Pre-Engineered Buildings

A value migration story - Proxy to Private Capex

⚠️ ATTENTION

I am not SEBI Registered. This post is not a recommendation or investment advice. Please consult your financial advisor. This sector came on my radar after watching SOIC Video on Emerging Trends for 2025. What are pre-engineered buildings? let’s dive in.

A Primer on Pre-Engineered Building (PEB) Sector

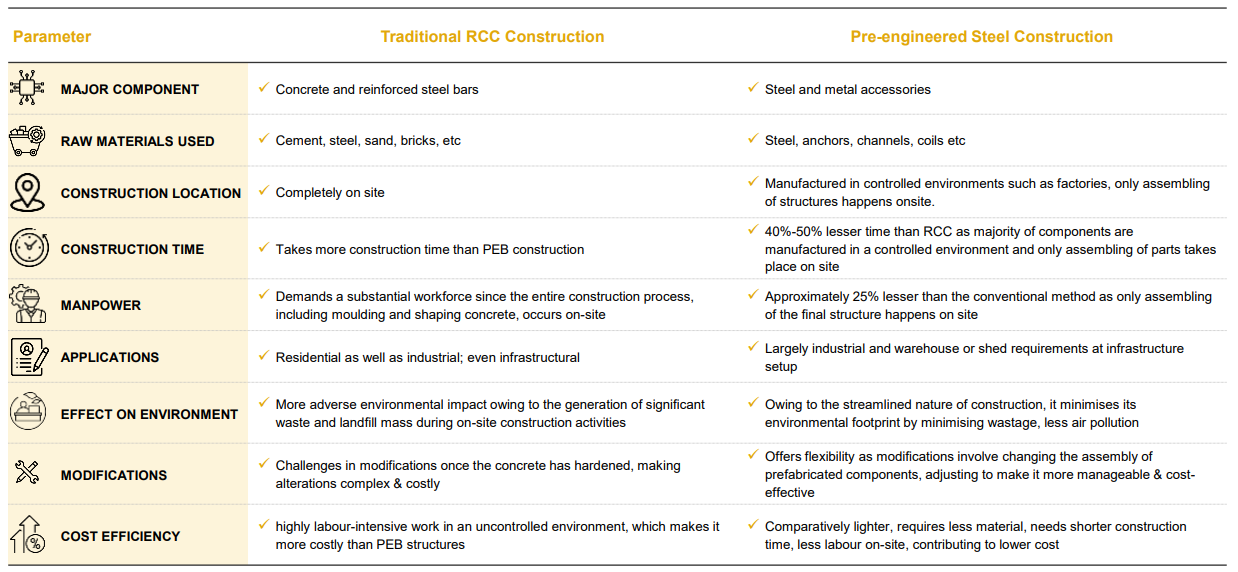

In layman's terms, the building is designed into multiple parts, these parts are then designed in a factory and then assembled onsite.

This sums it up well:

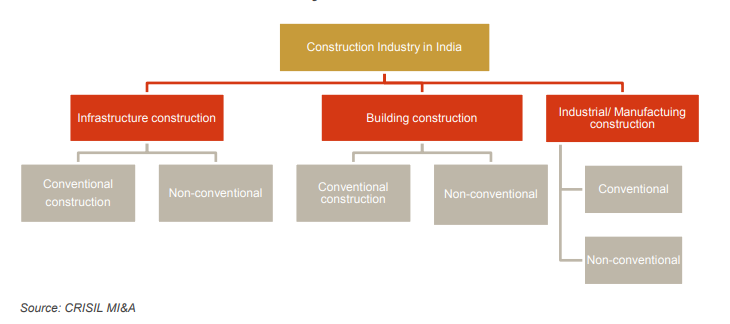

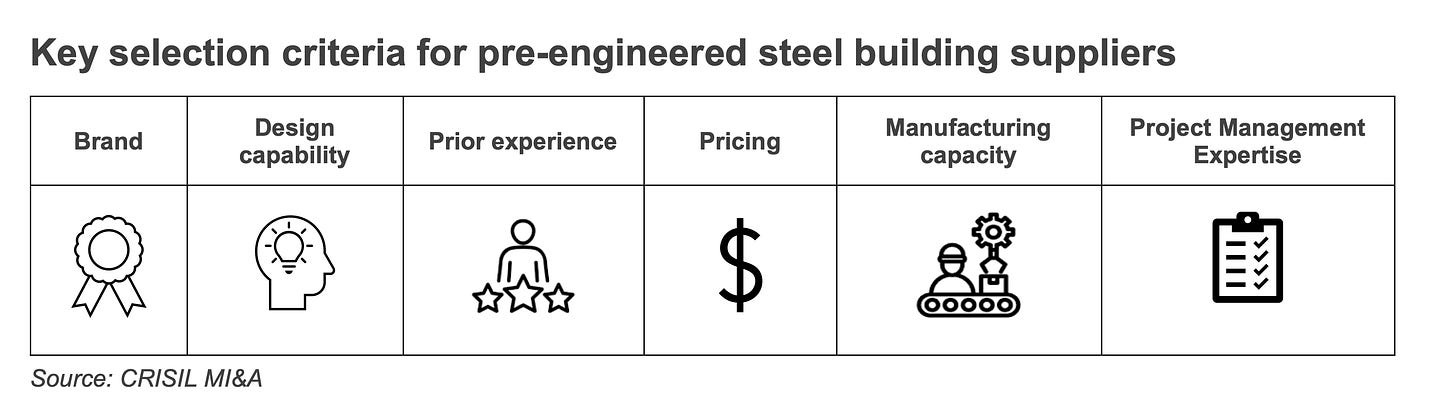

So far my takeaway is that the USP in this Industry is designing prowess and operations (delivering on time). Delay in execution can lead to increased exposure to commodity pricing, a penalty from the customer, increased working capital, etc. PEB is a subset of the Construction Sector.

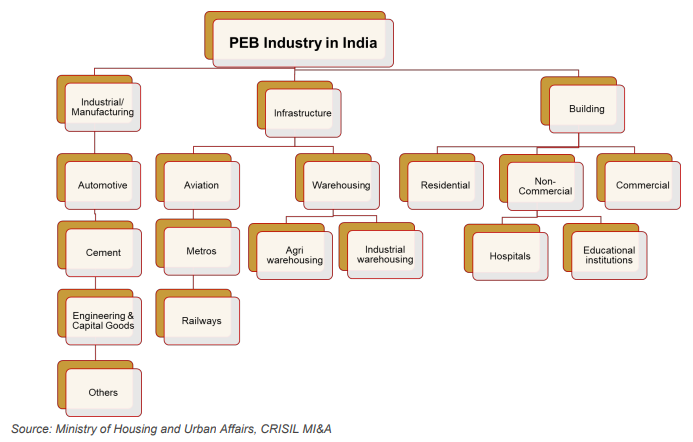

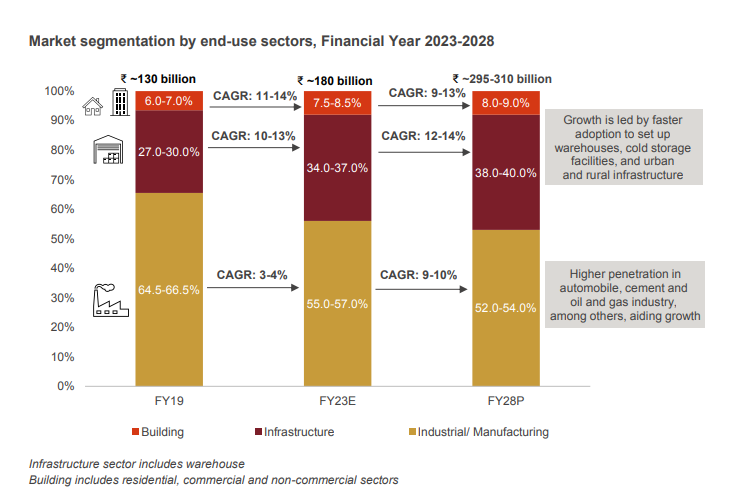

PEB Industry by End Sector - This makes this sector a proxy to private sector capex

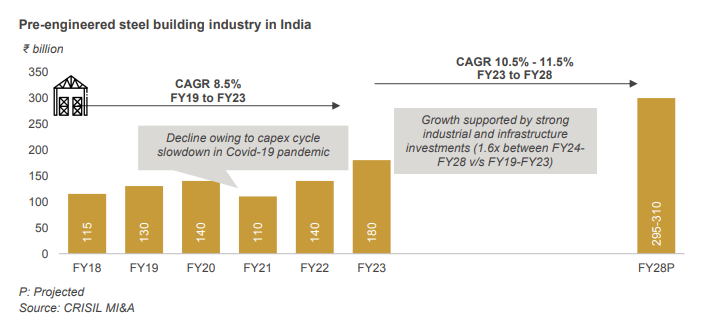

Industry Growth Rate

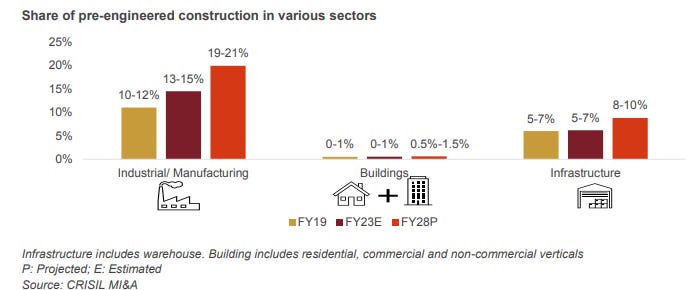

This growth is clearly on account of value migration from conventional construction to Pre-Engineered Construction

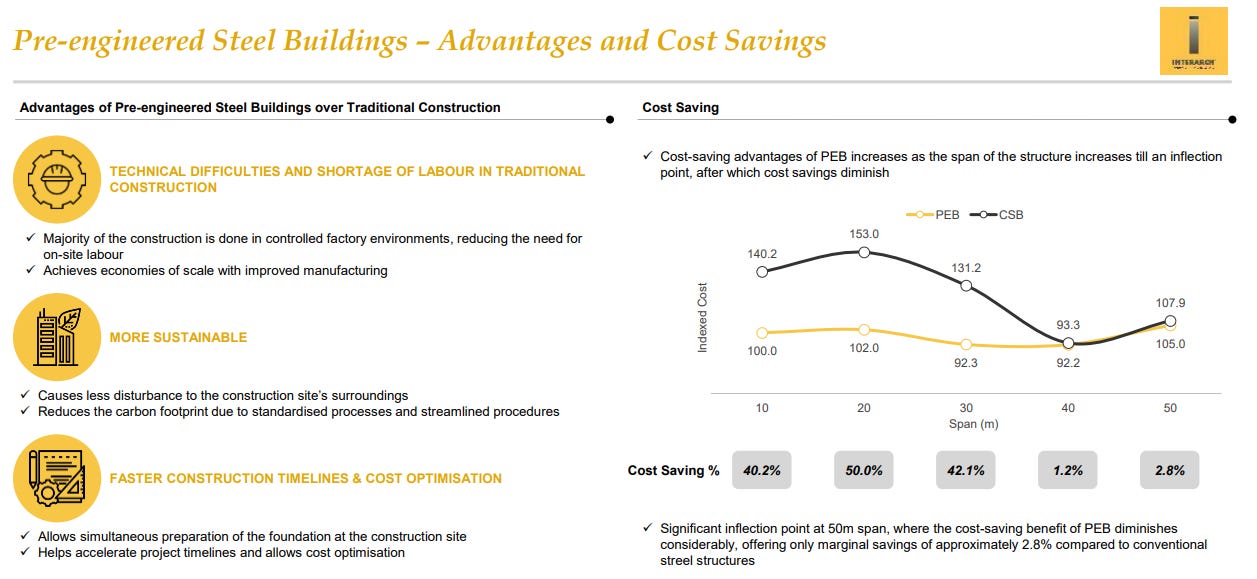

Part of the reason for this shift is the value proposition - PEBs save time and time is money

Putting it all together

Positives

(1) Value Migration: PEB Sector is growing at a faster clip than the overall Construction Sector. This is evident from the increasing share of PEB in the overall construction mix.

(2) Shift from unorganized to organized: Organized players are growing faster than unorganized players.

(3) One Stop Shop including designing: For the customer, the building is not a core activity. From the customer's point of view, it is easier to give the requirements and then the whole plant construction is handled by 1 party.

(4) Proxy to Private Sector Capex

Negatives

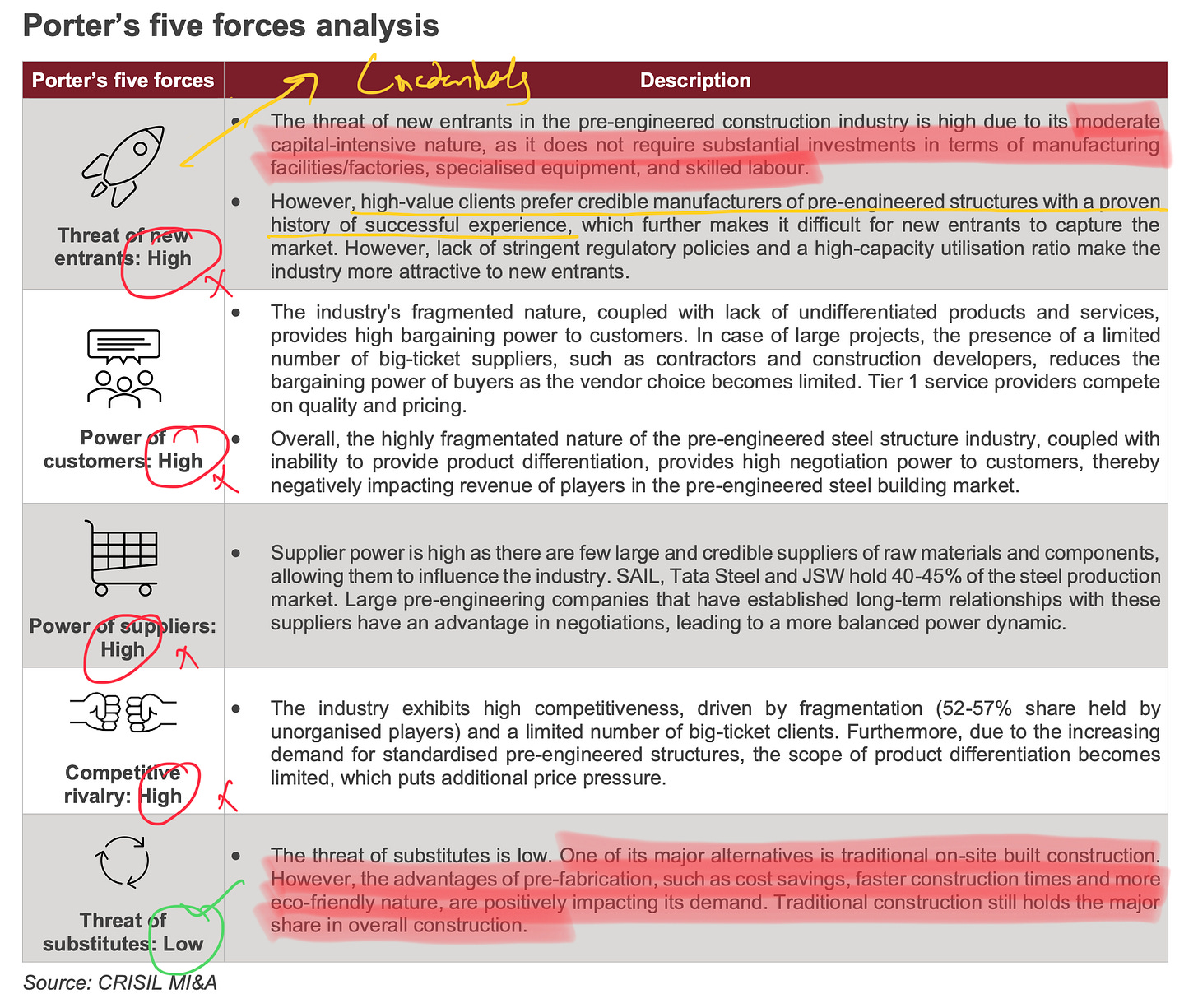

(1) A highly competitive Industry

(2) Commodity price fluctuations can play havoc - Steel is a major raw material

(3) Transportation challenges

As pre-engineered structures are manufactured offsite, transportation of these structures to the construction site involves logistics expenses, which are a function of the distance and the complexity of the transportation process and can significantly impact the overall project cost. Furthermore, these components are susceptible to damage during transportation and handling and may require rework or replacement, which, in turn, could lead to additional costs and project delays.

The risk was seen playing out in the Wind Energy Sector as the logistics of windmills is tricky.To Sum up

This is an industry with tremendous potential but susceptible to three challenges: (1) the inherently competitive nature of the Industry as the capital requirements are not that much (2) Commodity (3) Cyclical as a lot depends on the capex cycle akin to the capital goods industry.***

Invest in yourself…. be a learning machine

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

Resources:

(1) Industry Report by CRISIL: Assessment of pre-engineered steel buildings industry in India

(2) SOIC Video

Only for factories or housing also?