Energy Transition #11: Quest for Security

Security > Economic Efficiency > Environment

This is the 11th post in the Energy Transition Series. The previous posts are collated here:

This post is about the why of Energy Policy decisions. The world is changing, and that is impacting the energy policy decisions. What is shaping the energy policy of the countries?

The global geopolitical landscape is undergoing a profound transformation, shifting from a unipolar or bipolar world dominated by a few superpowers to a more fragmented, multipolar arena where emerging powers assert greater influence.

I suggest EAM’s book “The India Way” and Ray Dalio’s “Principles for Dealing With The Changing World Order” to understand more about the changing world order.

In this evolving order, nations are increasingly adopting "nation-first" policies, prioritizing domestic interests over global cooperation. This inward turn has led to rising trade barriers, a retreat from global supply chains, and signs of deglobalization.

The trade barriers are evident with the heightened trade war and uncertainty about tariffs. Looking at it from the lens of game theory, this can be seen as a shift from cooperative strategies in a repeated game — where trust and mutual benefit previously underpinned global trade, to a more zero-sum, non-cooperative framework. Countries now perceive the payoffs of self-reliance and strategic autonomy to outweigh those of interdependence, leading to Nash equilibria that favor protectionism over collaboration.

Energy is a foundational pillar of national stability and prosperity. A reliable and secure energy supply is critical for economic growth, industrial productivity, and national security. With so much geopolitical uncertainty going around and shifts in the world arena, Energy Transition, which ensures energy security, becomes paramount.

Energy security = Shift to Non-Fossils

Non-fossil fuels are not traded and are local.

If you don’t have fossils, you will try to increase the supply of nuclear and renewable energy. Energy security is emerging as an urgent priority. Oil dependency has created a security vulnerability that needs to be tackled.

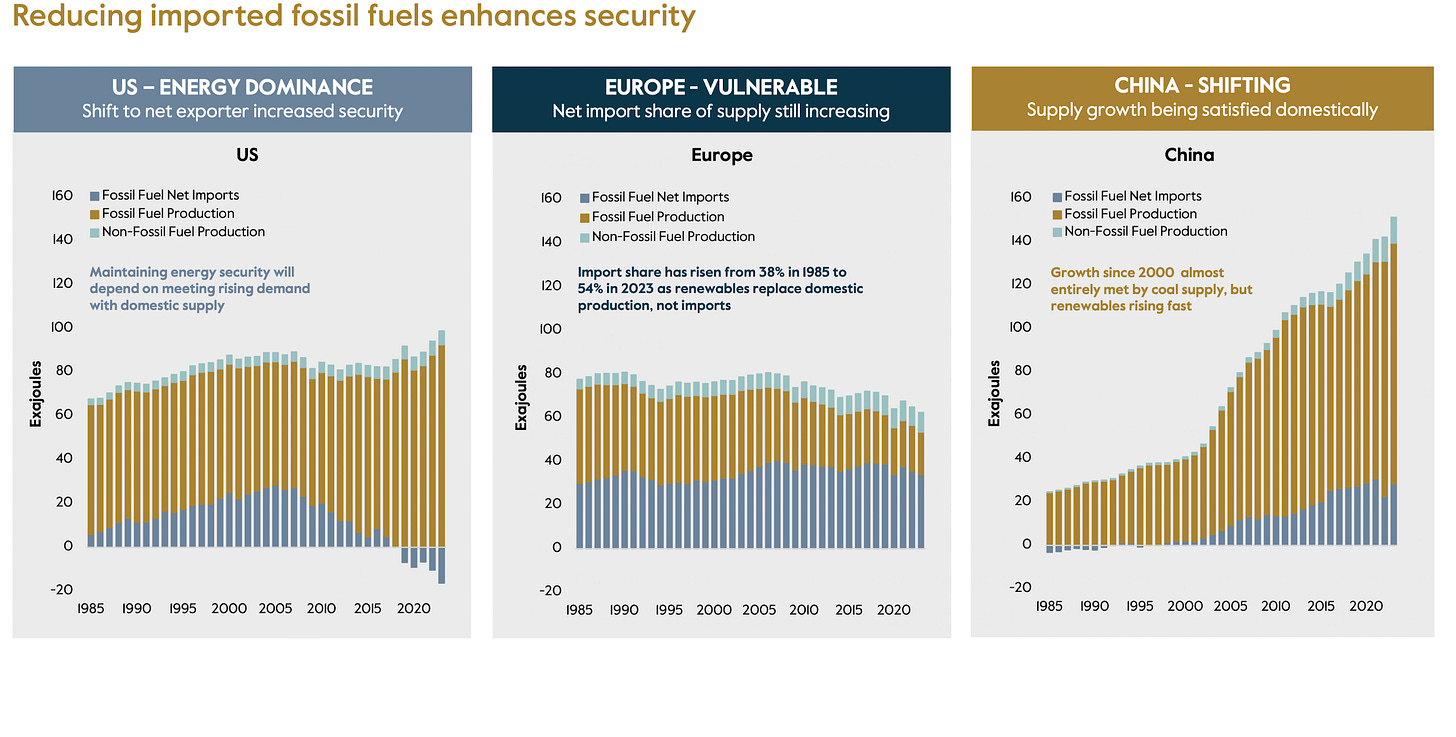

The situation has become more profound with the transition of the US from being a net importer to a net exporter. The earlier arrangement incentivized the US to invest in securing global trade routes. Now, securing global routes is not a priority.

This objective would drive investments in renewable energy and nuclear for India as well. It is evident by the ongoing investments, e.g. India at #2 in the world in terms of nuclear capacity under constructionand it is set to accelerate

The pecking order of energy decisions seems to be Security > Economic Efficiency > Environment

This, in my opinion, leads to a virtuous cycle. The case in point being China, where energy security concerns bolstered investments in green energy, driving up the economic efficiency of renewables through economies of scale and technology breakthroughs.

China didn’t build its renewable power, energy storage, and electric vehicles industry to comply with the Paris Agreement of 2015 - the transition began in the early 2000s, setting targets for energy security. They achieved peak fossil imports in 2019.

Electrification - enabler of energy security

Applying this framework to India

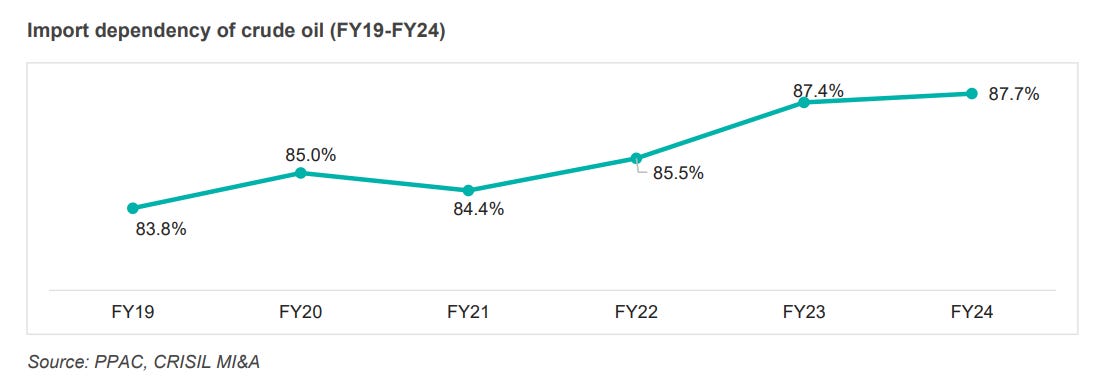

India is highly dependent on imported crude oil. India hedged its bets by having its own refining capacity and hence going downstream in the value chain.

However, now there are other players on the table for diversifying the energy mix - Solar, Wind, Nuclear.

These non-fossils are likely to get priority to diversify the burgeoning energy needs of our country. India’s Dependence on Fuel Imports

Crude oil contributes to more than 30% of India's total primary energy supply and is the second largest after coal at ~58% (fiscal 2023). Crude oil has been the main source of energy in the transport sector over the past few decades.

Due to high import dependence, India's energy security is severely impacted by price and supply shocks of crude oil in the international market. Crude oil imports also make a significant impact on India's foreign exchange reserves.

INR has weakened - the INR/USD exchange rate has risen from 64.4 in fiscal 2018 to 82.8 in fiscal 2024. This not only widens the trade deficit but also raises input costs for auto production and fuel prices. Further, volatility in crude prices is a threat to the economy as it impacts the price stability of fuels in India, driving inflationary pressure.

India could potentially lower its dependence on imports based on its ability to substitute/replace crude oil with other energy sources, that can result in a positive effect in the Indian economy. There is a thrust on demand substitution, promoting biofuels and other alternate fuels/ renewables, EV charging facilities and refinery process improvements for reducing the county's oil dependence on imported crude oil.

To Sum Up

The key driving factor for energy transition is securing energy, leading to growth in renewable and nuclear, but at the same time, continued reliance on fossils, depending on the resource availability/securing resources in various geographies.

Every country will require a different optimal mix of energy sources with energy security at its core. This will accelerate the Electrification trend.

For India, the best way forward seems to be investing in Renewable/Nuclear to reduce the crude oil import dependence. Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: Views are personal. I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Learning Lifelong! Subscribe for free to receive new posts and support my work.