India’s Chemical Industry: The Next Global Manufacturing Hub?

Notes from NITI Aayog Report - Chemical Industry: Powering India’s participation in Global Value Chains

When we think of industries powering India’s growth story, IT and pharma often steal the spotlight. But behind the scenes, one sector quietly forms the backbone of almost every major value chain — the chemical industry. From agriculture to automobiles, textiles to electronics, the reach of chemicals is both vast and vital.

India is 6th largest chemical producer globally; 3rd largest in Asia after China and Japan.

Contributes 7% to GDP

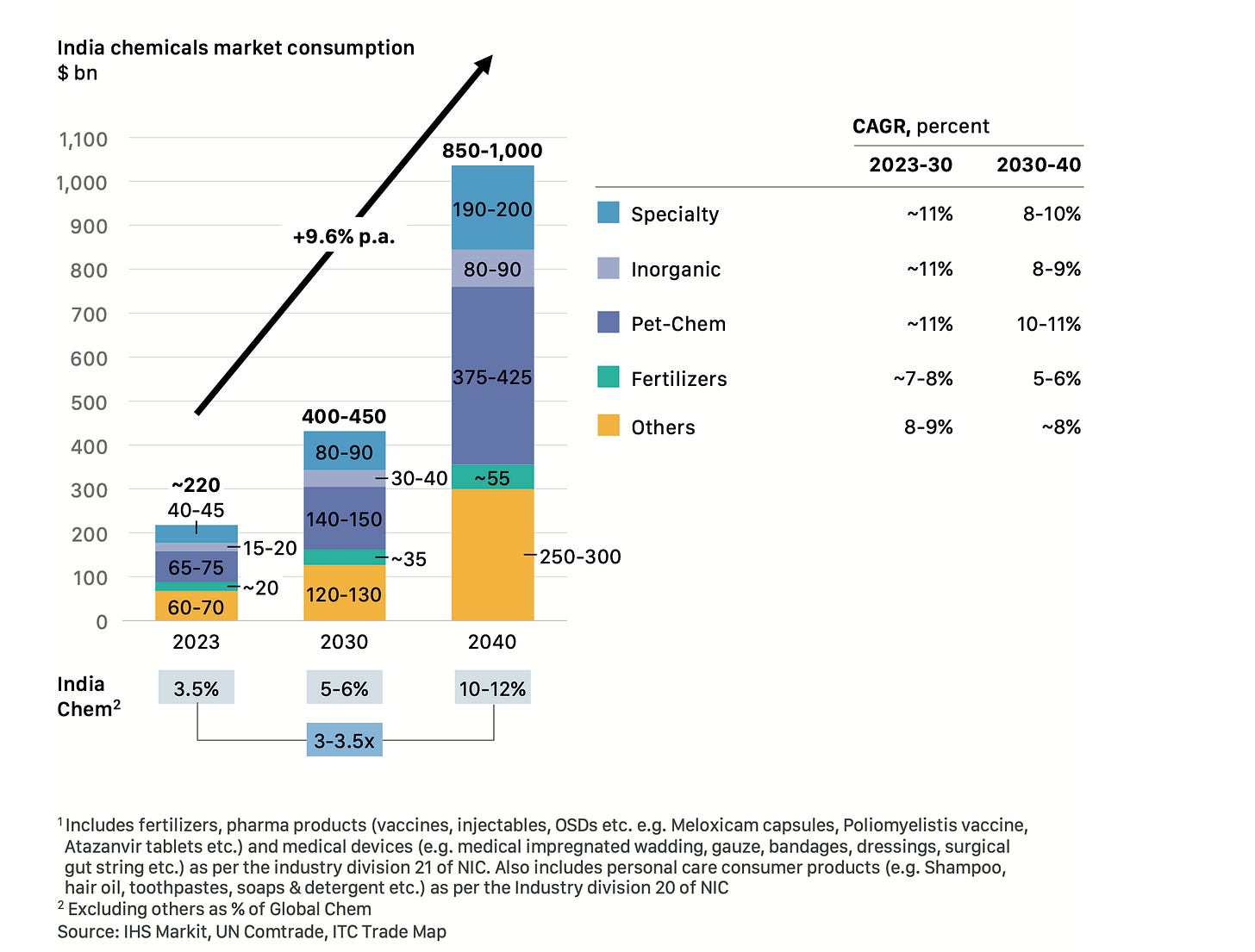

India’s chemical consumption was valued at approximately $220 billion in 2023 and is projected to grow to $400–450 billion by 2030.

By 2040, it is expected to nearly double again, reaching between $850–1000 billion.

Major driver of this growth is the surge in disposable incomes, which is anticipated to add around $1500 billion to overall consumer spending by 2030.

The near-term vision is to take India’s share in Global Value chains to 5-6% by 2030 from the current level of 3.5%.

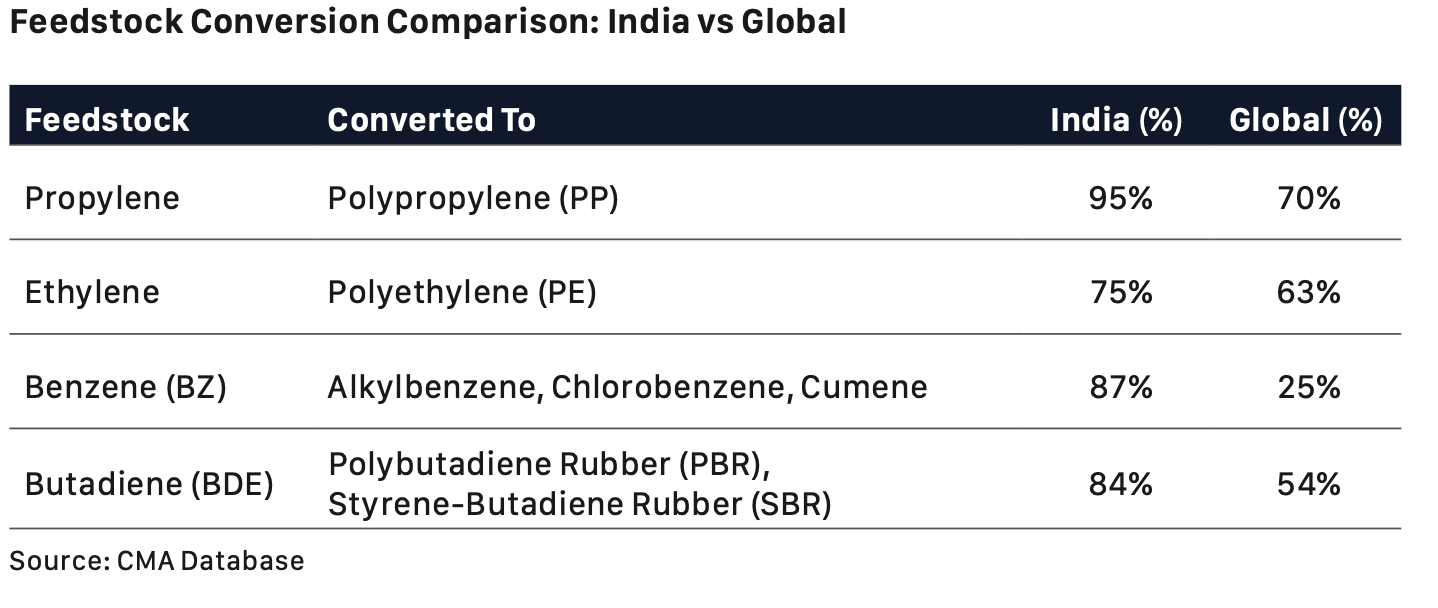

Chemical Industry is dominated by commodity chemicals or upstream chemicals. This is evident from the feedstock conversion % vis-a-vis Global averages

Plus India has a trade deficit in Chemicals at approximately $31 bn.

This points to the fact that there is significant scope for (1) Import Substitution (2) Moving downstream into spec chem Pillars to accelerate growth

Export Market Expansion - focus on strengthening high-potential segments such as agrochemicals, dyes, pigments, to tap into growing international demand.

Investment in Sunrise Sectors - including battery and electronic chemicals etc. to position India at the forefront of emerging technologies.

Improve Production Competitiveness - enhancing domestic capabilities in key segments like PVC, VAM, EVA, and Nylon-6 etc.

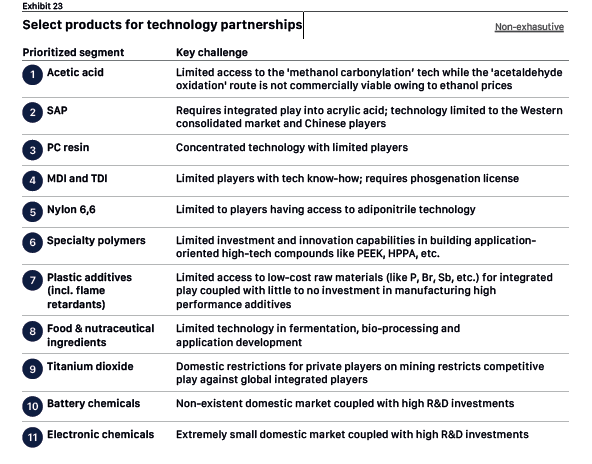

Aid Technology Access - by targeting import-dependent products such as acetic acid, MDI/TDI, PC resins, and plastic additives etc., reducing reliance on external sources and fostering self-reliance.

So for opportunities looking for companies increasing capacities, going downstream, introducing new products, import substitution and tie-ups for technology or development of technologySome of the products where technology partnerships are being sought - potential areas of focus

Policy level Support / Intervention

Creation of World Chemical Hubs and Development of Port Infrastructure

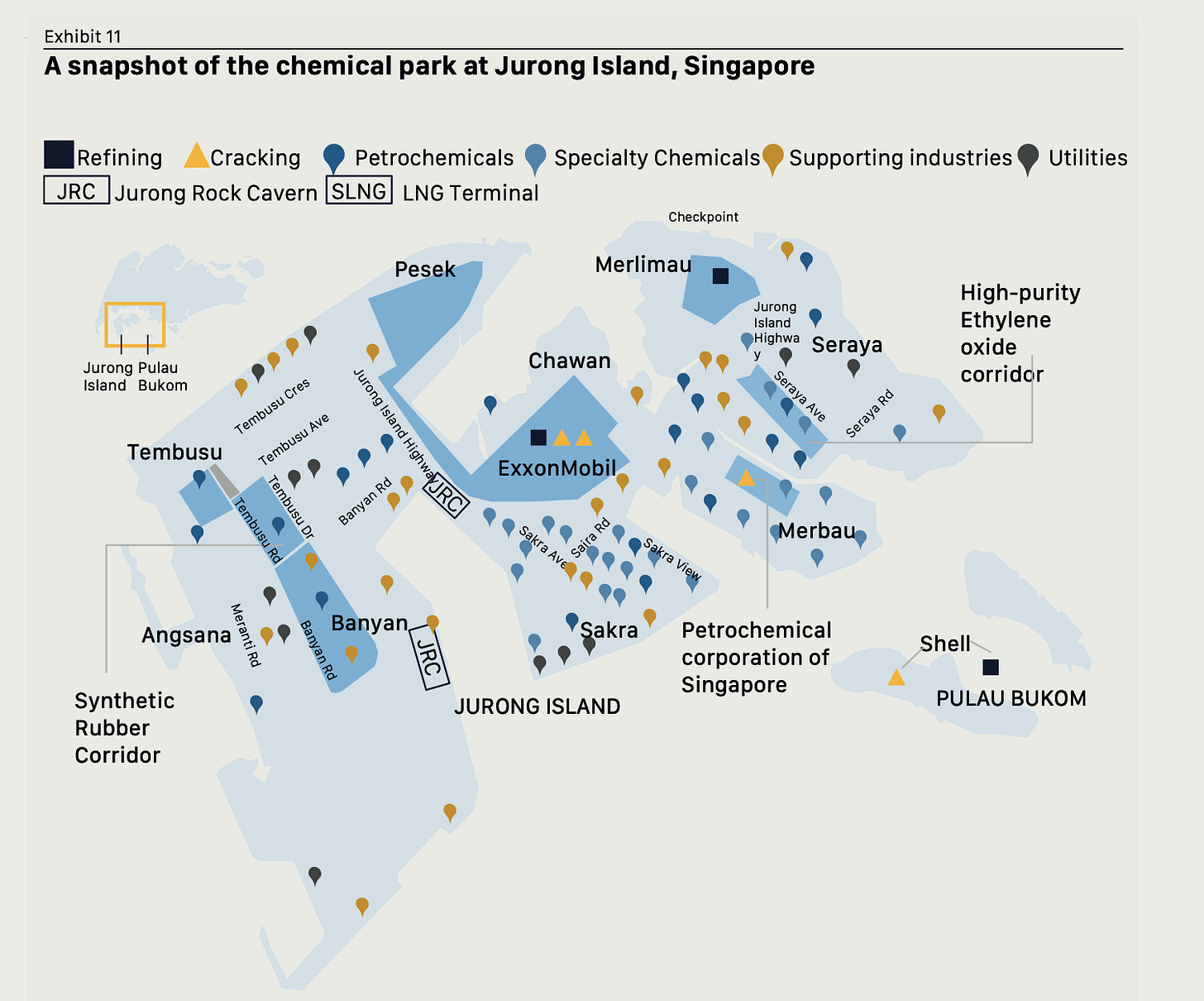

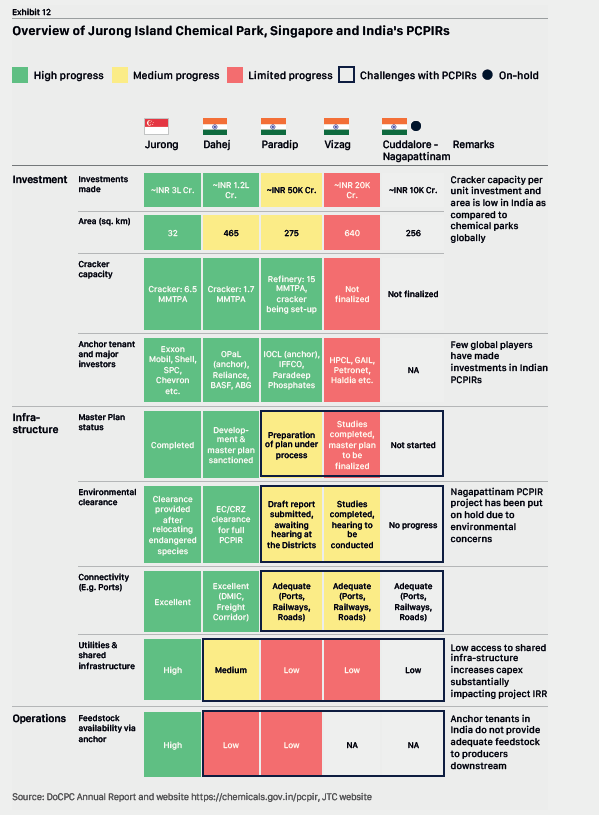

This intervention is inspired by Singapore’s Jurong Island (3% of Singapore’s GDP) and Saudi Arabia’s Jubail Industrial City (7% of world petrochemicals).

Key features of the park are: 1) strong feedstock integration - creating an ecosystem for downstream production; 2) shared infrastructure- reducing opex; 3) Multi-modal connectivity

Plus proactive support from the government and furthering sustainability initiatives reducing carbon footrprint (Chemicals is a carbon heavy industry)The fact is India already has four approved chemical hubs - in Visakhapatnam (Andhra Pradesh), Dahej (Gujarat), Paradip (Odisha), and Cuddalore and Nagapattinam 16(Tamil Nadu) (approved but on hold) - that have made some progress in attracting investments and creating jobs, there are still critical areas that need further attention to fully realize their potential.

These regions have already made significant progress in establishing infrastructure, attracting anchor tenants, and laying the groundwork for chemical industry development. However, they face challenges related to infrastructure quality, financial incentives, and regulatory complexities.

To maintain global competitiveness, these regions would need to improve infrastructure, streamline regulatory processes, prioritise sectoral growth, and address environmental and community issues.

Enhance Feedstock avaialbility - Enhance Cracker Capacity

Enhancing cracker capacity at Dahej and Paradip is crucial to meet the growing demand for petrochemical products and improving operational efficiency. Dahej, which already hosts the largest petrochemical plant in India, can further solidify its position by expanding its cracker capacity, thus ensuring a steady supply of ethylene and propylene for downstream industries. Improving shared infrastructure such as utilities, logistics, and waste management systems at both sites can reduce operational costs, enhance efficiency, and attract more investments

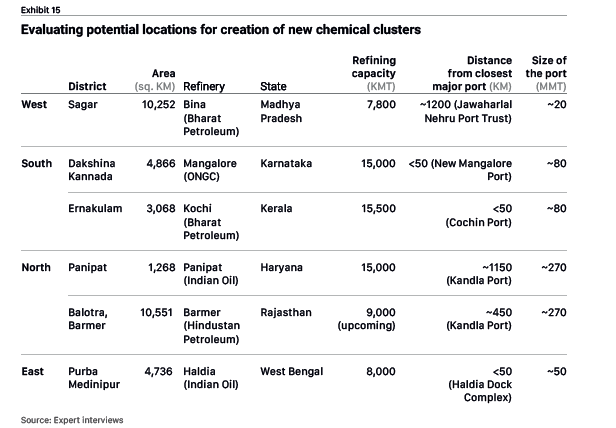

Creation of New Chemical Clusters

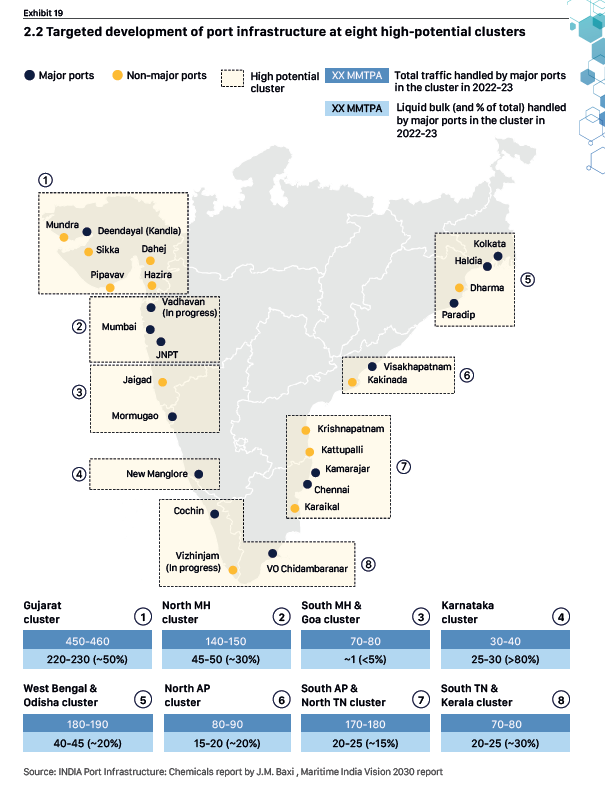

Connectivity

Chemicals is one of 12 industries identified as a focus area for major ports in the Maritime India Vision 2030

Waste Management Systems

Provide sustainable solutions for effluent treatment and waste disposal to meet environmental compliance. Waste disposal to be handled inside the chemical parks. Deep sea discharge standards to be at par with global standards

Sustainability is no longer optional. The next phase of growth in India’s chemical industry will depend heavily on green chemistry, circular economy principles, and low-carbon manufacturing.

Zero liquid discharge (ZLD) norms and Common Effluent Treatment Plants (CETPs) in chemical hubs is the way forward

This is a potential theme to trackTo conclude

With geopolitical realignments, increasing focus on self-reliance, and rising demand for greener products, India is uniquely positioned to become a global chemical manufacturing hub. If it addresses structural challenges and drives innovation, the industry can significantly contribute to India's ambition of becoming a $5 trillion economy. The chemical industry may not always be visible to consumers, but it is foundational to nearly every product and process in the modern economy. As India builds its industrial base for the future, chemicals will remain a core enabler — quietly but powerfully shaping progress across sectors. Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Make your stock scanning easy with ChartsMaze

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Interesting piece thanks for the write up!