Laurus Labs Ltd.

Will the history repeat?

Welcome to the 100+ subscribers who joined since the last post.

⚠️ Not SEBI registered, invested & biased Laurus Labs

The story of the Elephant and the Blind Men related perfectly to the business of Laurus Labs. Some say it is an ARV Company, some perceive it as an API company, and others may call it a CDMO Player.

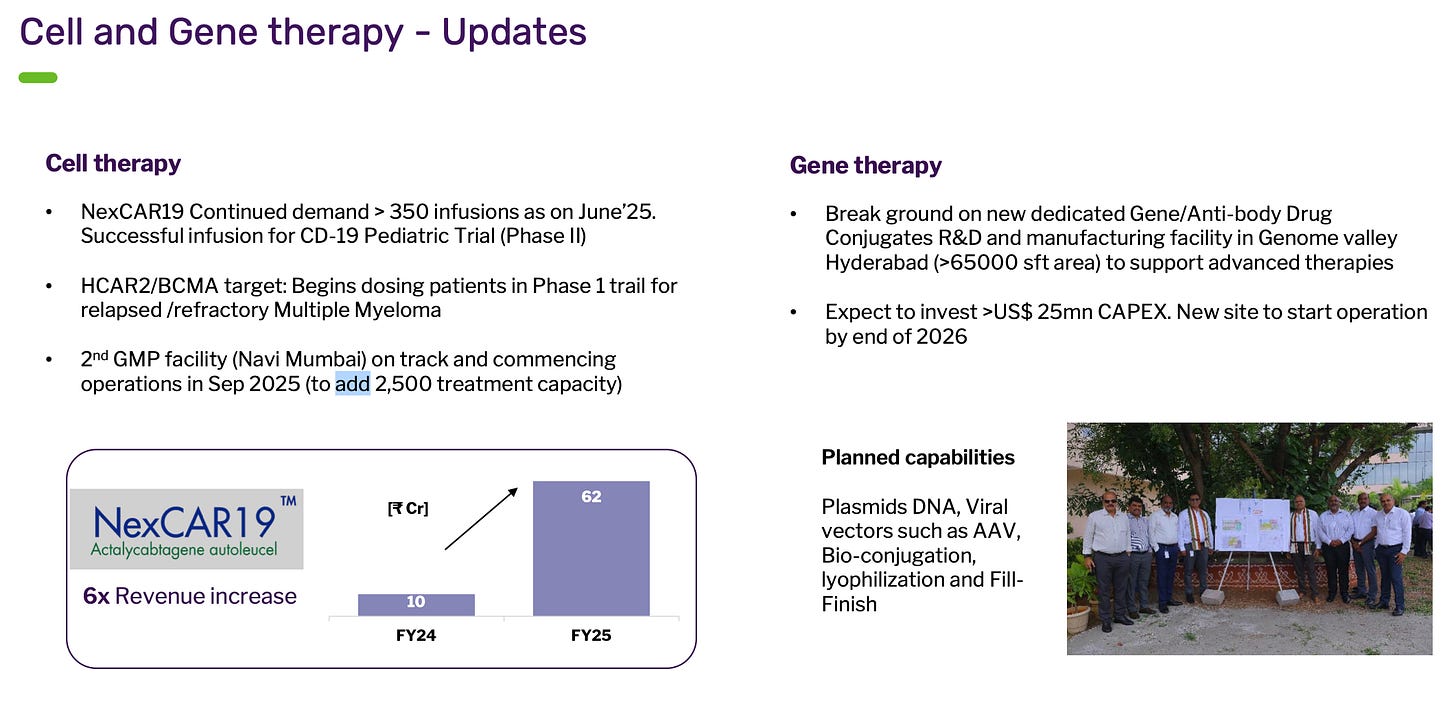

My take on Laurus Labs is that it is a research-focused company that is trying to move up the value chain, driven by growth-hungry promoters. From being a dominant player in ARVs (in layman's terms, drugs for HIV patients), they have diversified and grown other verticals like Formulations and CDMO. Now, building a Biologics Business as well.

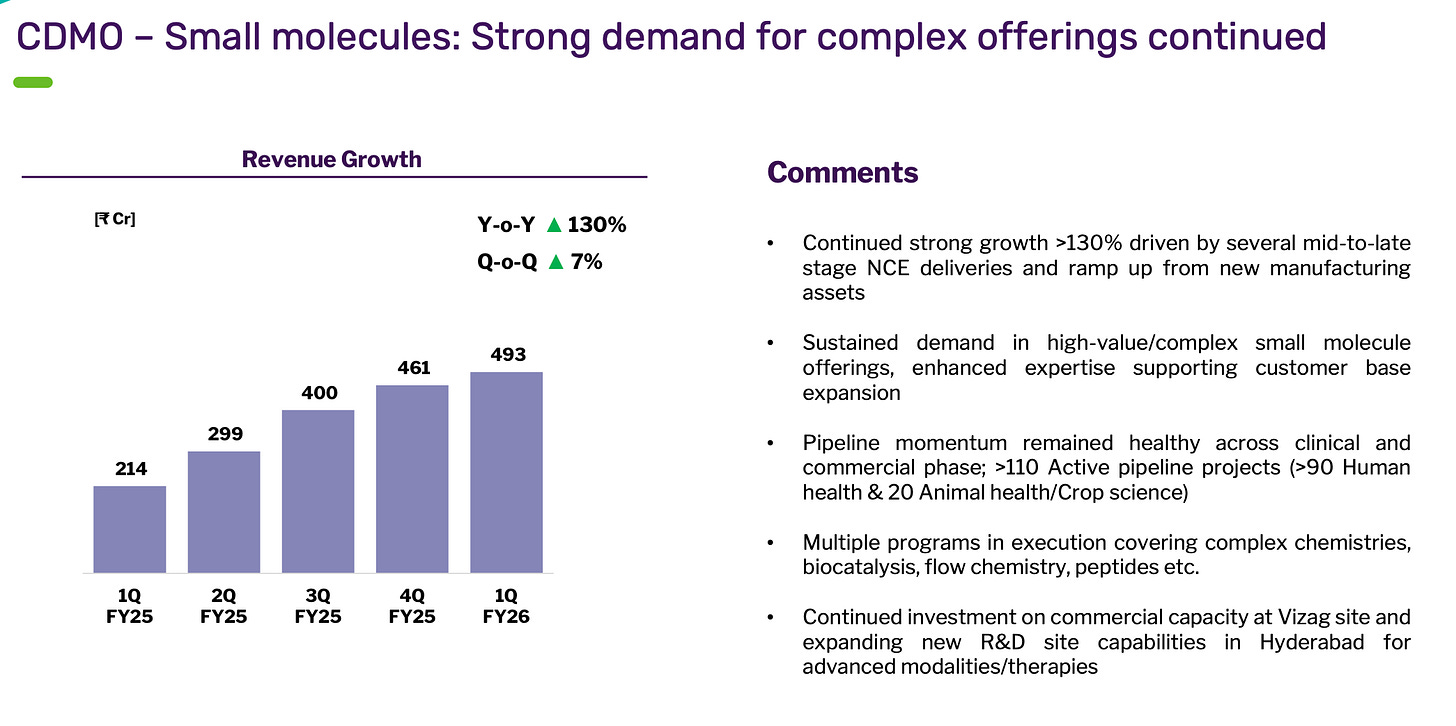

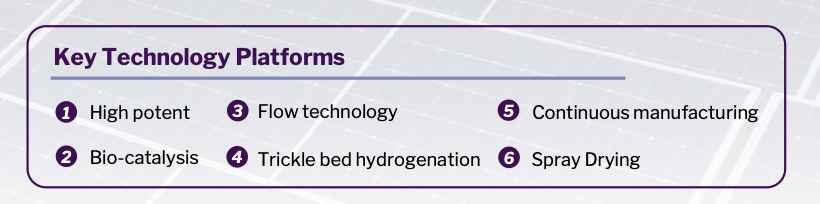

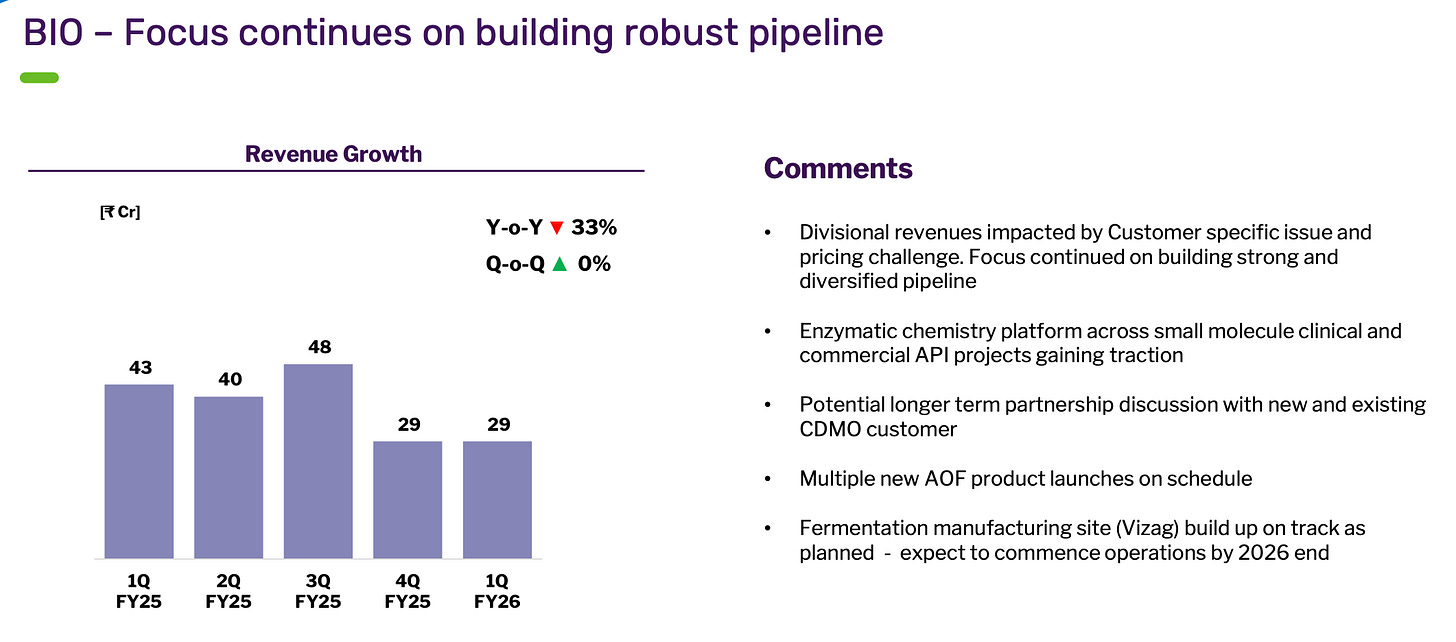

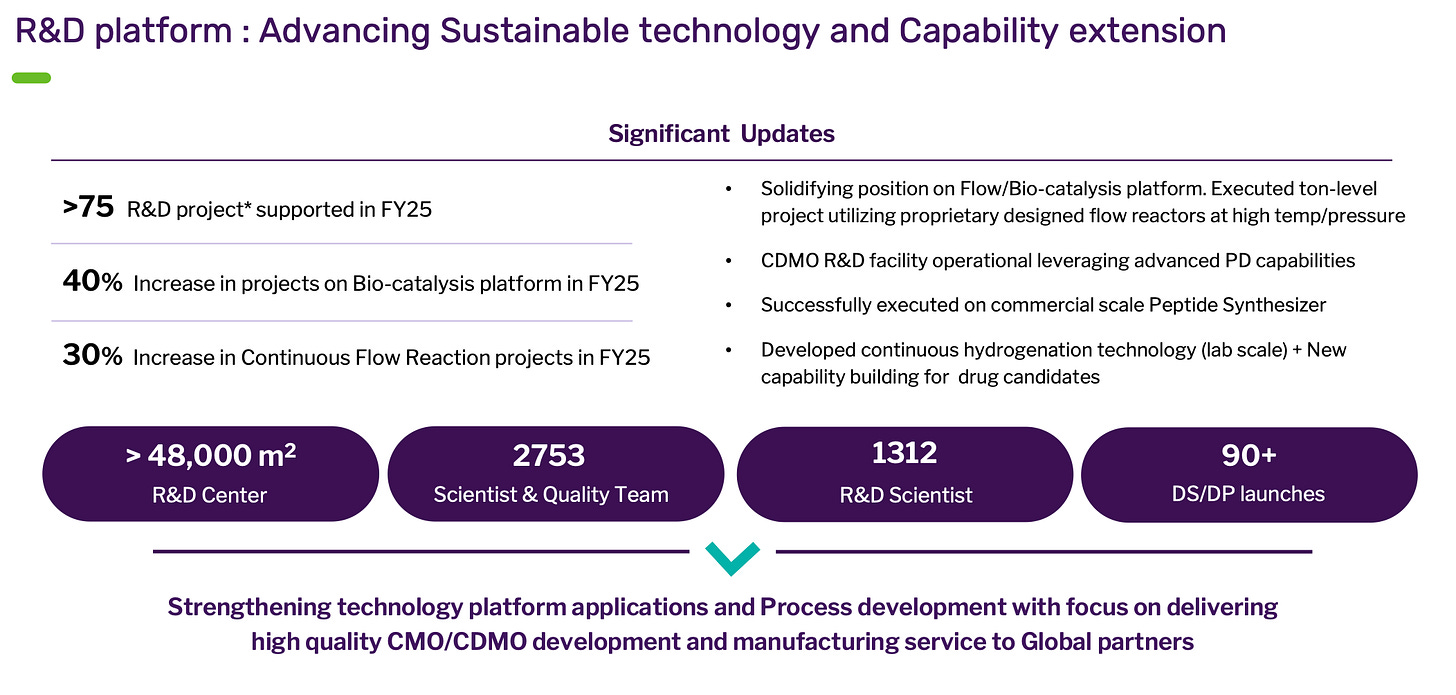

This is an indication of where the business is pivoting. CDMO as a % of total revenue is increasing while the contribution of Generic Business is decreasing. They manufacture both API and formulations for ARV, which is a saturated market. This also points out that CDMO is growing at a much faster pace.Apart from the impressive growth (remember CDMO is a lumpy business), the key highlight is the pipeline and investments in capabilities like flow chemistry, biocatalysts etc. Bio Division was muted this quarter due to specific issues but look to grow here as well

The key growth driver is CDMO R&D Focus

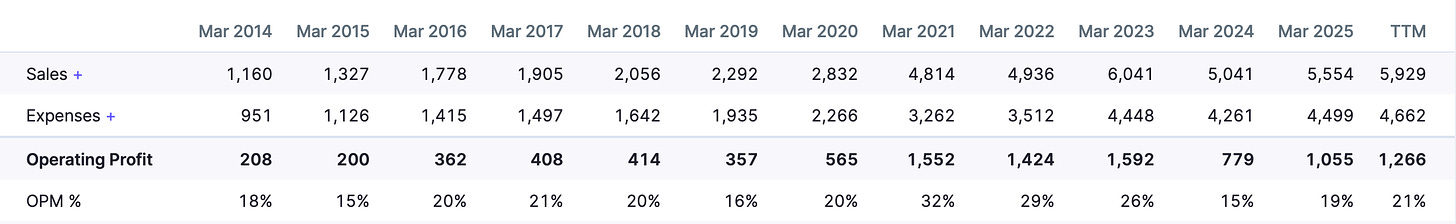

Given their aggressive nature, they have at times overstepped the investment pedal, leading to a fall in asset utilization, which leads to the cyclical nature of their growth.

I distinctly remember a case study during my MBA days, Ford vs Toyota. Ford’s growth came in step functions, while Toyota worked on continuous improvement and gradual expansion.

IMO, Laurus is a company that believes in step functions. Deploying large capex, which in the short term reduces the utilization, effectively reducing margins. When the ramp-up happens, i.e., capacity utilization starts improving, there is a big jump in margins.

The Capex is still Continuing but majorly focusing in Ramp-up

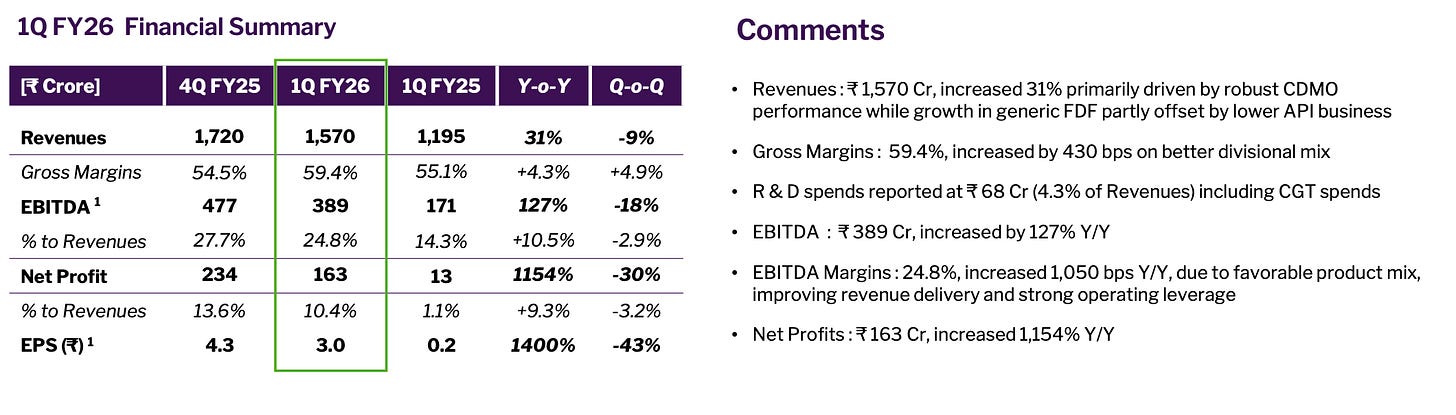

Q1FY2026 Results

Strong growth YoY. Can't compare QoQ as June Quarter is generally weaker than Mar QuarterRisks

CDMO is a lumpy business - given the size of investment in the past - the capacity utilisation recovery might not be linear

Capacity Expansion - Still investing a lot in Capex. But most of the capex is towards ramp up

Laurus Bio may take longer to gain traction. A lot of gestation period and further investments may be required

So far excellent regulatory approval track record…but in pharma industry this is always a risk (e.g. Divis in 2017)

To sum up the key interpretation for the results is that Laurus Labs is transforming as a business from an API company to a CDMO + biotech company and hence moving into high margin R&D‑driven segment.

They have invested a lot in the past two years in terms of their capacity. Time has come that operational leverage will come into play as capacity utilization picks up and asset turns improve.Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Make your stock scanning easy with ChartsMaze

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Nice interpretation of Laurus Labs, but this is just the beginning of becoming the WuXi of India. Wait and watch.

good