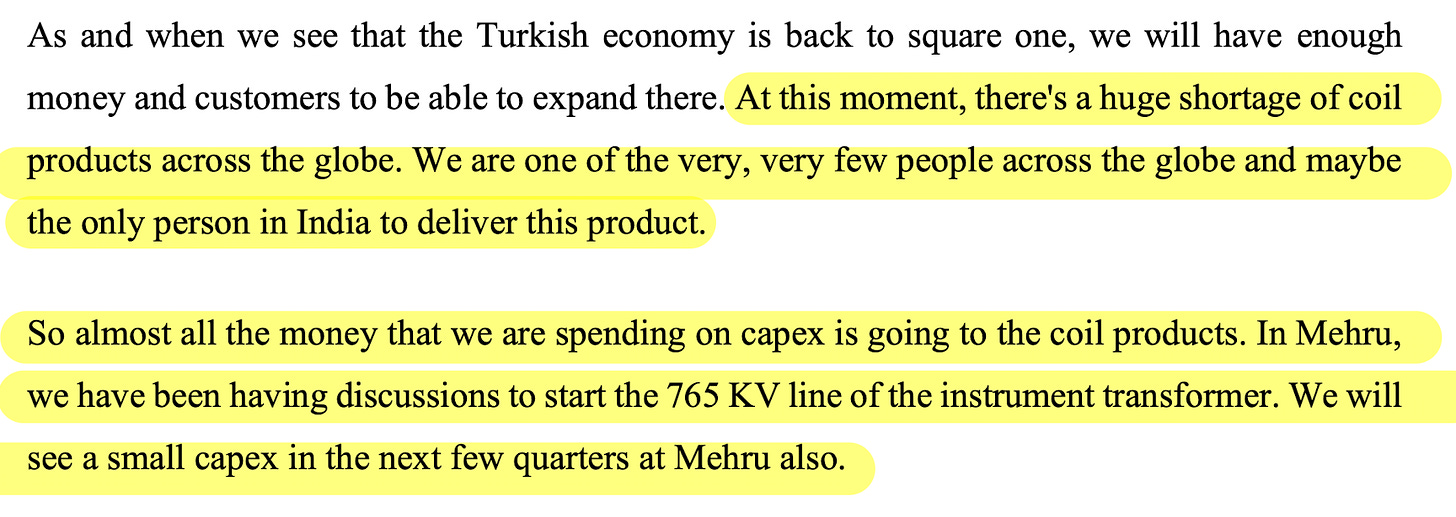

Shortage in Coil Products as well

There are significant Barriers to Entry

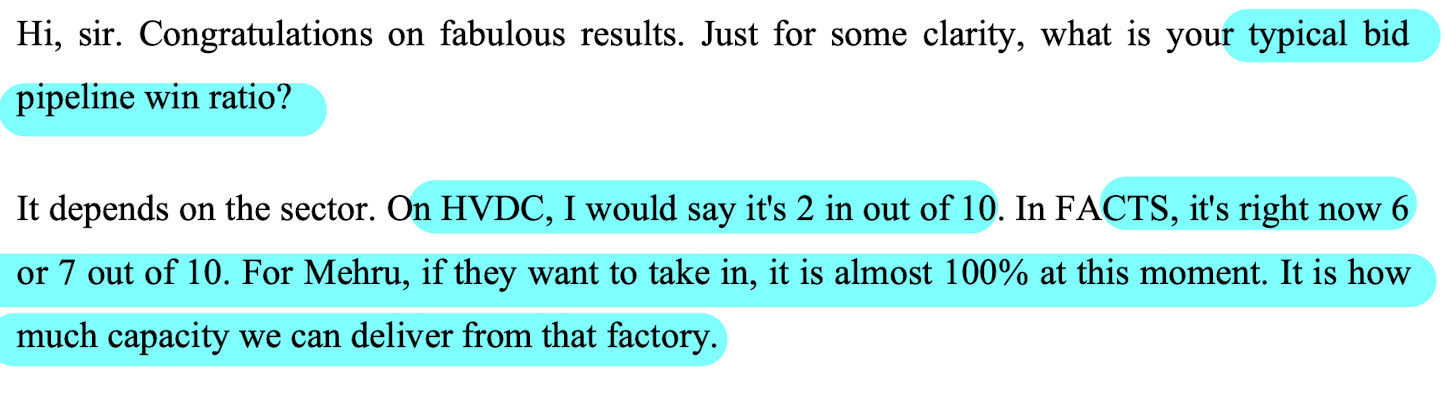

As far as Quality Power is concerned, they supposedly are doing well in FACTS with a strike rate of 60%-70% in winning bids.

HVDC order is 50-150 Cr (2-3 Year execution period billed every month) while FACTs order is 20-50 cr (12-15 months)

and the only manufacturer of Coil Products in India.

Their products might be going into the final products of Electric Capital Goods Players. So, in a sense, Quality Power is a second-order player in Electric Capital Goods.

Capacity Expansion and Guidance

Expanding its production facilities in Sangli, Cochin, and Bhiwadi.

Has acquired 10 acres of land close to its headquarters to set up a new facility in Sangli.

It will make the coil capacity 9X - expected to be completed by Q2FY27

The Cochin facility is being expanded to double its production capacity - expected to be completed by Q3FY26.

Mehru in Bhiwadi is increasing capacity by 45% - expected to be completed by Q3FY26.

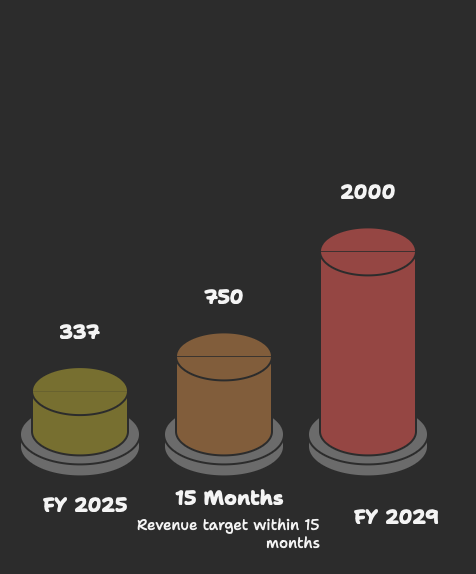

Post expansion, at peak utilisation, the company can clock annual revenues of INR 2,000cr

Expected Revenue Trajectory (based on Q4 FY25 Concall)

6X growth in 4 YearsMargins: Blended margins expected in the range of 16-17% - The Mehru acquisition will lead to revenue growth at the cost of reduced margins compared with the standalone Quality Power Business

Inorganic Growth: They have in the past relied on inorganic growth, with Mehru being the latest one. They claim that they are able to expand the margins, but the proof of the pudding is in eating, so does the management walks the talk or not has to be seen.

They announced the buyout of Sukrut Electric

More on HVDC and FACTS

Some snippets from Concalls I found interesting to know more about the company

Nebeskie (they are increasing stake to 24% here)

Risks

Apart from the usual raw material risk (mainly metals in this case). There are certain risks we need to be wary of:

Geo-political Risk (Turkey Operations)

Turkey operations are where the most value-added products are being manufactured. The geopolitical risks with Turkiye supplying drones to Pakistan in the India-Pakistan Conflict backlash against Turkiye’s businesses in India, there can be repercussions against Indian operations in Turkiye - capital controls, etc., can’t be ruled out.

The Turkish operations are very important for Quality Power as they do a lot of international business through Turkiye and execute products at the top end of the value chain there.

Management will, of course, try to pacify investors, but one has to be wary of developments.

Backward Integration

Just thinking out loud, given the current tight supply-side conditions, the customers (other capital goods companies) can also look at integrating backwards. The same has happened in other industries as well from time to time.

Related Party Transaction

Management loan to Company - I don't know what the incentive is. Technical Analysis

Full Disclaimer: I do have a position in this company - This is not an investment adviceTo Sum Up

Operating in fast growing sector with moats. However, the key thing is to look beyond the growth projections and actually track if they are delivering on the guidance given.

Market so far has given thumbs up and clear sign of accumulation is there on the chart.

Not a recommendation. Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Make your stock scanning easy with ChartsMaze

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.